I haven’t blogged about bank results for a while, but was asked by a few media folks today about Lloyds Banking Group, who have their major stand-off shareholders meeting tomorrow.

This is going to be quite a major shindig as there all sorts of machinations going on:

- the Chairman is leaving;

- the CEO is under pressure;

- the Acquired Bank, HBOS, is a basket case;

- the Acquiring Bank, Lloyds TSB, is finding it hard to work out what to do; and

- the Shares are bouncing around more than an MP’s expense budget.

Let’s look at what’s happening.

The Chairman is leaving

Sir Victor Blank, the Bank’s Chairman and previously Lloyds TSB’s Chairman, has agreed to stand-down next year when a new Chairman is found but investors want him to go now. He has been targeted as the scalp required to recognise the disaster of Lloyds TSB acquiring HBOS. The fact that Sir Victor is seen as the architect of the deal, even though it was under Gordon Brown’s prompt, he is the target of the investment community’s ire and fire. Therefore, even though Sir Victor did the honourable thing and fell on his sword, they’ll get rid of him tomorrow by not endorsing a re-election. Likely candidates to take his place include Gerry Grimstone, Chairman of Standard Life, and Mervyn Davies, formerly Chief Executive and then Chairman of Standard Chartered and currently advisor to the Treasury as trade minister.

The CEO is under pressure

Eric Daniels, the quite American, is also under fire for the lack of due diligence in taking on HBOS. Luckily, he’s got a get-out clause … “I’m implementing the integration”. The fact is that Mr. Daniels is at the helm of implementation and is tasked with delivering £1.5 billion per annum in cost savings from the rationalisation program. This is why the team that monitor the government’s banking programme – the UK Financial Investments (UKFI) committee – are saying he’s safe. You could take him out of the equation of course, but who would be better? The names being bandied about include Mark Tucker, the recently departed CEO of the Prudential and former Finance Director of HBOS; and Luqman Arnold, the former CEO of Abbey. To be honest, they aren’t going to be much better. However, if a new Chairman comes in and wants fresh blood at the helm, you never know. Mr. Daniels may still be fighting for his future. In fact, his is fighting for his future and will be for some time. Until the HBOS situation is resolved, he cannot rest easy.

The Acquired Bank is a basket case

Turning our attention to HBOS, what went wrong? A nice quiet Scottish bank based in Edinburgh and famed for prudence. Ah, then there’s the old mortgage provider Halifax, a converted building society that followed their demutualised cousins – Northern Rock, Alliance & Leicester, Bradford & Bingley – and feasted like a child in a candy shop on the easy access to wholesale funding to enable an expansion of the mortgage book that ballooned into a major debt. The Halifax is the real issue here, as they pushed the loan book to the hilt through leverage and, when wholesale funding dried up, were left high and dry. Just last December, the bank doubled its impairment expectations as they announced that HBOS had lost £9.6 billion with £8 billion of loan debts. This year, that figure is rising to around £13.6 billion or more. And they blame the whole thing on commercial loans director, Peter Cummings, although whistleblower and former Group Risk Officer, Paul Moore, has a card to play here too.

The Acquiring Bank doesn't know what to do

Compare all of this with the more stable and secure operations of the old Lloyds TSB and you wonder why they put themselves in this mad position. Whilst HBOS lost £9.6 billion the old Lloyds TSB turned in a respectable £1 billion profit … and yes, this was even in the worst year of results ever seen in the industry. The fact that Lloyds TSB is grappling with a demented twin is now putting pressure on all of the executive. Take note, for example, that the executive package for performance which should include 375% of salary being paid in shares if the leadership team deliver has already been slashed to just 200%. OK, that’s still not bad, but the incentives for getting the bank out of the brown mire it finds itself wallowing within, is unlikely to happen whilst the existing management team are targeted as being asleep at the helm when they agreed this merger.

The Shares are bouncing around more than a politician’s expense budget

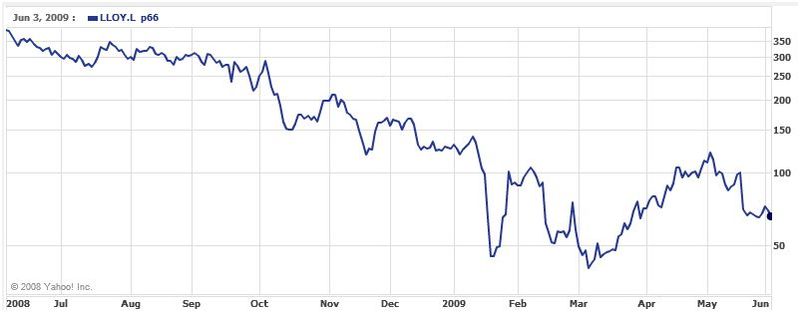

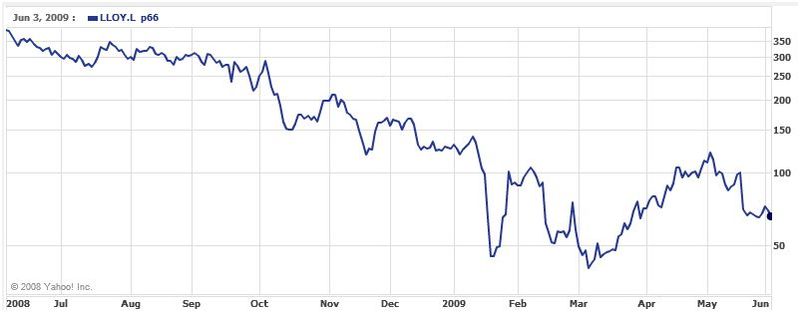

For all of these reasons, this is why the shares are bouncing around faster than a politician's second home nomination. Lloyds Banking Group traded at near 70 pence today, having been down to under 40 pence and up to £1. Looking at the chart below, you can see the ups and downs since the HBOS deal was agreed in December however.

Oh, for the days where the shares were up at almost £7 for the combined group a year ago.

Bear in mind that this bank has the largest private shareholding of any firm in Britain, with 2.8 million private investors. Add to this that the Group has a 43% stake from the UK government (or taxpayer to you and I) and the big issue is that we now have four sets of players involved in the future of the Group: individual investors, institutional investors, the government and the executive of the bank.

UKFI, the government steering committee, is playing a balancing role in trying to appease and keep at bay the institutional funds whilst allowing the management to ‘do the right thing’ for the Group to sort itself out. Meanwhile, the £4 billion share offering appears to be good news for all of us.

The private shareholders get cash if they don’t sign up for it; the government makes £2.3 billion out of it, as the share offering is converting their preference shares to ordinary shares and, as a 43 percent stakeholder they only need to sign up for 43 percent, they therefore get £2.3 billion back on the deal; and it’s good news for the bank, as they will be paying £480 million less per annum in preference share interest rates, which were pegged at 12 percent.

The only question now is: what to do with those £260 billion worth of toxic assets Lloyds placed in the government’s toxic insurance scheme, or the septic bank scheme as we like to call it.

Should be a wonderful shareholders meeting tomorrow.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...