Let’s look at the relevance of social media to banks.

Banks are starting to get into the idea of social media with Scotia Bank, Bank of America and HSBC running small business community networks for example, as well as some such as Wells Fargo pushing the envelope with blogs, Facebook, YouTube and Twitter. The usual question I then get from other banks is: “does it make money?”

Sure, for Mark Zuckenberg and Biz Stone, the founders of Facebook and Twitter respectively, of course it will make money ... but for the rest of us?

The problem for banks is that asking whether social media will make money is the wrong question. The question should be: “what is the relevance of social media to banks?”

You see, the former question assumes you are getting into this to make money and the answer is, you don’t make any money directly out of social media. This is because social media is social. It’s there to have a conversation: to debate, discourse and discuss. It is not a platform for directly making money.

But then, neither is marketing or sponsorship or corporate hospitality or any form of promotional investment ... not directly anyways. That doesn’t mean that you stop marketing, sponsoring, entertaining or promoting though, does it?

And there’s the core point: social media is exactly that. It is media. Another form of communications channel alongside television, radio, newsprint and related media.

The point of this media however, is that it is far more entertaining and inclusive than any other form of media because it is interactive, two–way conversations, rather than just one–way broadcasts. So, for those of you who aren’t Facebooking or Twittering yet, here’s why it is relevant to banks.

Imagine you are running a bank advertisement and your customer(s) could tell you what they think about it.

Imagine you are launching a new account with a superb interest rate, and your customers could tell you what your competition are doing.

Imagine you are considering opening a branch in Tumbleweed and the residents of Tumbleweed could tell you whether they want one before you invest a cent ... instantaneously and in real–time.

Finally, imagine you go to the expense of opening a branch in Tumbleweed after extensive research, and a significant budget deployed for planning, developing, building and marketing the new branch ... only to find that the real audience you should be serving are in neighbouring Cyberville and it would have cost you hardly a bean to launch there.

It’s this last point that is the most critical point for banks to understand today.

If you are still working in a 20th century world of ‘branch distribution’ in a ‘multichannel mix’ using ‘integrated media campaigns’ supported by a strong percentage of ‘online marketing’ ... you are dead meat.

We no longer have multichannels and online ... we just have real–time. Real–time experiences across multiple points of contact.

And if you think in that form of 21st century way - it's all about real-time experiences - then you can start to see the relevance of social media.

And the real relevance is that:

- 2 out of 3 people on the planet visit social networks (Nielsen, 2009)

- Visiting social sites is now the fourth most popular online activity—ahead of personal email— 66.8% of Internet users have used social networks, while only 65.1% have used email (Nielsen, 2009)

- Social media is democratising communications with over a million blog posts written every day by people like you and me

- YouTube has over 100 million viewers worldwide

- 13 hours of video is uploaded to YouTube every minute

- 100 million YouTube videos are watched every day

- 13 million articles are now stored on Wikipedia

- 3.6 billion photos are archived on Flickr (June 2009)

- Twitter grew 1382% between February 2008 and February 2009

- Twitter is expected to have over 100 million users by 2010 and 250 million in 2011

- 3 million tweets are posted on Twitter every day on average

- Facebook doubled from 100 million to 200 million users between June 2008 and February 2009 [ComScore 2009] and is now in excess of 250 million users

- If it were a country, it would be the fifth largest country in the world (bigger than Indonesia)

- Its traffic has grown immensely in one year’s period, especially in Europe where it grew 314% (2,721% growth in Italy from February 2008 to February 2009; 999% in Spain, 607% in Belgium, 518% in France, 499% in Switzerland) [ComScore 2009]

- 5 billion minutes are spent on Facebook every day

- 1 trillion web links, news stories, blog posts, notes, photos and more are shared on Facebook every week

- Time spent on social networks is growing at three times the overall internet rate, accounting for around 10% of all internet time (Nielsen, 2009)

- 93% of social media users believe a company should have a presence in social media (Cone, 2008)

- 85% of social media users believe that a company should go further than just having a presence on social sites and should also interact with its customers (Cone, 2008)

These numbers scream one conclusion: if a bank is not actively engaged in social media and using it to dialogue with their customers, it is the equivalent of a bank seeing all of their customers moving out of Tumbleweed to live in Cyberville and saying: “oh, we like it here. We're not moving.”

As a long-term strategy, a bank that lives in a place with no people is not a good thing.

In summary, if you really want to know what the relevance of social media is to banks, then take a note of this quote from Business Week in February 2009:

“For companies, resistance to social media is futile. Millions of people are creating content for the social web. Your competitors are already there. Your customers have been there for a long time. If your business isn't putting itself out there, it ought to be.”

If you want more of this in presentation format, take a look at this slide deck:

And thanks to Brand Infiltration and Mashable for the numbers.

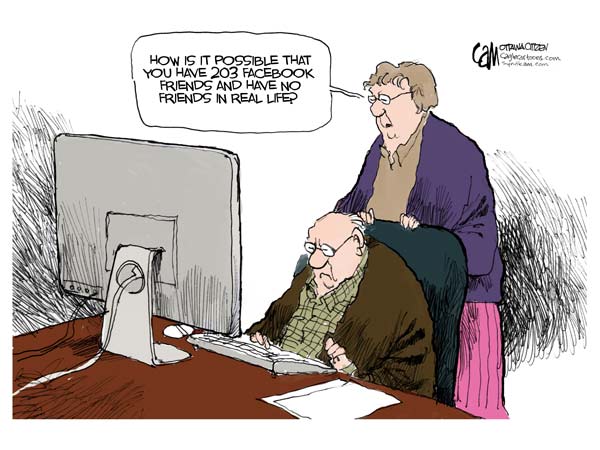

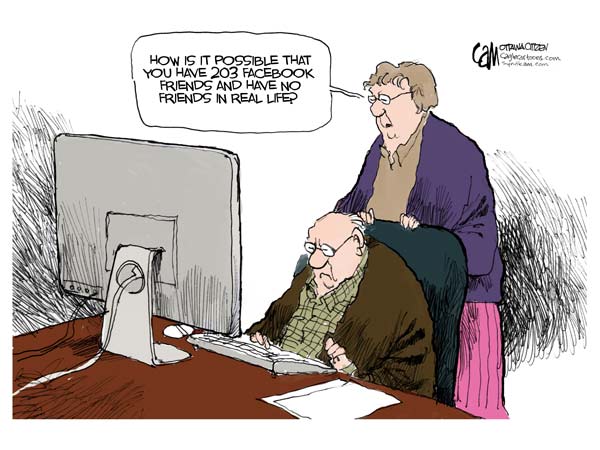

Oh yes, and just in case you missed it, the Catholic church came out over the weekend warning about how social networking can be bad for you.

“Facebook and MySpace might contribute towards communities, but I'm wary about it. It's not rounded communication so it won't build a rounded community,” according to Archbishop Vincent Nichols. He continued, “if we mean by community a genuine growing together and a mutual sharing in an interest that is of some significance then it needs more than Facebook.”

I see what you mean Reverend

Source: Cam Cardow

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...