Things we're reading today include ...

To be honest, there are more things worth watching than reading at the moment.

For example, this guide to high frequency trading from the folks at the MarketPlace:

High-frequency trading from Marketplace on Vimeo.

And an interesting chat between the Telegraph's Robert Miller and David Buik of BGC Partners,

about which bank shares to buy after the UK banks reporting season came to a close:

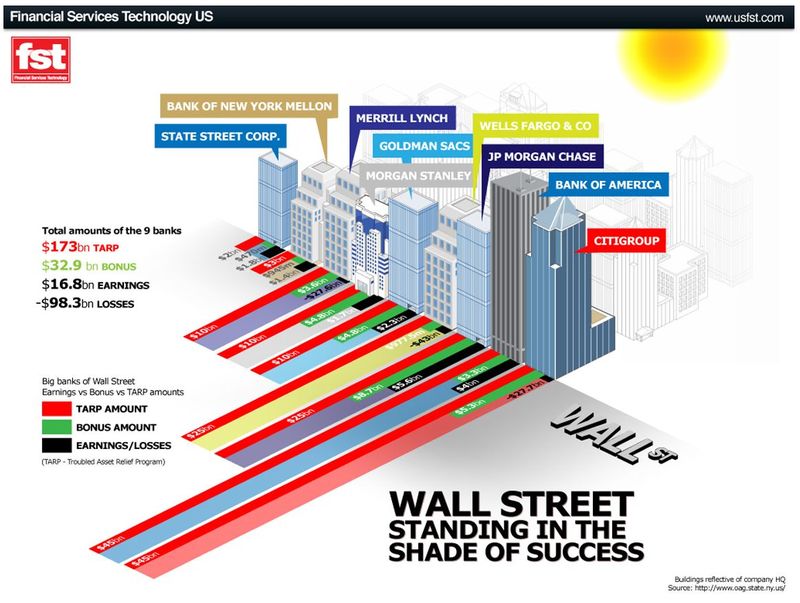

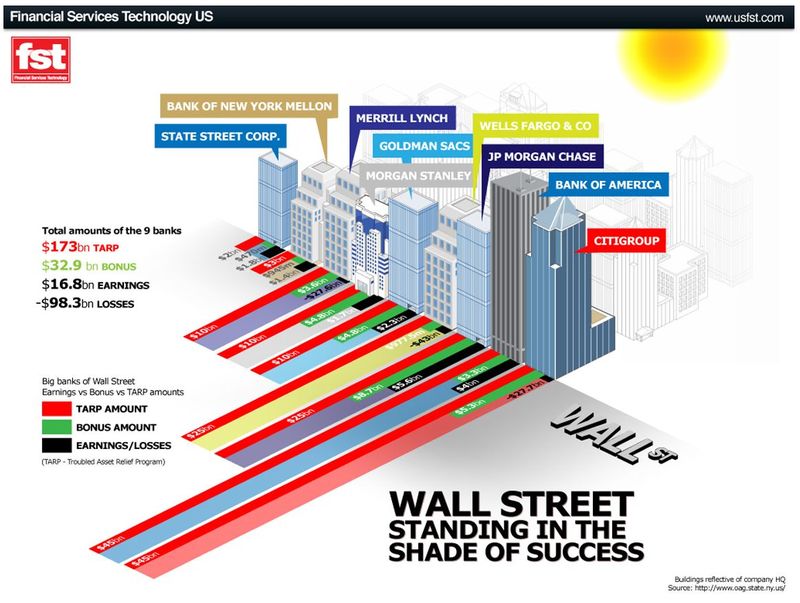

Talking of bonuses, here's a great chart from Financial Services Technology showing the US banks' TARP to Bonus ratio:

(Click to enlarge)

Other than that, there wasn't much news yesterday except for an article about the issues Americans have with Chip & PIN EMV cards - U.S. magnetic stripe credit cards on brink of extinction? (CreditCards.com) - so here's a few other interesting articles:

Stats Confirm It: Teens Don’t Tweet (Mashable)

Teens Don't Tweet... Or Do They? (Zephoria)

Twitter’s platform shortcomings (Scobleizer)

Quote of the Day:

"The borrowers who are most likely to face rejection today are property

developers, closely followed by investment bankers and hedge fund

managers."

Mortgage lenders turn backs on those in ‘risky’ businesses (Times)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...