People have talked about an L-shaped, U-shaped, V-shaped or even LUV-shaped recessions, but don’t believe them.

This is not a LUVerly recession, it’s a nasty one as demonstrated yesterday by the news that Dubai is deeply in distress.

Dubai's news will make this the internet, or WWW-recession.

Just as we get a bit bolder – with stock markets rising 60 to 120 percent in some regions – we then get our fragile confidence knocked for six.

Why is this so much of a shocker?

Because Dubai has been in denial of any issues for months.

For the past three months Dubai's leader, Sheikh Mohammed bin Rashid al-Maktoum, has always said there are no issues. He has adamantly claimed that he has made no mistakes and any rumours of issues between Dubai and Abu Dhabi are unfounded and the scaremongers should just "shut up".

So yesterday ends with everyone disappearing for the religious holiday of Eid al-Adha for a week, what does the Sheikh do?

Oh, he just says that the $80 billion worth of debt may be in doubt (btw, it’s probably twice that amount as that’s just hte official numbers) and could they postpone their mortgage payments on Dubai World and Nakheel, the two largest firms in Dubai.

Dubai World owns P&O (controversial buyout in March 2006) whilst Nakheel are the developers of the Palm Resort where David Beckman and other stars own properties.

What

yesterday’s announcement really means is that Dubai can’t afford its

debt. Not paying back the capital on its debt, but even paying the

interest on its debt.This has been denied as an issue by Dubai until yesterday, and is a reflection that even with the $10 billion

borrowed from Abu Dhabi, it’s not enough.

Dubai World on their own owe $22

billion and the issues of interest drifts on sovereign debt – the cost

of borrowing has doubled in recent months – created this

chasm of cost.

For the UK banks this is particularly difficult. Just as they were getting some sense of normality back in the system with share prices rising and Lloyds recapitalisation rights issue looking sound, the markets take a knock for six.

The thing is that the UK banks have been the most supportive of the region during the growth years ... which obviously means they would be the most exposed in a recession if Dubai does implode.

It is interesting for example, that for some time we have known the region has issues, with a mass exodus of workers leaving cars at the airport as they flee the country and their debts.

This is highlighted for me with the fact that I first visted Dubai in 2003 and there were a few buildings being developed, but you could count them easily. Returning each year, it amazed me how many more new buildings were flying up, with what seemed like hundreds of new skyscrapers appearing each year.

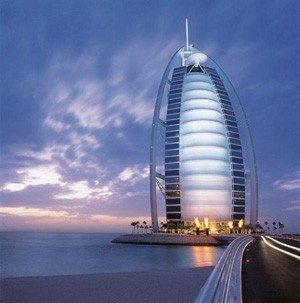

In fact, with the ultimate arrogance, Dubai has most recently been building the world's tallest building for a cost of over £1 billion. I also remember visiting the Burj Al-Arab Hotel a few years ago ...

... and seeing it's opulence, with gold leaf pillars and emerald encrusted walls, asking: "how much did this cost to build?" The answer was that no-one knew. They just said spend whatever it takes.

This would be fine for an oil-rich state, but Dubai is not oil-rich. They realised twenty years ago that their oil reserves would run out before any other GCC nation, so they switched tack to create a logistics (cargo and port authorities), tourism and financial mecca for the Middle East.

And they have been on track to achieve this, but with the implosion of goods, tourism and finance in this crisis, their three main focal points, this is a bad time for Dubai.

Now whether this means the end of Dubai, another global knockdown, tighter lending or worse, we don’t know yet as it could not be as bad as it looks (really?!) ...

... but it does mean that the banks exposures to Dubai which people are saying is in the $13 billion to $40 billion range – WHAT? that’s a massive range!!! Yes, but no-one knew what the cost will be as the Dubai authorities aren’t saying – will mean that the recapitalisation and rights issues of the UK banks means diddlysquat if partner nations move into meltdown.

All in all, a bad day and it’s no wonder that one City analyst described this as the new Lehmans.

Let’s hope he’s wrong.

The BBC has been collecting views from the region:

ANONYMOUS BUSINESSMAN, TEXTILE INDUSTRY

This news doesn't come as a surprise to anyone here, although the government has kept quiet on the subject and people don't discuss it. We've been concerned about the situation for quite some time. Since July we've had two increases in our electricity bills. Our monthly bill was £15,000, now it is nearly £30,000. That is a massive industrial price hike and it's totally unjustified in this oil-rich country.

SARAH, WESTERN JOURNALIST

Six months after I bought a flat, it lost more than half its value. I'm trapped here - even if I rent it, the rental income won't cover my mortgage payments.

MATTHEW, PERSONAL TRAINER

The word out there at the moment is that Abu Dhabi will bail Dubai out and people here are confident that sooner or later it will happen.

ANDREW, MANAGING DIRECTOR OF A COMPANY

I have to say, I think the West and the UK in particular focus too much on the negative stories from Dubai. Like all places, Dubai has been hit hard by the global financial crisis. But believing rumours of 5,000 cars abandoned at the airport, which has only 1,950 parking spaces, is a case of not letting the truth spoil a good story ... we have no rain, no tax and no jury service. I can think of many worse places to be.

PHILIP, FINLAND

Nakheel carried out the most ambitious projects in Dubai - too too ambitious and costly. They damaged the very thing that was Dubai's jewel in the crown - the beautiful white sandy beaches. Dubai needs to invest in a wider range of sectors: manufacturing, the service industry and perhaps more specialised industries. Unfortunately the emirate has learnt the hard way, but it will recover and it will be a good place to live and work in the future.

REBECCA, TEACHING ASSISTANT

I feel unsure about the future of Dubai. When I was listening to the news this morning I was thinking, if things get worse, maybe we should consider moving. It's not what I want to do, but the thought crossed my mind. As my husband says, Dubai has been going too big too fast and now there are not enough funds to sustain this development.

PAUL, DUBAI

A few of my friends lost their jobs, then over a period of three, four months most of my friends lost their jobs. Then I lost my job too. I was really hit hard. The bars and restaurants here were full of unemployed people, talking about moving. Then I noticed the small things - rental prices dropped massively, the daily commute to work in horrendous traffic took only 15 minutes instead of one and a half hours. Lots of abandoned cars in the car parks gathering dust ... greed played a huge part, short-sighted planning, an attitude of get what you can and get out, all played a big part. That's all over now, it's time for Dubai to mature. This is a good thing, I am staying as I know Dubai will come back as a vibrant, successful and truly amazing place to live.

JOHN, DUBAI

I never noticed those signs last year but now they are all over. There are so many office buildings empty here, giant letters on their sides spelling out how cheap the square footage is. There was no control, just wild building and even worse inflation. Now things are on the slide, you can pay your rent monthly and negotiate with desperate landlords for 50% reductions.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...