Good friend of the FSClub Emmanuel Daniel joined us this week to talk, about the future of banking and the rising influence of Asian banks, especially those from China and India.

Emmanuel Daniel is the founder of The Asian Banker, a leading provider of strategic business intelligence on the financial services industry for the Asia Pacific and Middle East region.

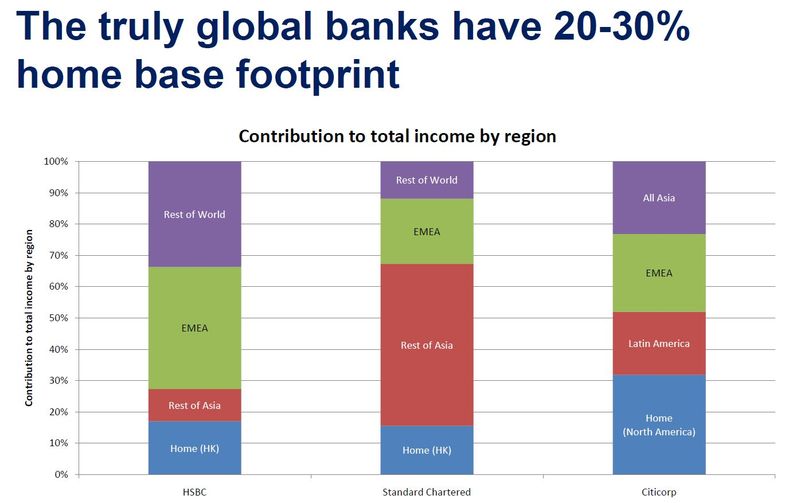

He began with a review of the composition of the largest banks’ income streams, which shows that the truly global banks keep a small home income balance (doubleclick images to make them bigger) ...

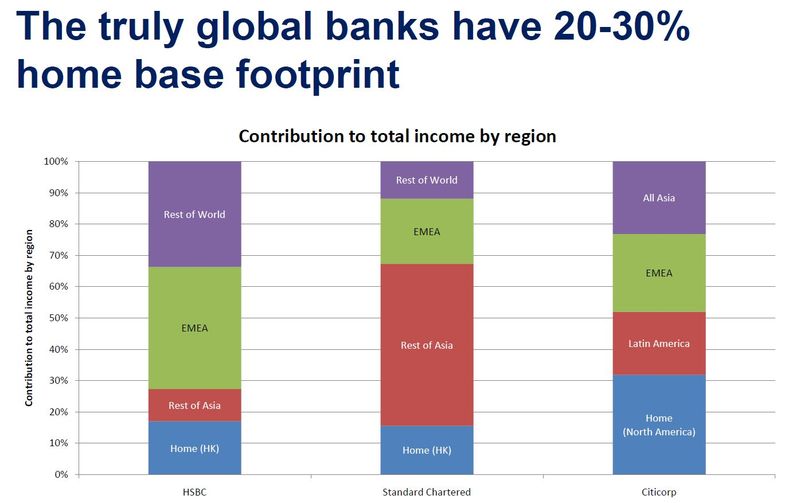

... by comparison with banks from larger countries like the UK and US, which are

essentially domestic in their income even if they were international ...

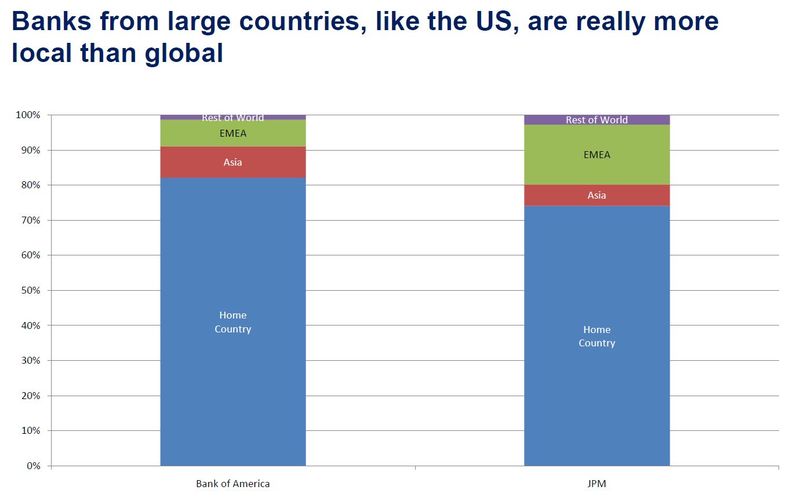

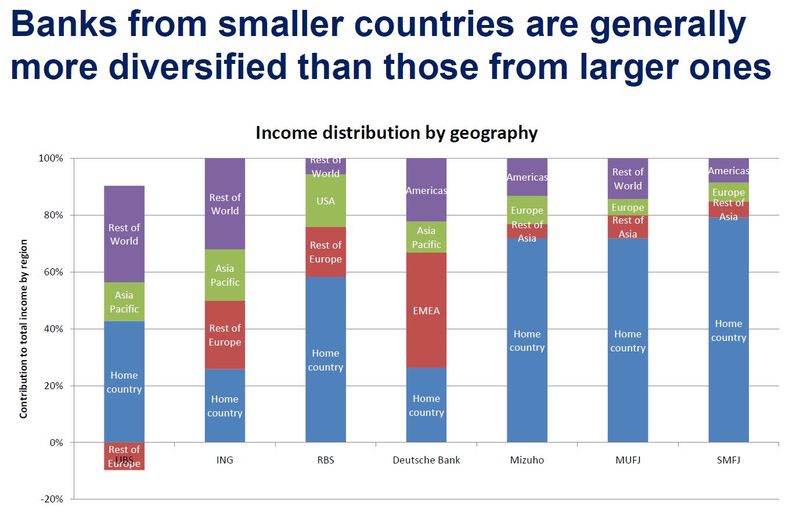

... whilst banks from smaller countries like the Netherlands and Switzerland, have large earnings from outside the domestic base of the bank.

He thinks the same trend will be the case if Asian banks globalise, namely that the ones from smaller countries will be truly international whilst the ones from larger countries, such as China and India, will be essentially domestic.

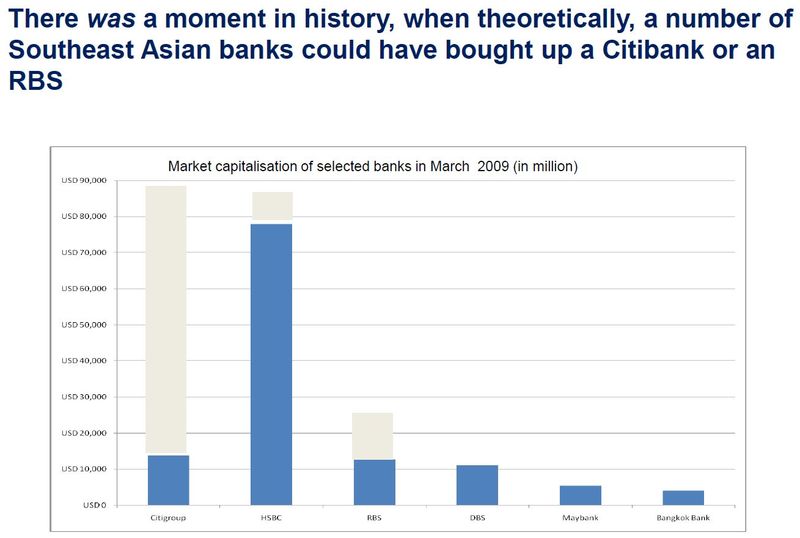

Emmanuel then raised the striking point that at one point during the financial crisis – March 2009 – many Asian banks, such as DBS, UOBC and ICBC, were larger by market capitalisations than the world’s former big banks, such as Citi and RBS.

So why didn’t these banks buy an American or European bank to make themselves global?

Emmanuel puts it down to culture and a fear of repeating past mistakes.

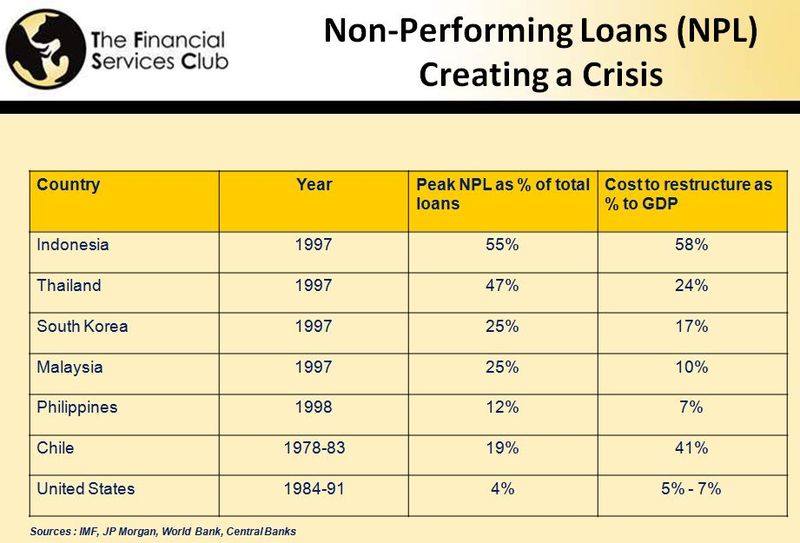

After the Asian financial crisis, many Asian banks were beaten up by American and European financial markets for being too lackadaisical with their management of risk, especially credit risk. Non-performing loans (NPLs) were rife across the Asian markets, and this led to huge issues.

As a result, Asian banks had looked to American and European banks for leadership practices and, when China opened its borders to foreign bank entry in 2001, it was the world’s global banks they sought for knowledge.

Now, these banks are looking around and saying: “whoa, there’s no-one out there who can help us but ourselves”, and this has led to the realisation that these banks are leaders themselves today.

Not only that, but these banks are big.

ICBC has 20,000 branches and over 400,000 staff, so change is a challenge. But these banks are changing and changing fast. For example, the Asian Banker presented an award to ICBC for consolidating 1,000 fragmented data centres into two in a program that took under a year to implement. That’s the sort of leadership these banks are achieving – best practices in data centre management; branch distribution and transformation; use of new technologies especially mobile; and more.

Equally, Chinese banks are now clearly generating profitable leadership, as around $20 billion in profit is created in Chinese banks every year. So, after a couple of profitable years, China’s banks could buy an RBS or Citi.

But they didn’t because they were not ready.

Indian banks are even more risk averse than the Chinese in this process, as their Chairman is normally elected when he is three years from retirement. As a result, an Indian bank rarely wants to make decisions that are aggressive or growth oriented. They would rather be boring and safe, and are incredibly account driven with a focus upon stability.

Equally, there is a lot of unionisation in India which halts change. For example, the State Bank of India has tried to introduce branch automation programs over the years but the unions have resisted this strongly as they don’t want to see job losses.

In contrast, China wants to create a long-term, sustainable, commercial banking model. This is unlike the Japanese who have far more interest in gaining global credibility in capital markets, as demonstrated by the likes of Nomura.

Emmanuel finally left us with something to think about, by bringing in the

impact of technology and customer expectations to realise that our

biggest fear may not be Asian banks but any small player who can

disintermediate the larger banks just by being relevant.

All in all, a really insightful review of the state of

Asia’s banks and the thing that surprised me most is that we haven’t seen an Asian bank become truly global yet.

But we will, with ICICI (India) and ICBC (China) being the two most active players today.

That's why Emmanuel reminded us that two global banks originated in Asia – HSBC and Standard Chartered - albeit run by British Chiefs.

Now, the question is whether the banking talent found in banks like ICICI and ICBC will throw up ambitions to repeat what their colonial masters did a century ago.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...