A cheque processing conference sounds pretty dull these days, especially as cheques are on their way out across most economies. However, a cheque processing conference celebrating 350 years since the oldest surviving cheque was written? No, not that boring.

In fact, as I’m a sucker for numbers and facts, the annual conference of the Cheque & Credit Clearing Company (CCCC), which took place this week was surprisingly interesting.

An audience of over 100 folks from banks and technology companies attentively listened to presentations from the CCCC folks, the Payments Council, Visa and yours truly, with interest.

First, the bad news. The cheque is going to die a slow and interminably difficult death over the next eight years. It is to be phased out in 2018 according to the UK Payments Council’s National Payments Plan. It will no longer be a valid form of payment. In fact, the cheque guarantee card is being phased out even sooner, in 2011. And no-one is going to miss it or its paper based attachment.

Second, the good news. Because there will still be an estimated 600 million cheques being written in 2018, compared with 1.4 billion this year, the cheque will still be around and yes, will be honoured and processed for a period thereafter.

This kind of confused me – is the cheque dead or is it a case of long live the cheque. Well, it turns out that it is long live the cheque as, even with the Payments Council announcing its imminent demise in 2018, this is unrealistic. The banks, cheque processors and cheque users you see, don’t want it to die away that fast.

And this is because there are still not enough viable alternatives to a cheque.

You know, the old line of: “the cheque’s in the post”; what would you do without it?

So, the intention of getting rid of this 350 year old dodo is not quite that simple.

The CCCC guys then proceeded to present a very nice piece of research on people’s perceptions of cheques and the history of the cheque.

I’ll detail more about these over the next couple of days.To begin with, here’s a few short history of the cheque, summarised from the CCCC website:

The predecessor to the cheque was the ‘bill of exchange’, which was developed in Florence in the 12th century to help traders buying and selling goods without the need for quantities of gold and silver.

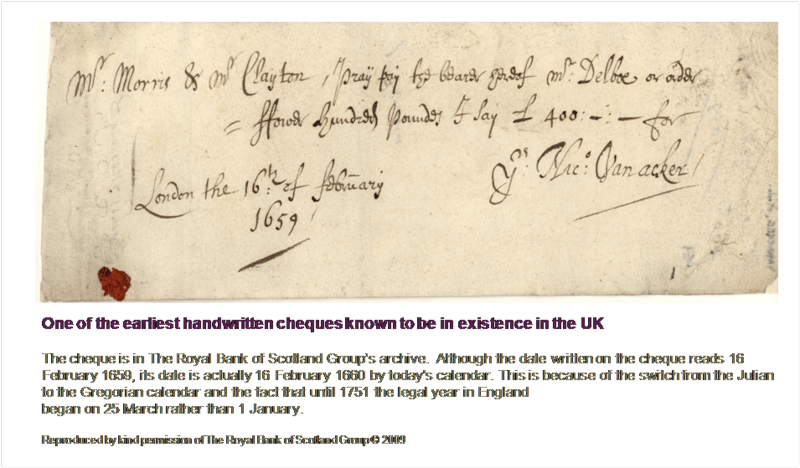

During the 17th century, bills of exchange started to be used for domestic payments and cheques, began with one of the earliest handwritten cheques known to be in existence in the UK written on 16th February 1659 by Nicholas Vanacker to a Mr Delboe for £400, about £45,000 by today’s standards.

During these early days, they were exchanged informally between the City’s bankers as it was before the days of a clearing house, with the bankers settling any net differences between the cheques they exchanged on a regular basis.

Then the Bank of England was formed and, at their first meeting on 27th June 1694, an account was created which allowed customers to draw notes on the Bank up to the extent of their deposits. These were the immediate precursors of the modern cheque.

The Bank of England persuaded customers to use printed forms over time, with the first printed cheques produced in 1717. The printed payment documents had scrollwork along the left-hand edge that could be cut through, leaving part of the scroll on the cheque and part on the counterfoil.

Checking that the scroll on the cheque and counterfoil matched was the real ‘check’ banks made to ensure a cheque was real.

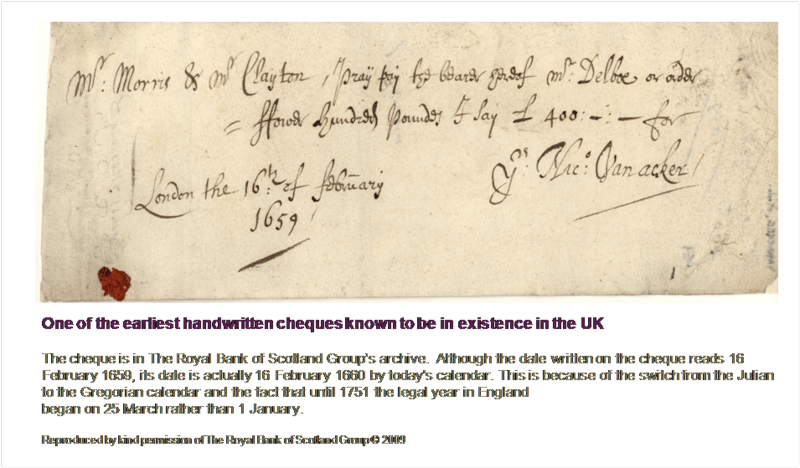

The first cheques printed with the name of the issuing bank were produced from as early as 1735. The Commercial Bank of Scotland (now Royal Bank of Scotland) is believed to have been the first bank to personalise customers’ cheques around 1810, printing the name of the account holder vertically along the left-hand edge. Over the years the process of producing, using and processing cheques has gradually become more sophisticated. For example, the settlement of payments was originally an informal exchange until about 1770, when the practice of clearing was officially recognised by the private bankers in the City. As a result, a room was hired specifically for the clearing of cheques and bills in the “Five Bells” tavern (just off Lombard Street) in 1773.

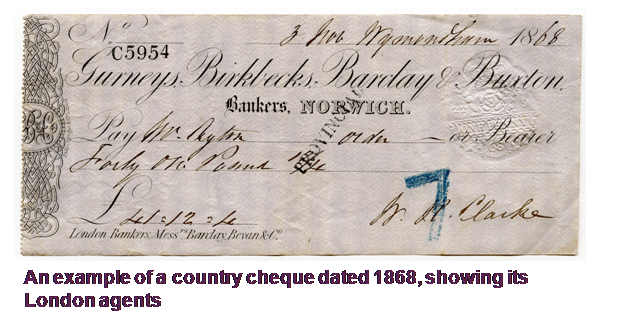

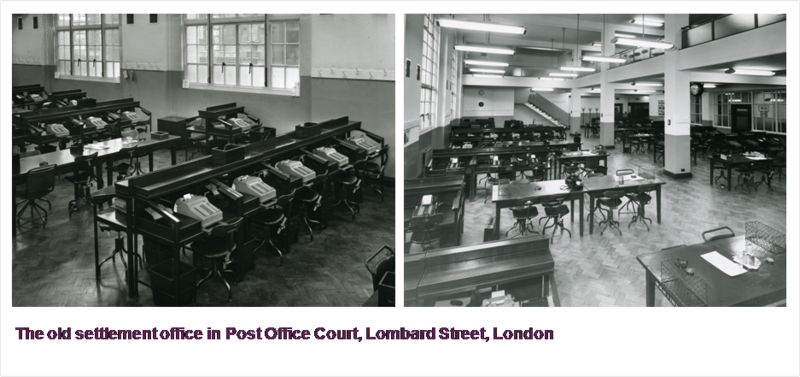

Later, a permanent committee of bankers was formed (later known as the Committee of London Clearing Bankers) to regulate clearing and the first clearing house building was built in Lombard Street in 1833.

This building was used for cheque settlement processing, in this way, until 1994!

Basically, clerks would keep the cheque settlement books for each bank and then compare credits and debits and net positions at the end of their book-keeping cycle. This would determine who pays what to whom between the bank counterparties.

Suprisingly manual, but this was replaced by an automated system from 1995 onwards.

The first cheque card was introduced in October 1965, guaranteeing payment of sterling cheques up to a value of £30. This limit was raised in 1977 to £50 and then £100 and £250 limits were introduced in 1989.

In July 1969 the UK Domestic Cheque Guarantee Card Scheme was established to create common, easily-identifiable design features to simplify acceptance procedures for retailers and other businesses. This card is phased out at the end of June 2011.

In 1990, UK cheque usage peaked with 9.7 million cheques processed per day, peaking at 80 million a day.

Today, that number is averaging 3.5 million cheques per day.

This means that cheques have moved from 11% of all payment volumes in 1990 to just 3% today.

This is why cheques are now being phased out.

More on numbers and plans tomorrow.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...