A year ago, I wrote a line in a blog:

“Boy, how the markets have changed in a year. We now see investment bankers facing hard times and selling second homes or pawning their Aston Martins and Rolex watches, as their wives divorce them before poverty strikes. We see hedge fund managers faking suicide leaps of terror in order to evade jail”

building on earlier discussions about wives of seriously rich bankers and hedge fund managers divorcing them, before the rot set in.

A year later, we now have a follow-on with wives who are stuck with their less than now successful husbands. This is being publicised in a new book by Tatiana Boncompagni, the author of previous hit “Gilding Lily” and millionairess wife of Hoover heir, Maximilian Hoover.

Her new book is all about hedge fund manager’s wives.

Discussed in the Times last week, Tatiana identifies seven types of New York hedge fund wife:

“The Accidental: so named because she never signed up for the life of a hedge fund wife. She thought she was marrying a lawyer or an investment banker — anyone other than the man her husband turned out to be. The most likely to look and feel out of place in a hedgie gathering.

“The Westminster: pure-bred and pedigree, like the best dog-show entrants. She has a recognisable last name and sits on all the right charity boards. Her husband brings the money; she brings the status.

“The Stephanie: includes all former models who decide to cash in their good looks and sex appeal for a home in the best part of town and a luxury lifestyle (NB: Stephanie Seymour is divorcing Peter Brant, her wealthy, polo-playing husband, and all New York is a-twitter, anticipating a messy, dirty laundry-airing divorce à la Christine Brinkley and Peter Cook, the architect).

“The Former Secretary: this one is self-explanatory. They have fantastically lazy husbands and tend to be insecure about their lowly backgrounds. Of all the wives, you don’t want to mess with this one.

“The Socialite: cares only about her social status. She is selfish, vain and stingy, so don’t be too surprised if you are stuck with the bill for lunch.

“The Workaholic: almost as obsessed with her high-powered job as her husband is with his. Her motto? What’s his is mine and what’s mine is mine. Not exactly what the feminists intended.

“The Breeder: the easiest to spot because she is usually pregnant or carrying a tot in a designer baby-carrier, or both. Those at advanced stages of breeding can be seen leading a parade of nannies and children into the Bonpoint store on Madison Avenue.

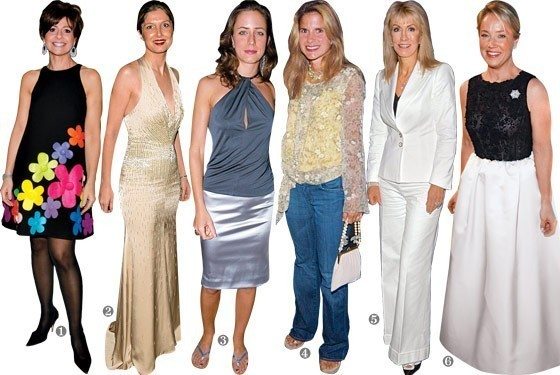

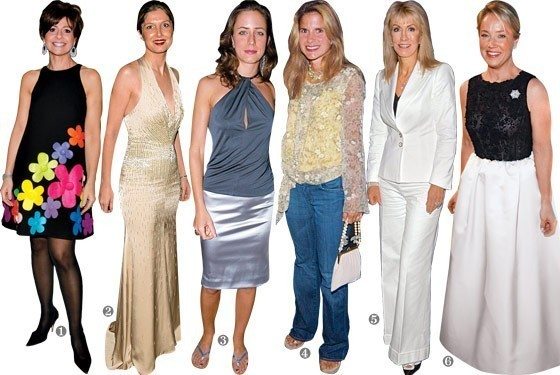

If you want to see what some of these wives look like in real life, then here’s a good photo from New York Magazine of some real American hedge fund wives:

Which is witch, I wonder?

Anyway, Tatiana goes on to point out how most of them are weepy ninnies, especially as “half the city’s 1,000 hedge funds have disappeared. Globally, 10,000 hedge fund workers lost their jobs last year, and a further 20,000 are expected to be out of work this year. An industry that was once worth about $1.9 trillion is now worth half that.”

You see, the problem is that many of these women have had unlimited excess and riches on tap, but now their husbands are failing and they have to start reining in these excesses.

"Not too long ago my husband and I were invited to the apartment of an

extremely successful hedgie for dinner. Five of us were sitting around

the giant coffee table, enjoying our cocktails, when one woman remarked

that the hedgie’s wife, who also works in the industry, was likely to

out-earn her husband that year. The silence was deafening."

She proceeds to tell tittle-tattle about another hedge fund wife, who tells her husband as he chooses wine in the restaurant: “I’m going to be a recessionista, and remind you that we’re on a budget.”

Another complains: “I didn’t get married for this. Do you know I have to take the subway now?”

They obviously should have dumped the suckers last year, but maybe now they're stuck with them or maybe they are just supportive people enjoying a love-filled marriage.

Whatever they are, Tatiana’s book is pure fiction of course, isn't it … or is it?

No.

Google “hedge fund wives” and you’ll find Tatiana’s book but also a load of articles talking about the difficulties of the industry and quite a bit of schadenfreude – pleasure from seeing the failure of others – too.

The Telegraph had a column nine months ago with the opening paragraph:

“Early one morning last week, a young man in his dressing gown was wandering around Chelsea Harbour, the exclusive enclave of penthouse apartments in south-west London, sobbing hysterically into his mobile phone. Asked by a passer-by if he was alright, the man stared at him then bawled: ‘I’ve lost everything. Every ****ing thing!’”

and comments on her book on the Times, MSN and Dealbreaker include:

“As a hedge fund manager times have been hard. i hade (sic) to cut half my personal staff at home. we also are looking at selling one of our vacation homes” Chris

“I actually do feel bad for them. It doesn't matter if you have a net worth of $5 million or $50,000 - I think its tragic to lose your financial security, your home, etc. I don't know why we feel bad for someone who loses their job at Boeing, but don't feel bad for a hedge fund manager who's lost everything. It's the same. They are all just people.” Tonya

“Feel bad for these crooks! No way and that is what they are, crooks! They helped drive this economy into the tailspin we are in. They think they're better than everyone else. They are not honest or people with integrity at all.” Tim in ABQ

“This reminds me of Gilligan's Is when Thurston Howell III's wifer libby reminisced about the great depression when Thurston changed from being a billionaire to only a millionaire.” Newtownian, Sydney, Australia

“You hear that . .. .... ? ? ? ? ? That's the sound of my heart bleeding.” Anon

“Hedge Fund Wives? Wastes of oxygen all of them. Eat the rich, and formerly rich..with lots of seasoning.” Ross, Boston, U.S.A.

and there’s worse ... and better.

Strangely enough, as I read these articles about her book, a few other headlines caught my eye, particularly:

“A billion to go hungry with food prices back on rise”, in the Independent

“The number of people going hungry is set to top one billion a day for the first time as green shoots in the world's biggest economies spell disaster for their poorer cousins. In line with other commodities, food prices are back on the rise. Combined with the effect of the credit crunch on poorer economies, the number of people without enough to eat will go up by 11 per cent this year, according to the United Nations' Food and Agriculture Organisation (FAO).”

That puts a journey on the subway into context.

This was followed by the news:

“Why Wealthy Nations Are Stiffing Africa”, in Time Magazine

“It may be no surprise, in light of the global economic recession, that the world's richest nations have failed to deliver much of the aid they promised Africa four years ago. But campaigners are not letting the Group of Eight (G-8) industrialized countries off the hook … most of the blame for the shortfall in pledges made at the high-profile Gleneagles summit in 2005 rests on just two countries — Italy and France. Italy, which next month hosts a summit of G-8 leaders, has delivered a minuscule 3% of the amount it pledged ... France has given just 7% of its pledged amount.”

So there you have it.

Hedge fund wives may have hit hard times, but many of them do more for charitable causes than most because of their position; whilst nations ignore other nations' desperate situations, when they are in a position to sort it out and made a pledge to do so with a signed commitment.

Not sure of the link there, other than the latter has nothing to do with banking or high finance ... has it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...