Back in January, I made five firm predictions for banking in 2009. Those predictions were:

- More major European and American banks disappear

- There will be some spectacular failures in the BRIC economies

- A Global Financial Regulatory Body is formed

- The US will drop IFRS

- Solvent banks gain major market share.

So what happened?

1) More major European and American banks disappear

With seven more failures last Friday, the total of US bank failures this year is now 140, wiping out the FDIC’s fund of $45 billion and way up on the mere 25 failures in 2008. Whilst none have been of the size of WaMu, there were some big ones. Here are the Top Ten:

#10 San Diego National Bank

Closed : Oct. 30, 2009

Assets : $3.6 billion

#9 Silverton Bank

Closed : May 1, 2009

Assets : $4.1 billion

#8 Park National Bank Closed : Oct. 30, 2009 Assets : $4.7 billion

#7 Corus Bank Closed : Sept. 11, 2009 Assets : $7 billion

#6 California National Bank Closed : Oct. 30, 2009

Assets : $7.8 billion

#5 United Commercial Bank Closed : Nov. 6, 2009

Assets : $11.2 billion

#4 AmTrust Bank Closed : Dec. 4, 2009

Assets : $12 billion

#3 Bank United FSB Closed : May 21, 2009

Assets : $12.80 billion

#2 Guaranty Bank Closed : Aug. 21, 2009

Assets : $13 billion

#1 Colonial Bank

Closed : Aug. 14, 2009

Assets : $25 billion

In Europe, the story is not as transparent as there is no central list of failed banks, as there is with the USA. Nevertheless, several banks received governmental support or were soft landed into an acquirer, such as the story of Alliance & Leicester gifted to Santander. There was also news on regular occasions of stressed or failing banks, such as WestLB in Germany or, just this weekend, Hypo Group Alpe Adria in Austria.

More noticeable, in the European situation, has been the failure of countries, with Ireland, Latvia, Iceland and now Greece all looking wobbly.

As a result, expect more failures in Europe next year, with Spain looking particularly unstable ...

... and the result may be questions over the future of the European Union. After all, adhering to constraints set by one country which force another into bankruptcy just does not go down well.

2) There will be some spectacular failures in the BRIC economies

To be honest, Brazil has outshined everything, China has continued to do well and India’s economy is still booming. In fact, India now talks about a G3 – the USA, China and India. Such confidence!

So I called this one wrong. Or did I as the last of the countires, Russia, was hit hard by this crisis and there are still major concerns about Russian banks.

The rouble has sailed close to collapse several times in the first quarter and, as President Medvedev said in October: “The real damage to our economy was far greater than anything predicted by ourselves, the World Bank and other expert organizations.”

So, although there has been no spectacular collapse in the BRICs this year, there has been a very shaky year in Russia.

3) A Global Financial Regulatory Body is formed

Wow! Now that was such an off-the-wall prediction wasn’t it?

Headline from September 2009: G-20 Summit: IMF as Global Financial Regulator

So that’s a done deal.

4) The US will drop IFRS

The SEC and others all believe that we need a global accounting standard, and are urging US firms to adopt IFRS accounting rules. However, many believe these are the wrong rules for US firms and, if you want to know why, read Professor David Albrecht’s blog.

In particular, in light of the crisis, IFRS rules just would not make sense for US firms. It would be far too costly as a massive departure from the GAAP rules. Therefore, the SEC may push for a change but:

(a) they’ve dropped the 2016 (previously 2014) target for IFRS; and

(b) they are now seeking a harmonised GAAP/IFRS compromise, rather than just getting firms to adopt IFRS.

This debate will continue.

5) Solvent banks gain major market share.

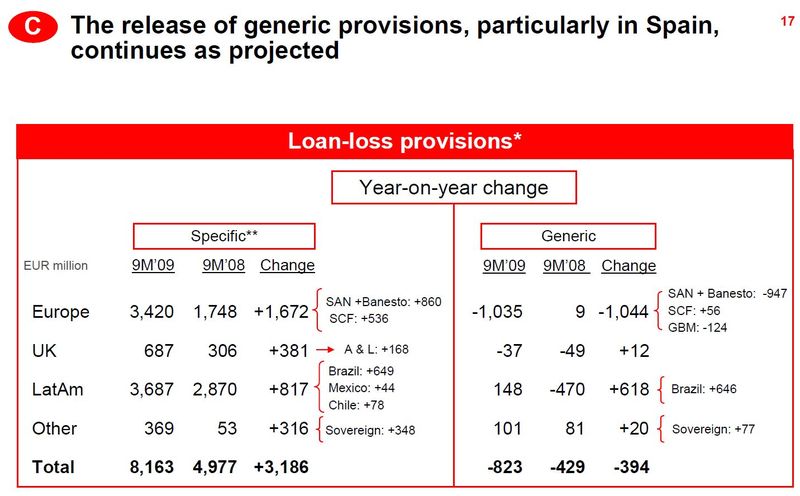

Again, a no-brainer. Just look at Santander’s last quarterly results release:

Santander (voted Bank of the Year by several media publications such as the Banker), JPMorgan, HSBC, Deutsche Bank, Goldman Sachs and more are not just big now, but set for hugeness, whilst Citi, Bank of America, RBS, Lloyds, Fortis, ING and others are still challenged in getting back to normality.

This will continue to serve the large banks’ agenda, and whilst more banks drop off the radar (point one), there will be several more ‘gifts’ to the big boys.

Should be fun.

Meanwhile, I’ll make a few more predictions for 2010 on return in first week of January, but one big prediction will be that the global regulations for the global IMF regulator will be firmed up.

In fact, Robert Peston’s blog today focuses upon the new Basel III, which corroborates that one.

Now that won’t be fun.

*

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...