Just as we post over 500 pages of research that conclude the European Commission's Payment Services Directive's (PSD) implementation could destabilise the Single Euro Payments Area (SEPA), the Commission strikes back.

Yesterday, they published a whole range of documents and details about how they would make SEPA work.

"The European Commission has adopted a Communication on Completing SEPA: a Roadmap for 2009-2012 in response to the Communication on 'Driving European recovery' ( IP/09/351 ).

The Single Euro Payment Area, or SEPA, is an initiative of the European banking and aims at creating an integrated market for electronic payment services in euros, with harmonised sets of business rules and technical standards. With these new European payments, consumers, companies, merchants and public administrations will be able to make payments under the same conditions throughout Europe as easily as within their own country. The Communication provides a framework for action within six priority areas where greater involvement of all relevant actors is required in order to achieve the full implementation of the Single Euro Payments Area (SEPA).

Internal Market Commissioner Charlie McCreevy said: "To make SEPA a success, a strong commitment by all actors concerned is needed to ensure that the project is delivered on time and in a fully accountable way. At the same time, there is an increasing need for regulators and market players to work together to give Europe an efficient, secure and high performance system for non-cash payments in euro. By providing a Roadmap where actions, actors and deadlines are clearly identified, this Communication will play a decisive contribution in helping SEPA successfully achieving its last miles."

The Communication , which is also in line with the view of the European Central Bank (ECB), presents a series of actions to be undertaken by EU and national authorities, industry and users over the next three years. The Commission has identified six priority themes:

(1) Foster migration : Rapid migration is crucial in order to minimise the costly period of running legacy and SEPA systems in parallel. Public authorities should play a key role here. An efficient monitoring of the migration process will help anticipate and remedy possible migration problems. Setting an end-date to the SEPA changeover could significantly boost the SEPA migration process.

(2) Increase SEPA awareness and promote SEPA products : All parties involved in the SEPA changeover need to be fully informed about its numerous benefits. This could be achieved through tailor-made information and communication initiatives.

(3) Design a sound legal environment and strengthen SEPA compliance : The removal of legal barriers and the design of proper business models which are fully in line with competition rules are cornerstones for a smooth SEPA take-up and increased competition in the payments market. In a self-regulatory context, efficient compliance monitoring deserves special attention.

(4) Promote innovation : SEPA should be a driver for the modernisation of retail payment markets, facilitating the use of internet and mobile phones for making payments and promoting the development of environment-friendly e-invoicing solutions.

(5) Ensure necessary standardisation, interoperability and security : Interoperable, open and secure standards are essential in a network industry such as payments in order to reap the full benefits of SEPA.

(6) Clarify and improve SEPA governance : A n over-arching and efficient governance mechanism that meets the needs of the users is needed at EU level. The main objectives of the new governance structure should be to define a clear strategic vision for SEPA, monitor and support SEPA migration and ensure transparency and accountability."

Good.

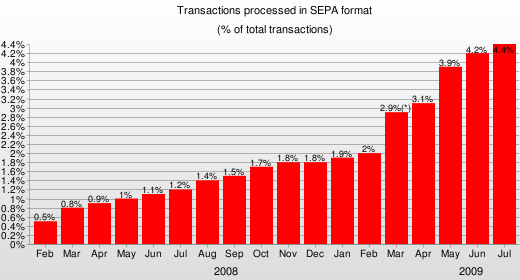

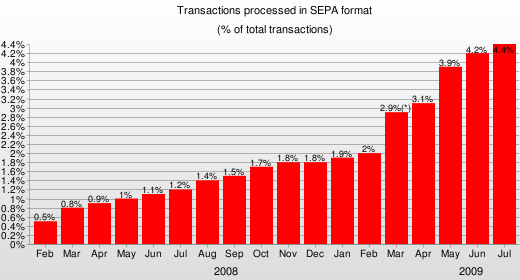

Various documents were issued to support this announcement including an intriguing chart on SEPA Credit Transfers (SCT) which supports the figures I heard where they went from 1.9% of volume to 5% in just a couple of months thanks to major banks converting their back office payments systems to use SCT formats:

Still no end-date or outline of how to get rid of the PSD's inconsistencies and issues ... but at least this shows some support for an industry trying to get to grips with a change program that they don't want and politicians are finding hard to enforce.

The Finanser is sponsored by Vocalink and Cisco:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...