I don’t know if any of you read the IMF report recommending two new bank taxes:

- a bank levy based upon the risk banks represent, called a Financial Stability Contribution (FSC); and

- a straight tax on profits and bonuses called the Financial Activities Tax (FAT).

If you haven't, then I can recommend it's worth a skim. For example, they reject the Tobin Tax / Robin Hood Tax idea, saying that this would just get passed on to customers by the banks.

However, the fact that they support the idea of a levy and a tax – a double whammy – could have bankers worried ... except that bankers are pretty clever at tax avoidance and Canada and Japan have said they won’t implement these plans so it’s a G18 agreement right now, or less.

In my view, the document is also flawed. Here's why.

The document itself is just for discussion for the G20 Ministers meeting this week, with the aim of agreeing something in June. It was leaked by Robert Peston over at the BBC, and has created a fair bit of mileage for him with two blog entries: IMF wants two big new taxes on banks and How much would IMF bank taxes raise?

Robert's estimate for the latter is about £5 - £10 billion ($7.5 to $15 billion) per annum.

The leak has also sparked a whole range of other headlines, including:

Leaked IMF document urges two new taxes for banks -

The Times

IMF recommends double tax whammy on the world's banks

- The Independent

IMF urges double tax hit on banks to refund taxpayers

- The Telegraph

IMF warns over sovereign debt - The Independent

Post-crisis banks must refinance $5 trillion - The Times

And here’s the document itself (Download IMF G20 Document, 57 page pdf).

All well and good.

Now the actual content is debatable and not set in stone.

As I said, it’s for discussion.

But it does contain some really interesting appendices which are noteworthy as useful research materials, covering diverse subjects from each country’s proposals for reform to their contributions to the bank crisis to date.

For example, here are the amounts announced or pledged for financial sector support so far, as a percentage of 2009’s GDP (doube-click chart to see a bigger version):

What this shows is that for the ‘advanced economies’ – think USA, UK, France, Germany, Japan et al – the cost has been 6.2% of GDP in direct support and a further 10.9% in guarantees.

The total of columns A to E represents 29.8% of advanced economies’ GDP in 2009.

That compares with 1.8% in the emerging economies – think the BRICs, Indonesia, et al.

Mind you, they then go on to say that “for the advanced G-20 economies, the average amount utilized for capital injection was 2 percent of GDP, that is $639 billion, or just over half the pledged amounts. France, Germany, the USA and the UK accounted for over 90 percent of this. For the advanced G-20 economies, the utilized amount for asset purchases was around 1.4 percent of GDP, less than two-thirds of the pledged amount. Similarly, the uptake of guarantees has been markedly less than pledged.”

This is why the report reckons that the global financial crisis has cost about $533 billion less than originally estimated, and is now just a mere $2.28 trillion when all is said and done.

Now how much is $1 trillion again?

So yes it’s still a lot, but it’s half a trillion dollars less than before.

Phew!

Now who’s the daddy when it comes to global bailouts and guarantees:

Wow, the UK wins!

We’re number one, we’re number one, we’re number wohohohohone.

Wait a minute.

That means we’re #1 in global bailouts of banks.

Hmmm ... not sure if we should be so thrilled with that accolade and maybe this is why Gordon Brown is so keen on the idea of a Tobin Tax or a Robin Hood Tax or a Financial Activities Tax or ... well, any tax really to help with our debt mountain to be honest ...

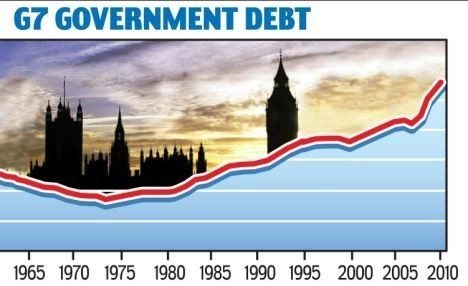

... as the burden of national debt amongst the G7 nations is at a 60-year high, with the UK’s Treasury planning to increase national debt by over £560 billion between now and 2015. That’s about $800 billion or almost a trillion (how much is a trillion again?).

Meanwhile, the emerging economies paint a very different picture:

Apart from Russia, this crisis has cost the key future economies of the world urrmmmm ... nothing.

These charts make it clear that NINE of the G20 nations have had no crisis. Add to this the fact that Canada’s financial system has been the most stable in the world, and Japan do not intend to implement these tax and levy options, and you realise that under half of the G20 will be keen to support any radical changes to the financial markets.

It's not as clear cut as this, as the fact that the Advanced Economies bailouts allowed the Emerging Economies to survive this crisis without their economies also imploding is a key part of the dialogue.

Another useful chart shows why the IMF has reduced the bailout numbers by $533 billion where financial markets have used far less of the pledged amounts than those offered by their respective governments:

Finally, these charts are followed by a review of each country’s bank taxation policies implemented or proposed (Appendix 2, Page 32), a review of corrective taxation and prudential policies (Appendix 3) and the current taxation policies (Appendix 4).

This last section is also particularly intriguing as it demonstrates why banking has been so critical to Gordon Brown’s policies of the past decade. For example, here’s the percentage of a country’s total tax pool raised from financial firms by country.

G20 Corporate Taxes Paid by the Financial Sector (in percent)

This makes it clear that for every country, but particularly for Italy, Turkey, Canada and the UK, the role and influence of the financial sectors on their economies and government policies is fundamental to the country and its economic and public sector health.

Without bank taxes, countries fail.

But with bank failures, countries fail.

And that is their Catch-22 and the reason why this is so hard to change.

Between domestic interests and focus, aligned with the radically different ways in which this crisis has impacted each G20 nation, it is unlikely that we shall ever see a simple agreement of policy reform now, or at the G20 meeting in Toronto in June.

UPDATE: 23rd April 07:50

Looks like the head of the IMF agrees with me:

IMF Says Financial Revamps Could Thwart Global Deal

The International Monetary Fund's managing director said he worried

that rivalries among countries could thwart a global overhaul of

financial regulation, as governments split over the merits of an IMF

proposal to levy a new tax on the world's banks.

"The risk…is that different parts of the world will have their

proposals which make sense" to them, but "which may be somewhat

inconsistent," Dominque Strauss-Kahn said at a press briefing ahead of

this week's meetings of financial officials from around the world.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...