After the downgrade of Greece led to the Greek crisis and the Germans worried about bailing them out, the crisis continues with the downgrade of Spain at the end of last week by Fitch.

In fact, it looks like many European countries are worried, with the PIGS now the PIIGS – Portugal, Ireland, Italy, Greece and Spain – whilst Hungary, the Czech Republic, Andorra and Montenegro are so hard up they couldn’t even send their national broadcast channels along to Oslo, to cover the Eurovision song contest over the holiday weekend.

So we asked the question: what happens if the euro fails, and the answer was: a great deal economically, politically and nationally, but not much in banking. The EU creations of SEPA and Chi-X would continue.

But what is the real likelihood of the euro failing?

Not much to be honest.

If it were open to failure, there would be far more concern being demonstrated at this week’s G20 meeting, and the truth is the Americans and Chinese – the other two large regions exposed to the EU – are comfortable with the two-pronger approach being taken by the European Commission and member states.

For example, Reuters reports:

“Early this month G20 governments were clearly worried that some European countries might not be able to summon the political will to confront their public debt problems. U.S. President Barack Obama spoke personally to Spanish Prime Minister Jose Luis Rodriguez Zapatero to urge him to implement budget reforms. G20 officials held conference calls to discuss European policy.

“Since then, Europe has come up with a two-pronged strategy. One prong is a string of national austerity schemes designed to bring state budget deficits and public debt down to safe ratios of gross domestic product in the next few years.

“The most heavily indebted states on the periphery of the euro zone, Greece, Portugal, Spain and Italy, have announced austerity drives this month. Even France, a stronger country, has acted, announcing an intention to enshrine deficit-cutting in its constitution.

“The other prong is emergency liquidity support from rich nations to give time for austerity steps to work; this ensures countries retain access to financing even if they lose the ability to fund themselves in the debt market, as Greece has.

“In addition to a 110 billion euro bailout of Greece, European nations are creating a financial safety net for indebted countries that along with support from the International Monetary Fund could total 750 billion euros -- three-quarters of the total public debt of Greece, Portugal, Ireland and Spain.”

So all is well and good in the garden of Europe.

Or is it?

As mentioned before, Germans are pretty unhappy about the Greek situation.

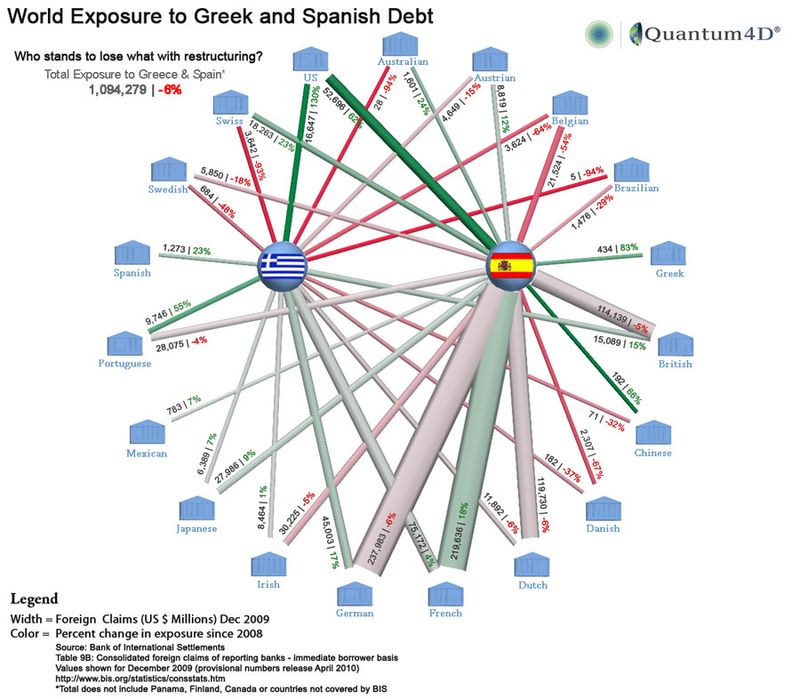

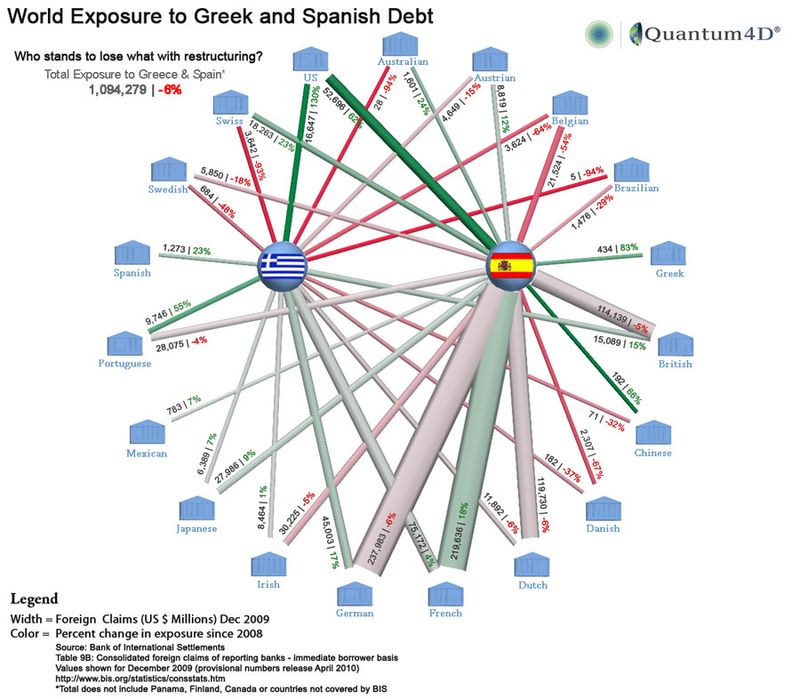

So I was quite interested when Mike Warner, CEO and founder of Quantum4D – a data visualisation firm – sent me this graphic (doubleclick image to see larger version):

Ouch!

What this clearly demonstrates is that:

Germany thought they owned Greece but they don’t – France do;

The total Greek exposure is €120 billion;

Germany and France have far more exposure to Spain (over €450 billion worth); and

By comparison, Britain is getting off lightly ... about the same levels of exposure as the Dutch.

Who wants to be in the euro, you might ask, but the Estonians still do.

Why?

Why would anyone want to be in the Eurozone today?

Because tomorrow it will be better. It will be a region that is as resilient, strong and powerful as China and America ...

... or is it more to do with this lovely little news skit from our friends in Australia?

This is a comic news report from ABC News’ mirthmakers John Clarke and Bryan Dawes, and is based upon a million dollar gameshow format (in the UK, this is Mastermind).

Here’s my slightly edited transcript:

QUIZMASTER: Your name is Roger yes?

CONTESTANT: Roger.

QUIZMASTER: Good. And what do you do Roger?

CONTESTANT: I'm a financial consultant.

QUIZMASTER: Fair enough. Okay, Roger your special subject tonight is the economies of the European community. Your time starts now. Best of luck.

CONTESTANT: Thank you.

QUIZMASTER: How much does Greece owe, Roger?

CONTESTANT: $367 billion.

QUIZMASTER: Correct. And who do they owe it to?

CONTESTANT: Mostly to the other European economies.

QUIZMASTER: Correct. How much does Ireland owe?

CONTESTANT: $865 billion.

QUIZMASTER: Correct. Who do they owe it to?

CONTESTANT: Other European economies mostly.

QUIZMASTER: Correct. How much does Spain and Italy owe?

CONTESTANT: $1 trillion each.

QUIZMASTER: Correct. Who to?

CONTESTANT: Mainly France, Britain and Germany.

QUIZMASTER: Correct. And how are Germany, France, Britain going Roger?

CONTESTANT: Well they're struggling a bit, aren't they?

QUIZMASTER: Correct. Why?

CONTESTANT: Well ‘cause they've lent all the vast amounts of money to other European economies that can't possibly pay them back.

QUIZMASTER: Correct. So what are they going to do?

CONTESTANT: They're going to have to bail them out.

QUIZMASTER: Correct. Where are they getting the money to do that from, Roger?

CONTESTANT: That is a good question. I don't know the answer to that one.

QUIZMASTER: How much does Portugal owe?

CONTESTANT: Hang on a minute, what was the answer to that earlier question?

QUIZMASTER: Just keep answering the questions Roger. Where is Portugal going to get the money it owes to Germany, if Germany can't get back the money that it lent to Italy?

CONTESTANT: Just a minute. What was the answer to the previous question? The question was: How can broke economies lend money to other broke economies, who haven't got any money because they can't pay back the money the broke economy lent to the other broke economy, and shouldn't have lent it to them in the first place because the broke economy can't pay back?

QUIZMASTER: You are wasting valuable time Roger. How much money does Spain owe to Italy?

CONTESTANT: $41 billion. But where are they going to get it?

QUIZMASTER: Correct. What does Italy owe to Spain?

CONTESTANT: $27 billion but they haven't got it - they're broke.

QUIZMASTER: Correct. How can they pay each other if neither of them has any money?

CONTESTANT: They're going to get a bailout, aren't they?

QUIZMASTER: Correct. And where is the money coming from for the bailout?

CONTESTANT: That is what I'm asking you!

QUIZMASTER: Correct. Why are people selling the European currency and buying the US dollar?

CONTESTANT: Because the US economy is so much stronger than the European economy.

QUIZMASTER: Correct. Why is that Roger?

CONTESTANT: Because it's owned by China.

QUIZMASTER: Correct and very well done! And after that round you've lost $1 million.

CONTESTANT: I've lost $1 million? I thought you said well done!

QUIZMASTER: Yes well done - you've only lost $1 million. That's an extraordinary performance Roger.

Thanks to Philip Brady from Oz for the tip-off re Clarke and Dawes.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...