I wondered recently about the potential of market abuse in new social media. This was inspired by an April Fool from the Insurance Post, which had the headline: "FSA proposes ban on social networking sites".

"The Financial Services Authority has called for a ban of social networking sites such as Twitter and Facebook for all its regulated and authorised firms.

"The FSA has launched consultation paper CP01/0409 following a series of allegations of sexual harassment of female members of staff in the financial services industry.

"An FSA spokesman said: 'The consultation was launched following a series of concerns expressed by senior management about the productivity of staff who have constant access to social networking sites. It was found that limiting access during working hours was counterproductive, and in some cases certain members of staff were believed to be cyber-harassing other employees.'

"Under the proposals, only authorised personnel with permission from the FSA – known as 'minded to socialise' - may use social networking sites, and failure to comply will result in fines.

The initiative has been supported by the Government, who will shortly be introducing legislation to the public sector."

This was a joke but I have a growing feeling that Twitter is a great medium for generating market abuse through insider trading.

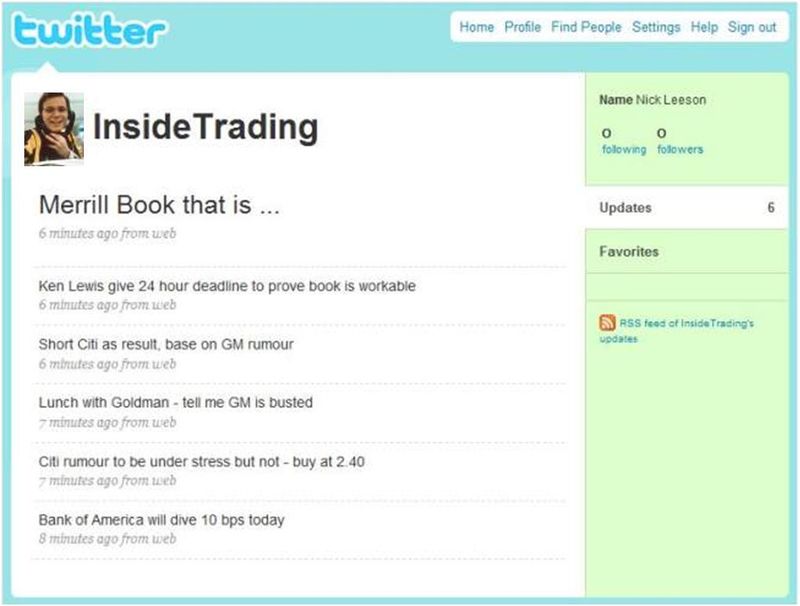

For example, using a duff email address - it's easy enough to get one on AOL or Yahoo! - you could create your Twitter pseudonyms and then merrily exchange insider news and views completely out of the loop of the regulator's eye.

I just created one a minute ago for a laugh:

Now ok, this could just be me mucking around but how would they know?

And if they did find abuse and wanted to track me down, how would they do it?

Through my IP address?

You see even if the regulator could track down exchanges, could they track those Twitters back to me if I were using a pay-as-you-go mobile or blackberry?

No ID, no address, no nothing.

Just a thought.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...