It's forty days since the introduction of the Payment Services Directive (PSD), so there has been lots of chat about the PSD this week, and how it’s working or not working.

Derogations and interpretations are rife, with the hottest and most contentious issue being the fact that charges are now meant to be shared (SHA in the SWIFT message exchange), except that many banks, institutions and even government administrations are insisting on OUR charging structures, where the sending bank pays all fees.

This issue is even causing ambiguity within a country, where one bank might accept OUR message payments from corporate clients in order to save the client having to re-jig their systems to accommodate, whilst another bank might not.

Even worse is where a bank sends a payment and gets a call from the beneficiary’s bank saying that they will process it as SHA but, if the client objects to the charges, then they will process it as OUR and ask the sending bank to pay the fee plus a potential ‘lifting fee’.

Elsewhere, some banks are taking the payments as SHA but then wrapping charges into other services and fees, so that the client does not realise they are paying or how much.

All of these shenanigans are just mere ‘teething troubles’ of course, as the PSD settles into the markets.

In fact, according to Ruth Wandhöfer, EMEA Head of Payments Strategy and Market Policy for Treasury & Trade Solutions at Citi’s Global Transaction Services and member of the EU Banking Council for the PSD, there are things that are being captured and changed. For example, some German banks were asking for €170 to process an incoming cross-border direct debit payment because their systems are so inefficient. This has been slapped down, with a maximum of €40 being viewed as an acceptable charge (that’s still high if you ask me).

Equally, some Spanish banks were asking for 4% of any transaction as their fee. That’s been slapped down too.

All in all, it is still clear that we have passed the start date for the PSD but the PSD has yet to start.

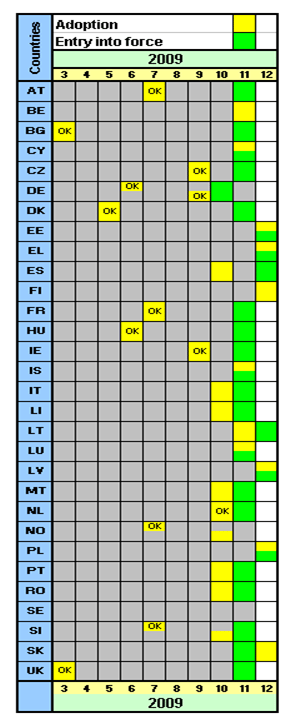

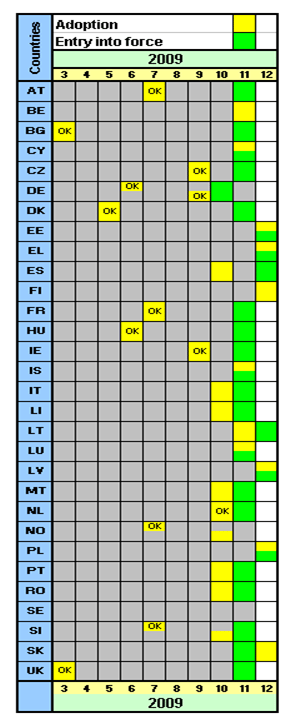

For example, here’s the state of transposition of the PSD according to the latest EU analysis:

What this shows is that Estonia, Greece, Latvia, Poland, Slovakia, Finland, Cyprus, Lithuania, Italy, Spain, Sweden and Belgium (Belgium!!!), all missed the deadline of 1st November 2009.

This is poor form as that means only 15 of the EU27 made it on time. Only in September, when I last checked the Europa website for the state of play, they had confidently predicted that 26 countries would meet the deadline.

Poor show.

Even worse, those that are making the deadlines are misinterpreting, adding or changing the intent of the text. These changes take one of three forms:

- Derogations

- Gold-plating

- Divergence

In the first instance, there are 23 derogations in the PSD. These are meant to allow each member state the ability to introduce the PSD without having to completely reinvent their payments infrastructures within country.

However, they are also creating major confusion, with the one derogation cited most often being the definitions of what is a microenterprise and how is it treated.

The UK classes microenterprises – small businesses – as consumers, and gives them all the rights and protections, products and services that would be afforded to a consumer in a payments transaction context. France, Spain and Italy, amongst others, use the derogation to classify microenterprises as corporates, and give them the rights and protections and products and services of a corporate client.

By doing this, they can offer and operate a consumer product as a corporate product under the PSD’s definitions, with the most obvious standout being the Italians who claim that the Riba – a direct debit in any other country – is actually a corporate product and therefore not subject to the PSD’s definitions of direct debits.

Gold-plating is also rife, particularly illustrated by the leg-in and leg-out dialogue where some countries are making themselves more attractive for payments processing by including US dollars and other non-EU currencies in their PSD definitions.

Finally, divergence is being created across countries by using definitions in different ways. For example, Belgium and Slovakia have used derogations to enable their markets to define the payments cycle to be same day, rather than the D+1 (or +3) as dictated by the PSD; meanwhile the UK, by clever interpretation of value dating rules, has managed to get around this completely.

No wonder this is all so confusing.

Anyways, to clarify the confusion, Ruth Wandhöfer presented some interesting insights, and here are a few of her bullet points ...

What is the PSD?

The PSD represents a legal framework for payments within the European Union Single Market, covering the EU 27 as well as Norway, Iceland, Lichtenstein (not Switzerland!).

The PSD is a European Directive, which means that all Member States were required to implement PSD rule into their national legislation, a process called transposition, by the deadline of the 1st November 2009.

The PSD applies to payment transactions in euro and all other Member State currencies within the Single Market, where those are provided by payment service providers located in this Community.

The PSD covers all electronic payment services, while cash to cash transactions and cheques are exempted from the scope.

The PSD does not intend to cover payment services associated with securities asset servicing.

The PSD’s focus is on customer protection (not just consumer protection), covering the relationship between all providers and users of payments services.

With the aim of enhancing competition the PSD creates a new lightly regulated entity called a “Payments Institution”, allowing non-banks to handle payments and join the bankers’ payment schemes and associations.

The PSD also defines conduct of business rules for all payment service providers covering the end to end payer to payee relationship.

The PSD will have a revolutionary impact on the legal framework between banks and their customers setting stringent rules for information disclosure, conduct of business rules and service provision

Harmonised refund rules have been established to support SEPA Direct Debits, while unique identifier primacy ensures for enhanced levels of straight-through-processing.

Central Bank Reporting requirements for Euro transactions across the EEA still constitute a barrier to the free flow of SEPA transactions.

Every credit institution that provides payment services in the EEA will have to comply to PSD’s conduct of business rules.

Short-term issues with the PSD

Banking industry and Commission were strongly in favour of all countries transposing the PSD for 1/11/09 given intra EU/EEA cross-border payments are in scope.

In reality, the following countries are understood to have not been ready for the 1 November 2009 deadline: Estonia, Greece, Latvia, Poland, Slovakia, Finland, Cyprus, Lithuania, Italy, Spain, Sweden and Belgium. Spain and Slovakia joined in early December 09.

Consequent impact in practical terms: clients may experience a brief period of non-uniform treatment where a ‘PSD payment’ is being sent to a country yet to complete its transposition; and hence where ‘old’ legal regime practices could be applied.

An ideal ‘best practice’ would be if banks in late countries could voluntarily adopt key PSD payment processing provision (e.g. full amount principle) between 1/11/09 and transposition completion, but this may not always be possible.

To help minimise uncertainty, the EU banking industry within the PSD Expert Group is looking to establish Best Practice Guidelines designed to establish an approach in the key countries where transposition was delayed to ensure broad principles of the PSD are nevertheless complied with (e.g. the ‘no deduction’ principle).

Full Amount Principle and Charging Options

General rule: no deductions of charges allowed from the full amount where both legs of the payment are in the EEA and the transaction is in Euro or another Member State currency.

EU Commission Services are strongly of the view that charges code SHA is the clear requirement in line with the charge sharing principle in Article A52(2) (excepting in cases where there is a currency exchange) – despite the slightly broader interpretation in a few Member States (who have not ruled out use of OUR option).

The Commission and Banking industry further support a general move to using the ‘SHA’ charge code for all EEA currency payments travelling within the EEA.

The usage of SHA will ensure that the ‘full amount’ of the payment transaction will travel up to the beneficiary bank and a separate fee agreed with the beneficiary client will be charged or deducted (in a transparent way from the full amount).

Generally, the recommended best practice to all beneficiary banks is not to reject an incoming payment just on the grounds that the charge code is possibly ‘inappropriate’ as generally the beneficiary bank will not have all the facts necessary to make such a determination with certainty.

There were lots of other discussions about this during the week, but far too much to blog about every nuance of every chat.

Suffice to say, my own bottom line is that this ain’t working.

Roll on the PSD II.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...