So, after chairing the securities infrastructure panel it was off for the first innotribe session of the week. Innotribe is all about visions of the next generation of banking and is specifically debating the role of cloud computing, mashups and crowdsourcing. My session is leading the crowdsourcing debate and we’ve already come up with something useful that I’ll blog about when it’s more fully formed.

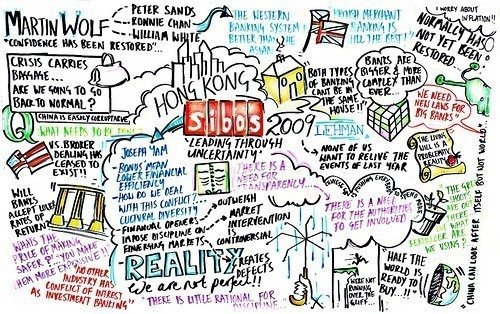

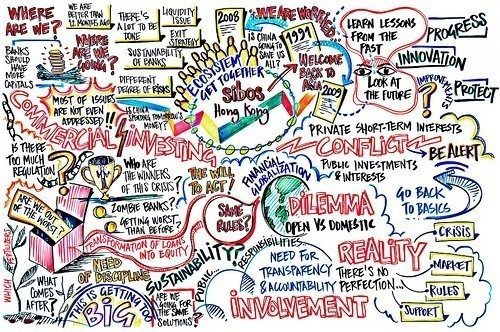

After the innotribe meeting, there was then the first main plenary session which was all about “leading through uncertainty” with:

- Peter Sands, Group Chief Executive of Standard Chartered;

- Ronnie Chan, Chairman of Hang Lung Properties Ltd; and

- Bill White, Chair of the OECD Economic and Development Review Committee;

discussing the state of the banking industry one year after its near destruction and chaired by Martin Wolf, Chief Economics Commentator for the Financial Times.

Here’s my summary of how their conversation went:

Martin Wolf:

Is the financial system healed?

Peter Sands:

‘Healed’ is too strong a word. Better yes, but healed is too strong. For me, think of the patient as dying and now we’ve moved out of the operating theatre and intensive care, but that doesn’t mean the financial system has left the hospital.

We still have huge imbalances which are an issue for the world economy and financial system and we still need to take leverage out of the system which has begun, but not happened to anywhere near the level it needs to yet.

Governments and central banks have thrown huge amounts o f money at the system as well, but without an exit strategy.

Then there are a whole slew of things for the regulatory architecture to fix and, finally, there’s a lot that we as banks need to mend as the business models of some of the banks are just not sustainable. For example, one of the biggest banking models until this time last year was the US broker-dealer model. Within a week of Lehman Brothers collapsing, that model ceased to exist, and the ramifications of that demise are still to filter through in terms of the wholesale lending markets.

At present, those markets have the support of the funding from central banks but, when that goes, then there will be further questions. For example, the cost of credit will go up and policymakers seem to think that banks and their shareholders will accept lower levels of return on credit but that is just not the case. The capital equation is therefore a difficult one.

Equally, the banker sector is more consolidated and concentrated now than it was before the crisis, so the idea of more competition rather than less as a result of these issues is also incorrect.

Ronnie Chan:

If the question is whether the financial systems is healed or not, I think we have not even gone to see the doctor yet. Many of the issues are not even addressed. Let’s face it, the Western financial system is far better than the Asian, but it is not a perfect systems and we need to address the issues we face.

I still think that commercial banking and investment banking should not mix for example. They do not belong in the same house and yet no-one is talking about Glass-Steagall and bringing it back. We need to do that as we need to define these parameters in the banks. Unless we define between and separate these sorts of banks, we still have issues.

Some people are even talking about shadow banking coming back already, and I fear that unless commercial and investment banking are put into a clearer perspective we will have all these issues again.

There‘s a problem with regulation as well, both under- and over- regulation depending upon where you look. By definition, regulation will always be behind product design and that is something we need to address, as many do not know of risks until after they occur.

On the final area, about the argument that we have to pay good bonuses to get the best brains, I would argue that if, by eliminating bonuses we lose those brains, then hallelujah.

Bill White:

There’s a question about a return to normalcy and getting back to equilibrium, but we haven’t talked about rolling back all that leverage yet, all those CDOs, ABSs, MBOs, SIVs etc, so we’re not out of the woods yet. We also worried about banks being too big and too complex to fail and yet now, two years into this crisis, the banks are even bigger and more complicated than ever before and every big bank is a universal bank mixing investment and commercial banking.

My concern is that these big banks will turn out to be zombie banks, and that they are too impaired to get the economic fuel moving again. Another concern is that they’ll now get even more cavalier than they were before the crisis, and credit lending standards will deteriorate further as a consequence.

Mervyn king said that if a bank is too big to fail then it’s not a viable bank, and that’s where we need to focus for the future of regulation. In fact, I agree with Lord Turner of the FSA’s view that we need every bank to create a ‘living will’. Institutions must have plans to close themselves down lodged with the regulators, and if they cannot show that plan to the regulator then they must unbundle themselves from their complexity until they can, as Lord Turner has proposed.

Peter Sands:

There’s much here that I agree with but where I do not is if we go for any form of new Glass-Steagall lite. That is just a distraction. It wouldn’t work. Supposedly we can have narrow banks that can go bust and that’s alright. This would be the Bear Stearns, Washington Mutual, Northern Rock. What you actually get through Glass-Steagall in this case however, is regulatory arbitrage which was a key contributor to the crisis. Therefore I think we need to regulate institutions regardless of what business they’re in rather than trying to narrow their business.

The idea of a living will is also flawed in that, if you only rely upon regulation to restrain entrepreneurial exuberance, you will undoubtedly get another crisis. You need market discipline too. So we should be looking for who is too big to fail, what would happen if they did and a market discipline to manage that uncertainty.

I also don’t like the phrase ‘living will’. A will is meant to be the spreading of your assets that you distribute to your heirs whereas, for a bank, it is the opposite. How do you distribute your problems to others if you fail?

Martin Wolf:

What about future growth then?

Peter Sands:

Markets are thrilled that we’re not disappearing over a cliff but no-one knows where we are going next. The view used to be that the world had this model where Asia produced and the West consumed but that model has gone. So where is the growth of demand going to come from? That is a structural issue and will be a reflection of domestic demand and balances across the emerging economies to rectify rather than the West, and that will take time. So there is a risk that this recovery will slow or stutter.

Bill White:

We have very, very deep-seated problems here that could have led to bad deflation as in debt deflation. Well, the authorities stepping in and using Keynesian methods stopped all that. But what have been the side effects? What are the long-term implications of those responses to deflation? I worry about that. In fact, I worry about three specific things.

First, inflation.

This is not a long-term thing as the issues are deflationary today but with quantitative easing, deflationary issues may come unstuck at some point. We’ve seen this in Latin America and over many decades perceptions of changes in the monetary regime can have a big impact on the economy. It will be very hard to know how to tighten things when needed. So I worry about deflation short term and inflation long term.

The second thing I worry about is asset prices. Yet again we are trying to get out of things the way we did last time, by generating another asset bubble. I worry about that.

Lastly I worry about what many of the governments are doing is getting in the way of the structural adjustments that are required to correct the economy. We have industries that are too big – the auto industry, construction industry, banking industry – along with geographical imbalances between importers and exporters. Then the UK and USA does this ‘cash for clunkers’ deal a

nd I take the view that the car industry is too big and what do we do? We create false demand and incentives to buy more cars to make the industry even bigger, which got us into the issue before: an industry that is too big.

So I’m worried about everything.

Peter Sands:

I think a lot of this crystallises about what happens with the dollar and we can see a very volatile future for the dollar. China has an exquisitely balanced equation between wanting to see the dollar play a less dominant role as the reserve currency, but then they also have a lot of dollars and don’t want to lose the value of that investment.

Ronnie Chan:

China cannot save the world as it’s not big enough – China has a $4tn GDP versus $40tn amongst the largest group of 7 others,

True, they pumped $200bn into the economy every month for several months, but what sectors are they stimulating? Infrastructure and that is government led. That is the sector doing its job.

You are not dealing with an economy that is purely market driven either, but one that is still centrally led. So they can drive change.

You don’t change 3,000 years of frugality being a virtue as a culture in a few months.

Peter Sands:

I think there have been some positive developments in regulation in terms of the Financial Stability Board, the dialogue globally, the acceptance of a need to be coordinated and consistent in reponse. This is a significant step forward. As an industry we do need better regulation as good banks get damaged by bad regulations.

There is a danger that we maybe get too focused upon this particular crisis and the closing of the stable doors for just these issues, which creates another set of issues downstream. I think we are doing this in some ways.

Equally, we are potentially creating an industry of overly complex and opaque regulation, by having too many cooks spoil the broth in terms of risk managers, compliance officers, accountants and auditors all in there trying to add to the equation. We also maybe get too embroiled in all the risks of liquidity and credit, and lose sight of what it is we are here to do as banks. There were issues in this area in Basel II for example, and there is a danger of more of this happening now.

There’s too much focus upon the institutional structures of regulation as well, such as the UK’s debate about who has control: the FSA, the Bank of England or the Treasury. The debate should be more about what regulators can do and should do well. Many of the failures of regulation were not because they couldn’t do something but because they failed to execute their duties properly. That is not to excuse the bankers but if we don’t have the right rules, well executed and to work against, then we don’t have a clear path forward.

Bill White:

There’s a lot of people focusing upon what was new that went wrong and say that if we could just fix all of that then all will be good. There is one camp for example who just want to tackle SIVs and CDOs and just fix that. But we should focus upon what was the same that caused this and other crises. The underlying issues that led to previous collapses. We are going to address these by taking the systemic issues and placing them front and centre this time.

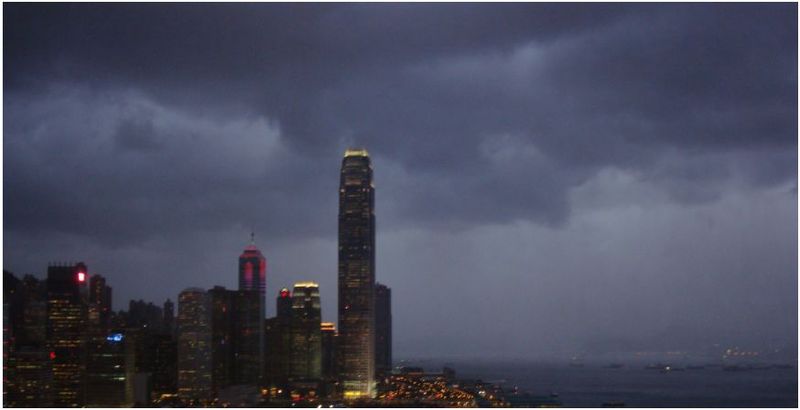

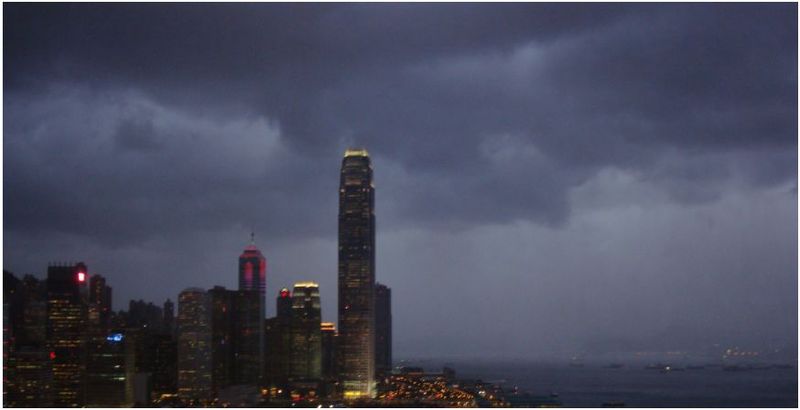

After that dialogue, which one banker told me was a bit depressing afterwards, Hong Kong announced a severe typhoon was approaching – a force 8 which means STAY INDOORS!!!

What was I saying about the Hong Kong weather being a bit weird?

Ah well, here’s the drawing of Bill, Peter and Ronnie’s conversation for those interested (click to enlarge):

After this, I strolled around the exhibit hall, meeting colleagues and friends and debating and dialoguing. A chance to see some more of the exhibits too, with one of my favourites being the Unicredit stand because they have this wonderful soprano opera singer belting out tunes from Puccini.

Sounded like something to do with death and destruction I think which, with typhoons approaching and bankers flagellated seems highly appropriate.

See ya later :-)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...