After the Fat Cat Cash Back internet game comes Bailout Wars, the iPhone App.

Here's a brief review:

The basic idea is you're defending the white house from five

different types of bankers all intent on stuffing their pockets full of

the bailout money which is somehow bursting out of the windows of the

White House.

The game is controlled the same way as other castle defense games,

you defend the White House using various flicking and swiping gestures.

Different bankers require different tactics, while the standard banker

can simply be flicked in the air, the stock broker will open his

briefcase and use it to glide to the ground. To kill them, you'll need

to slam them in to the ground with a swiping motion.

There's a banker with a vacuum that explodes when you tap him, high

risk investors in helicopters that you need to make crash, and a giant

CEO that can only be damaged utilizing the White House's weaponry and

by flinging other bankers in to him.

As you progress through waves of bankers, you'll earn coins that can be used to buy upgrades to your defenses.

The ad is seriously worrying ...

It reminds me of the new game on Southwold Pier in Suffolk, UK.

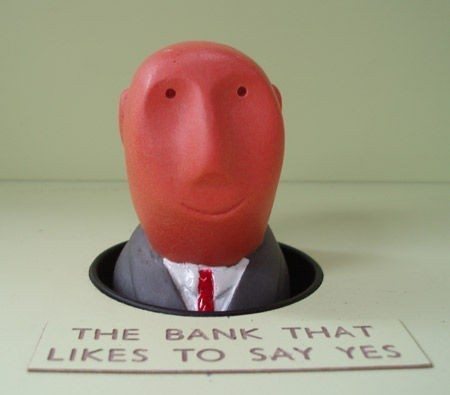

This idea is based upon the Whack the Mole game, but it's Whack the Banker.

The idea came to inventor Tim Hunkin to use a mallet

to hit as many bald pop-up figures as customers can in a limited time.

''You pay 40p to hit as many bankers as you can in 30 seconds as their heads

pop up,'' said Mr Hunkin. ''It's proving very popular. I keep having to replace worn-out mallets.''

What he has actually created is lots of pop-up bankers with the main advertising slogans of Britain's mainstream banks against each one. You then whack them away with your mallet and score points.

You can see this idea in reality in many YouTube clips. Here's one of the better ones:

... it all reminds me of the test the teacher carried out at my local school the other day.

The teacher asked the kids what their dad did for a living.

Mary's was a fireman, Davy's was a call centre manager, Mohammed's worked in an office and then they got to Johnny.

Johnny piped up: "my dad's a stripper in a gay and lesbian pole-dancing club which got busted the other day for drug dealing".

The teacher was visibly shocked and asked: "can this be true, Johnny?"

"Nah", Johnny replies and decides to fez up with the truth, "he's actually a banker but I get beaten up if I tell the kids the truth, so this sounded a lot better".

Ah well. At least he's not Tiger Woods ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...