Going back to the idea that a bank could offer a widget-based business model of functionality and that everything these days is free, makes me realise exactly what tomorrow’s bank will look like.

The thought struck me yesterday when I took my brother-in-law’s lad to see Clash of the Titans – more my thing than his – and we purchased tickets via the internet. This meant that we self-served, but the cinema charged us an extra £1.80 handling fee for doing so.

Duh?

We have avoided their peanut paid staff having to say: “Which screen? What time? How many?” by doing it ourselves, and yet they’re charging us for it.

When we saw the movie, they charged us £6.90 for reduced size popcorn and coke, and then an extra 80 pence for 3D glasses, even though we’d already paid an extra £3.50 to get into the 3D theatre.

Duh?

Why the extra charge for the 3D experience plus a charge for the glasses, and who is going to go into a 3D theatre without glasses?

All in all, the experience cost about £40 for drinks, petrol, treats and extras, for something that will be on Sky+ HD within a week or two.

Warraripoff.

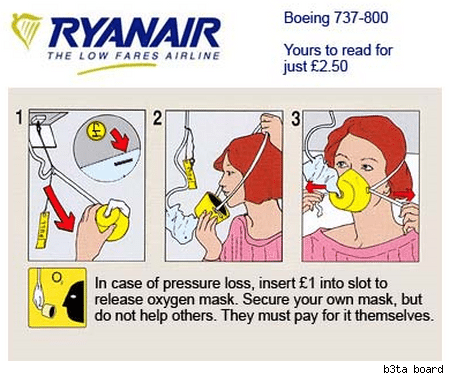

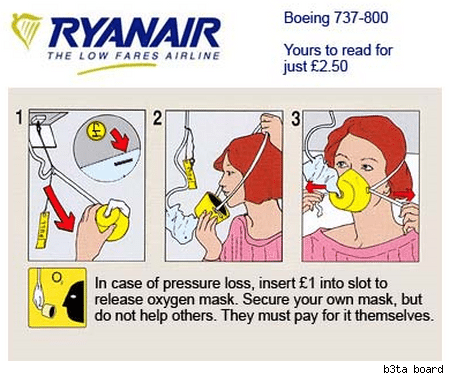

And that’s when it hit me as the whole thing reminded me of Ryanair, who charge a levy of £5 ($7) per leg of a trip per passenger.

Why not open the Ryanbank, based upon building a bank services around the Ryanair (South West Airlines for Americans) business model.

Why Ryanair?

Well, love ‘em or hate ‘em – and most of my snobby business class

flying mates hate ‘em – they offer a stripped down service with no

bells and whistles but, if you want the bells and whistles, you pay for

them.

The love em or hate em debate is raging right now over at the Telegraph, after columnist Bryony Gordon bet her flat on no-one using the words ‘marvellous’ and ‘service’ in the same line as ‘Ryanair’.

This debate intrigued me thanks to the over 90 respondents to her comments – most of whom love Ryanair's service. I particularly liked Alan James’ response: “I think it bloody marvellous that Ryanair provides any service”, although he doesn't win her flat for that response (unlike Ryanair who just might, according to this press release: Ryanair to Seek Journalist’s ‘Flat and Contents’).

No, what really intrigued me is the number of people who get Ryanair, and this is evidenced by the comments.

What I mean by this is that you just need to understand their business model and, if it suits you – and it doesn’t suit everyone – then it’s brilliant.

Their business model is this: if you want to travel as cheaply as possible, then you’ll love us. If you want some snobby service, then get lost and fly with BA.

For example, I fly with Ryanair regularly to Dublin. Ryanair are cheap, punctual, regular, very convenient and it all flows incredibly well. For these meetings, I have no hold baggage, just a carry-on; I don’t want any special service; it’s a short haul flight; and I don’t mind the things that are irritating - their charging policies, especially their policy of adding £5 per leg

per passenger for a credit card booking - as it’s appropriate for these needs.

On the other hand, they do have some things that let them down. For example, I flew with Ryanair to Rome last year for a holiday, and that was a disaster. Their limit of one 15kg bag per person in the hold was almost impossible to adhere to and meant that the whole experience left us feeling exhausted and disgruntled.

But hey, they’re not British Airways, which is what my family are used to, so take it or leave it. It’s cheap, cheerful and it works.

So get with the business model and work it.

That’s what many of the responses to Brynoy’s blog articulate very well. Here’s a small selection:

Jamie: All they have done is break the fare down into bits allowing you to pick what you do want and leave out what you don't.

Old Codger: I fly Ryanair whenever I can. Plan ahead, use your pre paid card, take on hand luggage - Yes that simple. Pisa for a £1 - yup, Rome for... you get the picture. Retire & travel the world (maybe?) with Ryanair. I Love Ryanair.

Alan: Ryanair only suits people that are able to read and understand the terms and conditions - like check in on line, don't bring check in size bags if you have not already paid for them, don't be late and read the destination information for where you arrive ... no Ryanair and we would still be paying the crazy prices of the 80s to travel and air travel would be for the rich only.

Geoffrey Walker: I have no complaints. Never late. Never on strike. Never loses baggage (if you have any). Dirt cheap if you know your dates and book in advance. What else do you want?

And so on and so forth.

So here’s the rub: Ryanair broke down the business model and made it clear that you could fly for nothing. Then they add on charges for all the other bits.

You want to take a lot of luggage. You pay.

You want to eat and drink on board. You pay.

You can’t be bothered using the internet to check-in. You pay.

In other words, for those who want cheap flights with no frills, you got it. For those who want BA or similar style services, go and pay more to fly with them instead.

I could labour the point further, as it’s a critical point, for this is the concept for one of tomorrow’s banks.

A bank that offers free banking, free cards and even free credit.

All core bank services are free.

But there are rules.

First, your services are all paid for through sponsorship.

Hence, before you can make any transaction, you have to wait for a 15 second video ad to play for Pringles, McDonalds, the next Harry Potter movie or whatever (all of which are personalised to your tastes of course). For the more frequent transactions, such as balance checks, then they can just be supported by banner ads and google ads.

Second, you can only deal with the bank for free via an internet or mobile internet service. You cannot talk to someone or visit a branch.

Yes, we have branches and call centre operations, but the fee is £1 per minute to call us or £5 to visit inside the branch.

Third, any charges from correspondent banks for services you use – e.g. if you make a payment to someone and it is rejected – are added to your monthly billing.

You get the picture.

Gradually, you create a smorgasbord of services, some of which are free and some are fee-based. The customer can effectively have a whole bank service for nothing if they work the rules. However, break the rules and they pay.

Students and the thrifty Ryanair demographic audience would suit this bank. Equally, for the unbanked and underbanked, a plain and simple

sponsor-based system for bank services would work.

You want personalised service. Go away and deal with the big banks.

You want basic, cheap and cheerful banking. Come and join the Ryanbank.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...