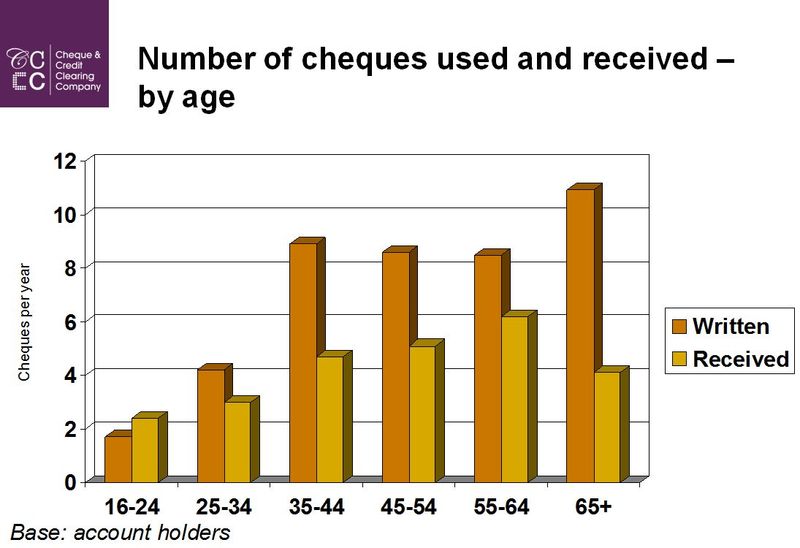

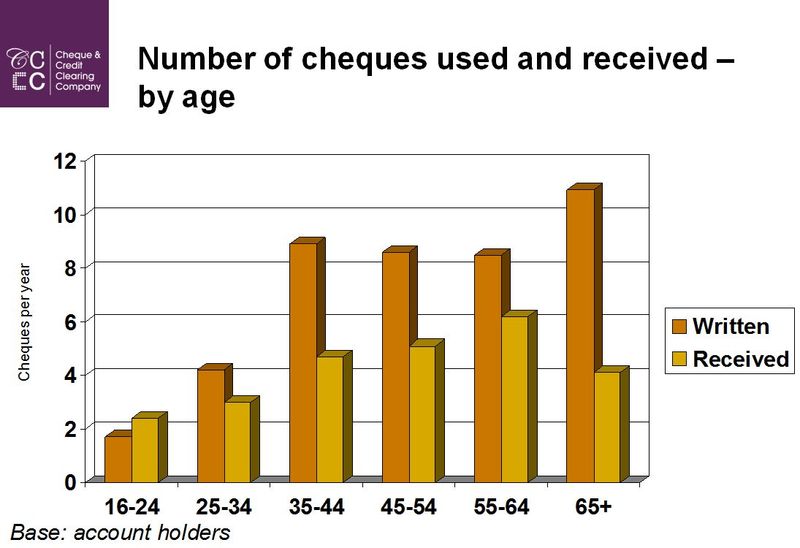

With the news that the cheque will end its life as a valid payments instrument in the UK on 31st October 2018, it's worth reminding all that it's not just old people who use them:

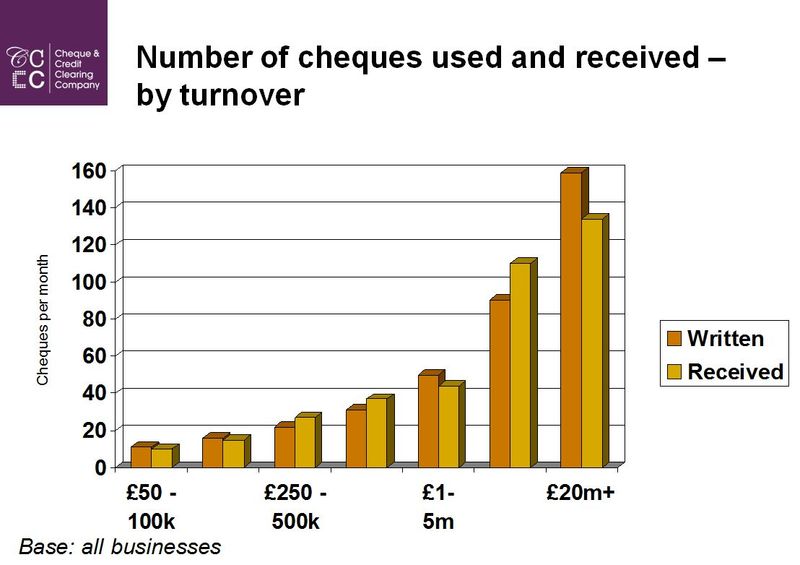

But that the main usage is with businesses, who want to keep cheques.

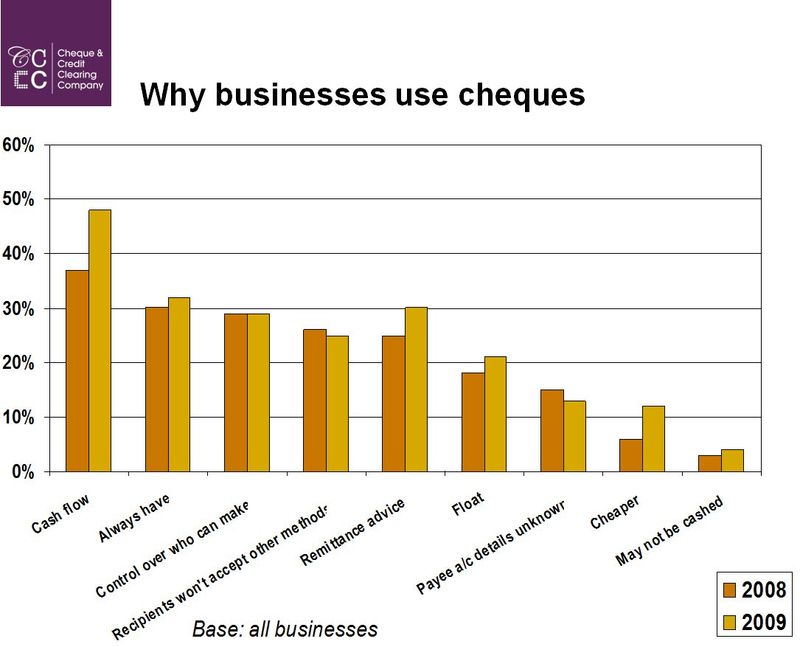

Because they like them for cashflow management.

PRESS RELEASE

16th December 2009

2018 target date set for closure of central cheque clearing

The Payments Council Board has agreed to set a target date of 31st October 2018 to close the central cheque clearing. Cheque use is in long-term, terminal decline. The Payments Council was faced with the choice of either managing the decline to ensure that personal and business cheque users have alternatives easily available to them; or to stand back and let the decline take its course. It has decided that its active involvement can help prevent confusion and deliver cheque alternatives that are acceptable to cheque users. The Payments Council wants to ensure that consumers and businesses are not left high and dry when the closure of the clearing occurs.

Over the next nine years the Payments Council will seek to promote and explain existing alternatives; and where innovation and new options are required to ensure that they are put in place. Although cheque use has been in decline since 1990, and has fallen by 40% over the last five years, there are still plenty of situations where cheques are used extensively. These include payments between individuals, and payments to sole traders, small businesses, clubs, charities and schools. The payments industry has to rise to the challenge of finding easy-to-use efficient alternatives for these payments and to ensure that they are easily accessible and well understood by cheque users. The goal is to ensure that by 2018 there is no scenario where customers, individuals or businesses, still need to use a cheque. The Board will be especially concerned that the needs of elderly and vulnerable people are met. The next step is to identify targets which the Council can measure progress against. It will undertake a full review in 2016 before any final decision is taken.

Chief Executive of the Payments Council, Paul Smee says:

“Customers aren’t likely to see any immediate change as the target date is still a long way off. This announcement marks the start of extensive work that we need to do to ensure that everyone has a viable alternative, should the cheque clearing close. We aim to be very transparent and we will continue to consult fully with all interested parties. There will be a critical review in 2016 when the Payments Council will decide whether sufficient change has occurred against agreed published criteria, to press ahead to do away with the cheque in 2018. There are many more efficient ways of making payments than by paper in the 21st century, and the time is ripe for the economy as a whole to reap the benefits of its replacement.”

The decision follows 18 months of extensive consultation and research to understand fully where and when customers still use cheques, and where alternatives need to be developed. This involved consulting with groups representing consumers including the elderly and consumers with disabilities, and those with other special requirements, and small and corporate business users of cheques. Feedback from all these groups showed that the vast majority accept that 2018 is a feasible end date but that many expressed concerns about viable alternatives being in place and being accessible to all those who currently use cheques. This is why the Payments Councilhave set the 2016 review date.

Smee added:

“We have already done a significant amount of work, research and consultation which has convinced us that 2018 is achievable. But the real challenge lies ahead if we are going to be comfortable to wave good-bye to the cheque, which undeniably occupies a unique place in British culture. The payments industry will have to react positively and take the lead on delivering solutions which suit all their customers. I know that the Payments Council Board will pay particular attention to check that the needs of disadvantaged consumers are addressed.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...