Things we're reading today include ...

Over the weekend there were loads of headline news articles, but here's the one that hit me right between the eyes.

Manipulation and abuse of the consumer credit reporting agencies

A white paper by Christopher Soghoian

"This paper will present a number of loopholes and exploits against the

system of consumer credit in the United States that can enable a

careful attacker to hugely leverage her (or someone else’s) credit

report for hundreds of thousands of dollars."

Meantime, here's lots of other news ...

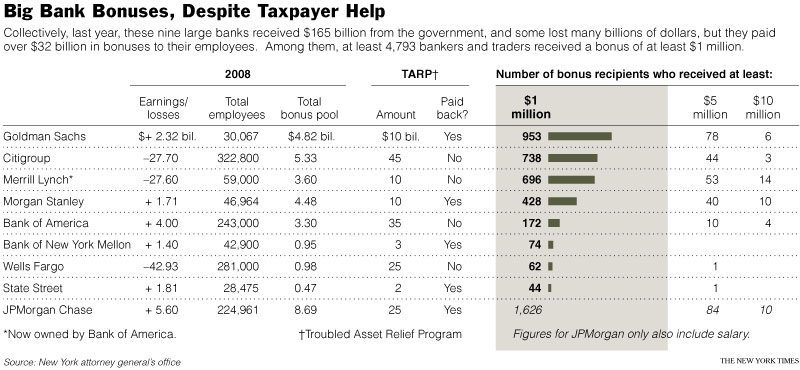

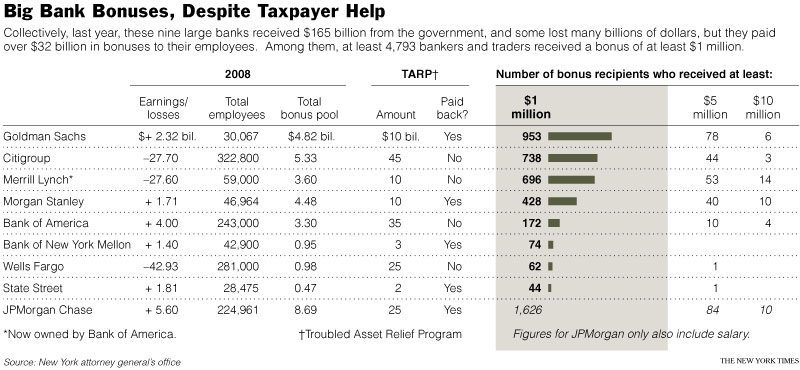

Big Banks Paid $32 Billion in Bonuses While Losing $81 Billion (AllGov)

Fight that could put paid to Wall Street's $100m men (Telegraph)

Looking at Wall Street Pay (The Big Picture)

Source: New York Times

UK Banks to come under scrutiny (BBC)

High street banks set to write off further £32bn (Guardian)

Lloyds and RBS in spotlight as banks issue first-half results (Independent)

RBS poised to deliver £1bn blow to investors as Stephen Hester plays safe (Times)

HSBC May Post Loss on $15 Billion Bad Loan Provisions (Bloomberg)

Companies

Barclays' star bankers to get bonus bonanza (Times)

Commerzbank ordered to pay £10m bonuses (Telegraph)

Icelandic bank chief in £500m of hot water (Telegraph)

Bank Of America Workers Organize Against Closures As Execs Get Big Bonuses (Huffington Post)

Regulations

Bank reform 'needs to be radical' (BBC)

Tories must have the courage to reinstall Glass-Steagall divide (Telegraph)

Brussels keeps watch as OTC clearing starts (Financial Times)

EU braced for autumn showdown on financial regulation (Euractiv)

Economy

Obama warns recession is far from over (Telegraph)

Have we hit the bottom? (CNN)

Technology

What's Behind High-Frequency Trading (Wall Street Journal)

Quote of the Day

"The careful were promised that whatever else the banking crisis brought, at

least it would drive a seminal change back to the old-fashioned values of

thrift and self-reliance.

How wrong can you be."

Bankers are getting away with murder (Times) - worth reading the almost 100 comments

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...