In the fourth of a series about innovation in banking, it’s worth looking at the business models of the new entrants who are trying to disrupt this space and pose the question: are they sustainable?

Zopa, Prosper, SmartyPig, Wonga, Mint, Wesabe and the many other new entrants into finance hoping to leverage the promise of Web 2.0 technologies and social networks: can they last?

The timing of this piece is particularly appropriate as fellow blogger James Gardner puts forward the banker’s view that many of these firms are not creating new demand or targeting new customer groups and therefore are not sustainable.

The discussion began a week ago in fact, when Zopa posed the view as to why they are necessary and, in fact, are needed by banks:

“Could Zopa become the first real competitive pressure banks feel to put their customers more at the centre of what they do? I think so … but when I have suggested this to one or two bankers in charge of strategy for a couple of the big banks, they laugh – out loud ... they say, ‘If Zopa ever gets big enough to matter, we will just undercut it on price for as long as it takes to kill it off, then get back to normal. Simple.’”

James, who works for a bank by the way, responds:

“Zopa rely on credit scoring, just the same as banks do. Zopa, if it is to be disruptive, needs to be creating lending to new customer segments either underserved or not served by traditional banks ... my argument here is not that P2P can't be disruptive, only that the Zopa strategy isn't disruptive. They could be, but they choose to do the same things banks do, but with a nice little social layer on top.”

Now, in the interests of full disclosure, you should be aware that James loves to pull teeth to stir a debate. It is the nature of his being Australian – a nation full of third and fourth generation criminals, which is why they’re so good at sport because you need to run fast enough to escape the local law (now, if that doesn’t stir a response, I don’t know what will!) – but let’s look at James’s view in more depth.

Are these new organisations serving new demands in new customer segments, in which case they are sustainable; or simply targeting the same traditional customer base as banks with just a social layer on top?

First, most of these new businesses are based upon a model of social connection first, with finance second.

This, to my mind, is the same as First Direct and PayPal, both of which are sustainable. First Direct was built upon a model of being a bank without branches built for the telephone channel. They were targeting the same customers as traditional banks but using a new channel for reach.

The core point of First Direct's model was: how could a bank operate without branches? This is why they are the best call centre bank in the UK, because they built a bank on a channel rather than a channel on a bank.

The target was the same traditional customer base as banks, with just a call centre on top.

And they are sustainable.

In First Direct's case they are owned by a bank and always have been, but the premise that a business is not sustainable just because it is targeting existing customers in a new way does not hold up.

For example, PayPal was targeting existing customers in a new way. PayPal’s business is built upon payments by credit card or bank account but through a new channel – the internet. Their new way therefore was to offer secure online payments to traditional bank customers and that has been a phenomenal success, so much so that banks now say that they wish they had thought of the idea or bought PayPal before their success. They just didn't realise how successful and disruptive they would be until it was too late.

And this is a critical point, it's hard to get on a train once it has left the station.

At the core of James argument therefore, which I refute, is that Zopa's strategy is flawed because they are targeting traditional customers of banks with just social media on top.

This is the reason why Zopa's strategy is fine in fact.

If we get it the right way round: Zopa and their siblings have a lean and mean social networking machine at their core, and then target traditional customers of banks with razor thin margin products and services that are fun, social and human. Their razor thin margins are sustainable, unlike traditional banks, because they do not have the staff, legacy, bricks and mortar overheads and costs of traditional banks. And that would be my second point. They have no legacy overhead and are sustainable because their fixed cost structures are a fraction of the legacy competition.

This is why they matter and are disruptive.

Third, these new business structures are fledgling but they are taking off. As Martin notes, Zopa “passes the £50 million of loans milestone and does 40% of that in just this year alone. Compared to the banks the numbers are of course tiny, but the pace of growth is quite remarkable.”

And he is right. The same is true of SmartyPig, a business that teams with banks. SmartyPig tell me that they currently have $170 million in core deposits in the US, and projections are to hit $500 million by year end. This is for a business that only launched in April 2008, and one that spends nothing on advertising.

How has SmartyPig achieved such phenomenal growth? A mixture of factors, from partnering with banks – West Bank in the USA and ANZ in Australia – but that factor is far less important than the fact that they get social media.

And this is the third point, these new business models are built for the 21st century consumer.

Take SmartyPig’s business model. Zero advertising but a great blog, actively twittering, and easily widgetized into Facebook, MySpace or wherever you want to plug and play.

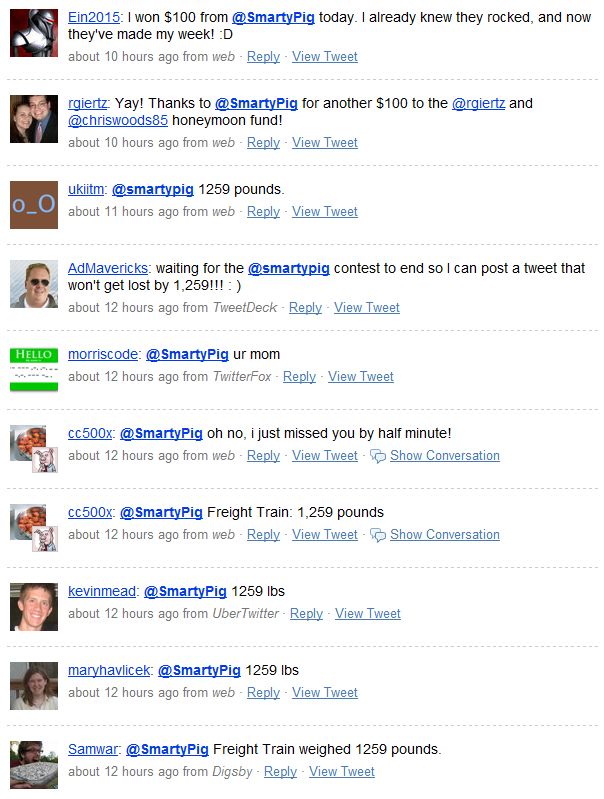

Here’s a great example of their business model: the Twitter contest.

Each month they flag on their blog that they’re going to be giving away $100 gift cards via a twitter contest. The question is posed at a set time – let’s say 8:00 p.m. – and runs for fifteen minutes from the tweet that asks the question. The first correct answer to their question posed wins.

Here’s yesterday’s contest in almost real-time.

First is the announcement of the contest on SmartyPig's blog:

Soon followed by the tweets:

Which got lots and lots of responses:

All in all, a great use of the new media and an illustration of how this creates the multiplicity effect through the network buzz.

And SmartyPig are not alone in getting this: look at any other new entrant to finance on the web such as Mint, Wesabe, Zopa and more and they all have active blogging communities. This is because they get social media.

Fourth, as illustrated, these businesses are targeting new customers in a new way as well as existing customers. The fact that they are leveraging new 21st century technologies means that they will be reaching new 21st century customers. A little like First Direct saw the opportunity for call centres and PayPal for online secure payments, Zopa and their brethren envisage the opportunity for social media.

That’s why the demographics of these businesses are so different. James’ bank for example, Lloyds, is well-known in the UK for the bank that’s full of old people who don’t open new products. Lloyds has been continually challenged with reaching the under 35 age group, the group most likely to be the next generation of loyal customers as customers don’t switch banks after the age of 35. And there’s the missed opportunity. By thinking that Zopa and other social financial services are irrelevant, James and the banks miss the fact that they are securing the net generation of customers.

Can we prove this?

I think so. Here’s an insight into SmartyPig’s demographics:

17% of SmartyPig’s users are aged between 18 and 25;

40% are age 26 to 35;

19% are 36 to 45; and

24% are aged 46 or older.

This shows the bulge bracket of new user is the core target base for next generation financial services; and the over 46 age group are their connections – the mums, dads and nans and granddads who invest and support the savings goals of their children and grandchildren.

That’s a social network for you.

The average goal size of a SmartyPig saver is $15,000 over 4 years, with one out of five savings goals created on SmartyPig designated as ‘public’, so that everyone can see what I’m saving for.

And the top categories of savings goals are:

16% for Travel

14% for Just Saving

10% for an Emergency fund

8% for Gifts and Shopping

7% for House Deposit

6% for Home Improvement

6% for Education

5% for Electronics

5% for a Car

and

8% for Miscellaneous

These are new business models of saving and connecting and, because these are new business models, we will see more and more hybrid versions of such businesses such as Caja Navarro’s Zopa-style service.

Fifth, there’s a view that banks can kill off these businesses once they prove any success. This view is a complete fallacy.

For example, taking another industry, the Home Shopping Channel QVC was pitched as an idea to the major networks, but was seen as not being worthy of note until it gained critical mass.

What's critical mass, was the question posed.

When you get 2.5 million viewers, was the answer.

The trouble is that when you get critical mass, you won't be interested in being acquired and selling out, because that's when the business is working.

Taking this and then adding the network effect, means that when Zopa starts working - let's say, it gets 2.5% of net new lending in 2011 - a year later, it can double, quadruple or even take ten times that market share because, once it has reached critical mass, everyone will know what it is, what it can do and why it is relevant.

That means they will trust it.

So, Zopa get 2.5% of net new lending in 2011 ... 2012 - 10%? 20%? or more.

This is highly likely and reasonable.

Then the banks think, let's kill it ... by undermining it's pricing model? Zopa's pricing is razor thin, so I don't think so.

By buying it? Why would you want to sell-out when you've just snatched victory?

By copying it? Who has first mover advantage?

Nope, as mentioned before, once the train has left the station, you can't get on it. Just like the PayPal reference earlier.

There are so many more points I could add but this post is already too long.

The real point is that, assuming there is a need for these new businesses which I believe there is, the only thing that undermines their business model is access to ongoing capital to get to the point of success. This is the challenge of any new business, and this is the real challenge to these new entrants: can they fund the business long enough to be successful?

Luckily there are plenty of financers out there who do believe in these new businesses however to fund them through their fledgling beginnings, including Red McCoombs for SmartyPig and Zopa’s investors range from Bessemer Venture Partners and Balderton Capital to the Rowland Family.

Even so, in Zopa’s case where they are creating a new market in P2P lending, the issue and challenge has always been getting enough people placing money into Zopa to enable them to meet the demands of those who want to borrow. Without funders, there is no marketplace.

So the challenge is to maintain investment and manage operating costs long enough during this start-up phase to get to the tipping point of growth. And, based upon a 40% increase in total loans just in the last year, maybe that tipping point has finally arrived.

Oh yes, the other little challenge is regulatory protectionism of course, as exemplified by the Italians.

All in all, I thank James for stirring up debate such as this. After all, it’s nice to hear a luddite banker’s view and being able to shoot them down for all the weaknesses inherent therein. Equally, James believes that some of us are being Zopa Zealots and SmartyPig Saints, caught up in the new church of the internet with no sight of reality.

In response to this, it is critical to realise that, as with Friends Reunited and Lycos, the first generation of these services are not necessarily going to be the winners but, if we had seen the opportunity, would we not like to be a part-owner of Facebook and Google today?

Finally, I would take note of some of James's other views. For example, he wrote:

“I think banks being on Twitter is a stunt. It is good for getting the attention of the social media mavens, but can hardly be economic if you have need to reach thousands of customers”

on April 28th this year, and then tweeted:

“Is twitter replacing email for your private messages? It seems to be for me”

on August 10th.

Things can change and, these days, change rapidly.

The bottom-line is that banks have little competition but, thanks to new business models created by new technologies, at least there are a few chinks in the financier’s armour.

For lots more on this, visit our directory of social finance.

Hattip to Mike Ferrari for the SmartyPig insights.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...