The Financial Services Club is pleased to announce that we have recently agreed a partnership with Thomson Reuters Equity Market Share Reporter (EMSR) to provide a monthly MiFID MTF Monitor. Our aim is to show how the pan-European investment markets are changing as a result of the MiFID and the entry of the new MTFs.

EMSR provides extensive, amazing, insightful and very indepth analysis of pan-European trades via electronic and OTC trading, including trade reporting on and off exchange through internalisation reports via Markit BOAT, as well as a pure comparison of trading venues, including dark pools.

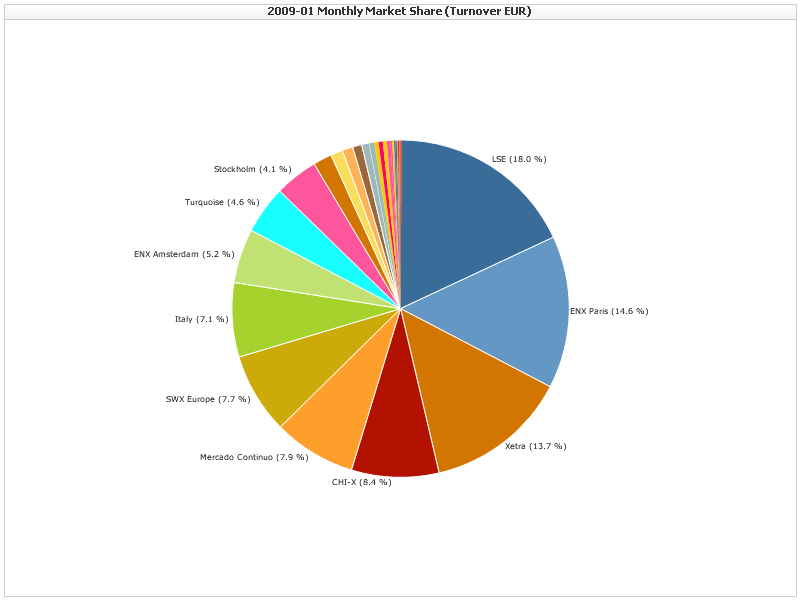

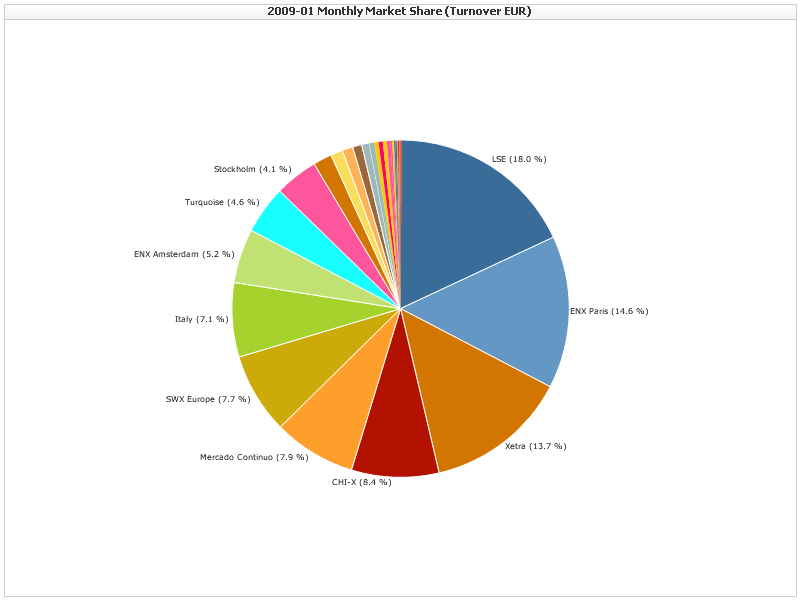

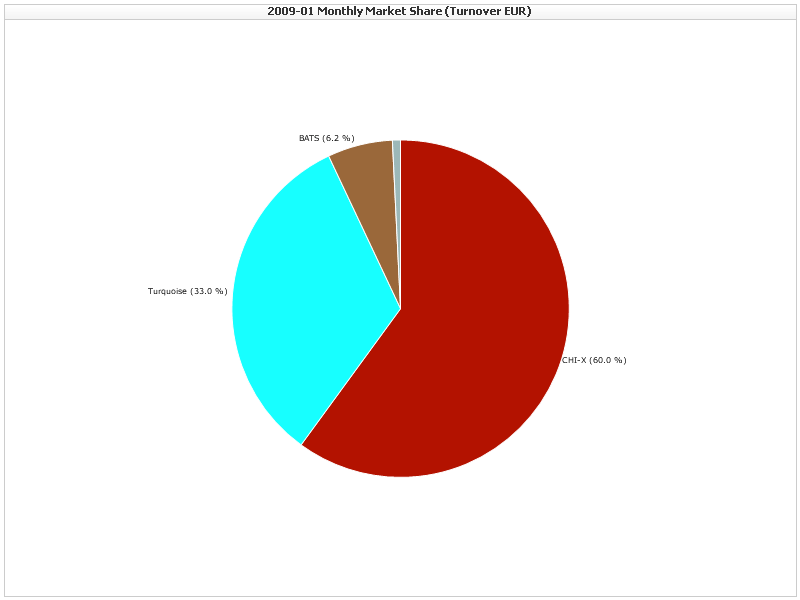

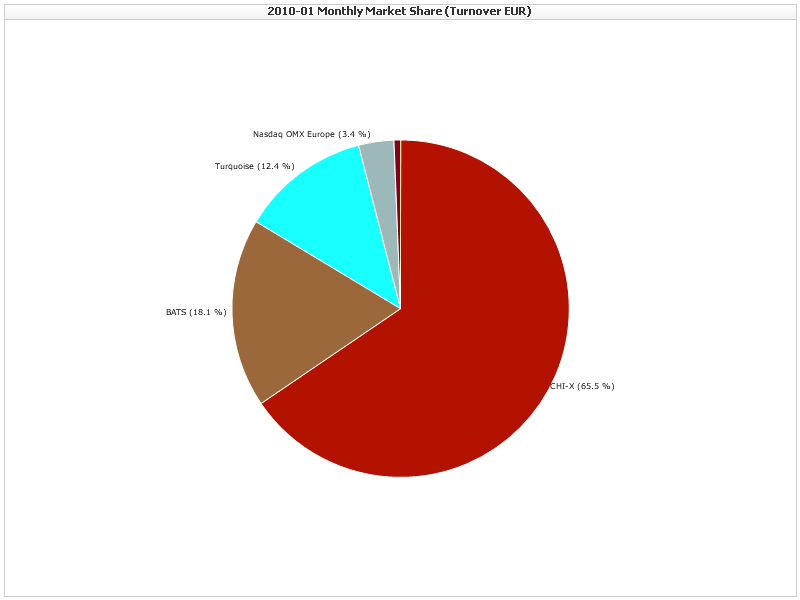

For example, and to begin with, here are the trading stats in euro by trading venue* for January 2009 and January 2010 (doubleclick images to see larger version):

Source: Thomson Reuters Equity Market Share Reporter (ENX=Euronext, Xetra = Deutsche Bourse)

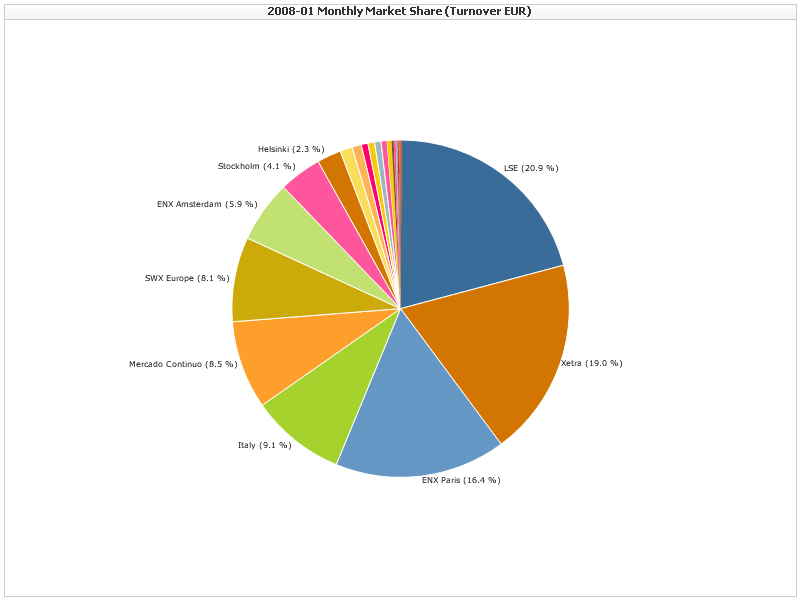

As can be seen, Chi-X have now reached the Number 1 spot for all European trading. Interesting to see how this has changed over two years. For example, here's the picture back in January 2008:

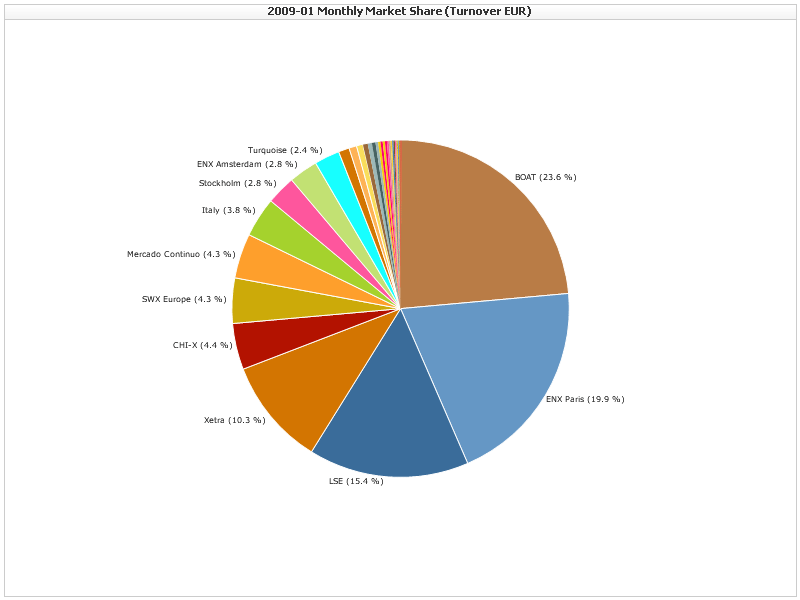

Meanwhile, if you include on- and off- exchange trades, including all OTC activity, the picture is more like this:

Source: Thomson Reuters Equity Market Share Reporter

Hmmmm ... no wonder LSE has been struggling.

Meanwhile, it's also interesting to compare the actual trading by value on the MTFs year-on-year:

Source: Thomson Reuters Equity Market Share Reporter

What happened to Turquoise you may ask? (a) their stakeholders contracts expired; and (b) they got acquired.

Finally, if you really want the detail, then the numbers are interesting (doubleclick to enlarge):

So, there you have our first monthly MiFID monitor. More to come, and lots of analysis and information we could share. All in all, thanks to Thomson Reuters for sharing ...

* these figures reflect auction and non-auction transparent order book and dark pool trades, but excludes real-time and post-trade on-exchange reported and off-exchange OTC trades in order to provide a true comparison between the MTFs impact and the traditional exchanges.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...