The biggest news stories of the week include ...

Fraud fear blocks Haiti donations - BBC

After £800bn loans, China tells banks to focus on the real economy - The Times

Barack Obama's speech on banking reform: in full - The Telegraph

Michael Geoghegan speaks to Sky News' Jeff Randall: Full Transcript - The Telegraph

Ben Bernanke requests audit of Fed's AIG bail-out - The Telegraph

And our biggest stories of the week are ...

Why would a bank change their core system?

I was asked a question about why a bank would change their core system the other day. There are lots of reasons why a bank would change their core system. Here’s my top five: legacy constraints, competitive forces, regulatory mandate, merger and acquisition and new management requirements.

The last pit ... the end of open outcry trading

For years, men have shouted at each other in open warfare outcry pits. These blood curdling scenes are reminscent of cock fighting or

pitbull terrier pits, where teams of angry testosterone fuelled alpha

males go at each other with their gesticulations and cries. What am I talking about? The traditional trading floor.

Mint’s blog sent a post out yesterday titled:

“David & Goliath: How Customers are Sticking it to the Big Banks”. It immediately caught my attention because the Huffington Post in the

USA has been promoting the idea of switching banks, as have others such

as the Guardian and more. But their campaigns are misguided.

Everyone's getting real excited about Jack Dorsey, the co-founder of

Twitter, and his new payments application for the iPhone called

Square. This simple plastic add-on and its app allows any iPhone

user to take credit and debit card payments. But is this a radical innovation or just a work around for a twentieth

century issue?

I’m continually impressed and amazed by the speed of change in

the technology of the investment markets. For example, last year was all talk about low latency and lit versus

dark pools. This year, it’s all about private cloud-based services

based upon colocation and proximity services. Next year, it will be all

about real-time liquidity and settlement. What's next?

UK bank Halifax, part of the Lloyds Banking Group rescued during the

crisis, has been heavily advertising a £5 gift to customers who

deposit £1,000 per month into their account. The trouble is

that customers hate the adverts. Is this good or bad? See

the advert and customer feedback by clicking here

, and find out what Halifax should

have done by clicking here

.

Just

back from Malta for a brief trip, and was particularly taken with the

fact that the country appears to be sponsored by HSBC. Not just the airport, a hotel or a football stadium, but the whole country. Where did this impression come from?

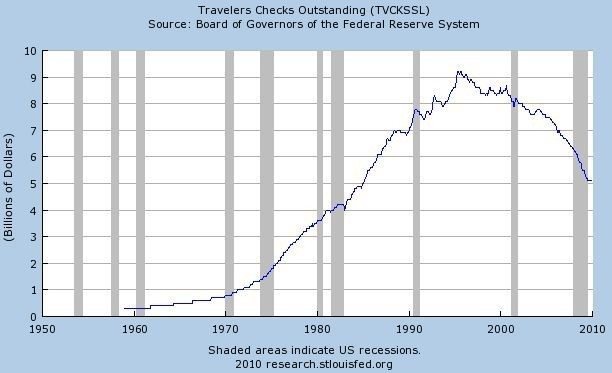

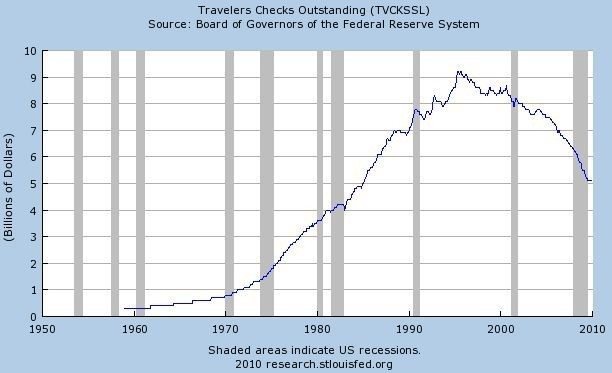

When will they ban travellers cheques?

Following the decision in the UK to phase out the paper cheque by 2018, here's a graph of travellers cheques usage as published by the Federal Reserve (double click to enlarge):

I wonder when these will be outlawed?

And, in other news:

Social media and financial services

Further to previous surveys conducted by the Financial Services Club,

we are pleased to announce our first research for 2010 focused upon

Social Media in Finance. Click here to take the survey.

The Financial Services Club's First Quarter Agenda

The

first quarter season of the London-based Financial Services Club has

just been announced and includes discussions on SEPA, EU regulations,

Innovation and the Media, and includes leading luminaries from the BBC,

Payments Council, EBA, Wonga and more.

The Financial Services Club is sponsored by:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...