After that panel session it’s literally been rush, rush, rush.

Rushed off to join a panel that I was presenting, chaired by Matteo Rizzi of SWIFT.

The panel consisted of a role play discussing the six themes I’ve blogged about in the build up to SIBOS with Mary Knox of Gartner and Richard Jaggard of HSBC playing the cynics and myself and Tim Collins of Wells Fargo playing the role of the optimists.

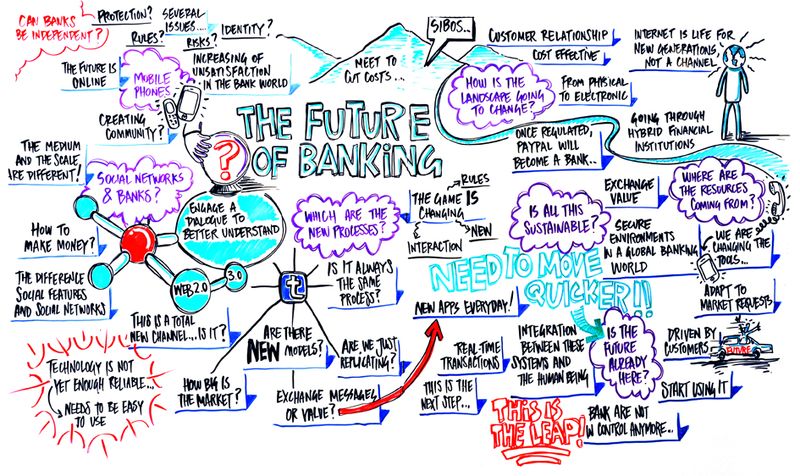

It was a good knockabout and resulted in this lovely little visual (click to enlarge):

Anyways, I don’t need to say too much more about that, as you can read the background which gives you my views on this.

Then it was back into our penultimate innotribe session.

Here's us being blasted out of the water by the venture capitalists:

I always knew capitalism was the problem!

Anways, the whole innotribe thing culminates tomorrow in a presentation to Lazaro Campos and some of the SWIFT Board Members to see if our idea gets the money, or whether they go with the Cloud Computing or Mashups teams.

Baa, boo, hiss to them. We’re gonna win this, especially as our idea is the only one based on business rather than technology, and it's socialist rather than capitalist.

Oh no!

Nothing that's social is going to meet with approval from a banker is it?

We shall see and I will tell all tomorrow.

After innotribe, it was off to the IBM booth where I presented the results of our PSD research and, just to be clear, the results are not negative.

The negativity is directed at the PSD.

SEPA, according to the respondents (the majority of whom are banks), is that banks are doing the job. It’s the policymakers transposing and drafting the PSD who are not.

This could get interesting, especially as I spoke with the European Commission last night who are interested in the research.

Ah well, must forget all about that for the moment as I’m off to the Hong Kong Jockey Club for dinner. Interestingly, I liken the PSD and SEPA to a horse race. Right now, all the horses are running in different directions. From 1st November, they’ll be running in the same direction, just at different levels of speed. Hopefully, they’re racing on the flat and not facing jumps or anything, as that would really mess up the process.

And the finish line?

Dependent upon your view, the finish line for SEPA is anything from three years away to sometime after 2018.

Boy, that’s a long race ...

The Finanser is sponsored by VocaLink and Cisco:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...