Here’s a shocker.

I blog all the time about social media.

We all love Facebook, with 500 million people in their community.

We love to twitter via tweetdecks 24*7 on our iPhones and Androids.

We Google, Amazon and PayPal.

The internet is pervasive.

It is so pervasive that the country is going to ban paper, with the Payments Council looking for an end-date for the cheque by 2018.

We can pay in real-time with Faster Payments every day.

Visa can clear a payment through a worldwide network in just over a second of time.

That’s via all the bank and payments infrastructures globally to clear and authenticate the payment.

All in just a second.

Yes, it’s the 21st century.

So I meet my bank manager and tell him that the landline telephone number they have on my account is wrong.

It’s my old office number.

I didn’t even know they had it, but they need it to authorise a payment via telephone, as proof that it’s me, and I couldn’t remember the old number.

After all, it’s years since I moved from that office.

I just didn't realise they had it on my account.

Or that they would try to use it to authenticate a payment.

So I tell him my new number.

Bish-bash-bosh, should be all done and dusted.

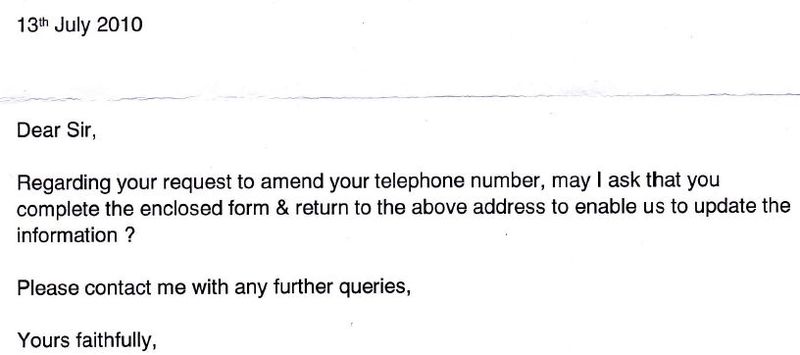

A week later, this arrives in the post:

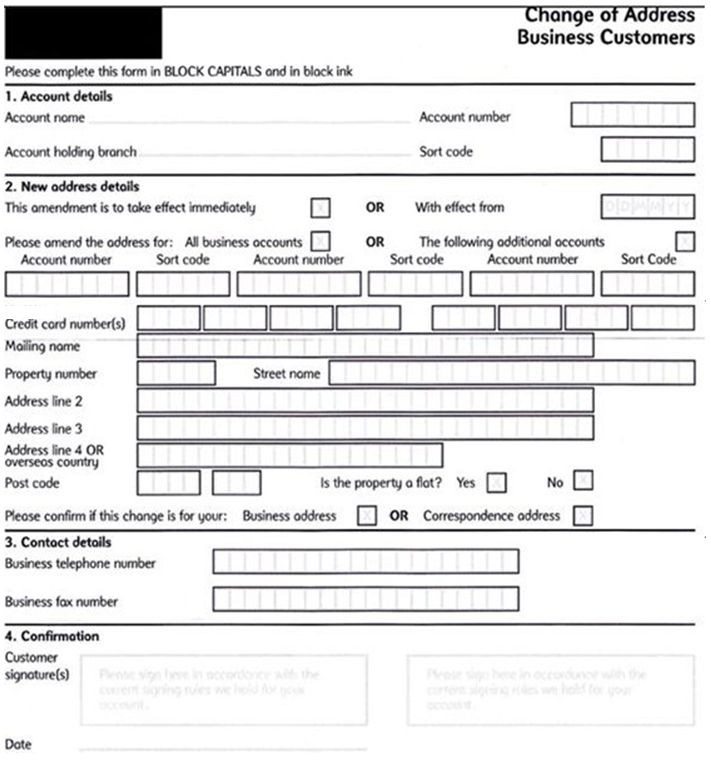

It has a double A4 form with it for changing the address:

I ring the bank and ask them what that’s all about.

“Oh”, they said, “you want to change your telephone number.”

“Yes”, I reply, “I gave it to my relationship manager.”

“Oh”, they said, “well he asked us to send you the form.”

“Well”, I reply, “do I have to fill it all in or can I do this online?”

“Oh”, they said, “just fill in the bit about the telephone number and then follow the instructions.”

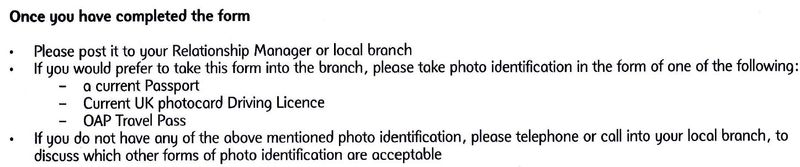

The instructions are on the other A4 sheet:

Yep, this is the 21st century.

On a more serious note, the consumer magazine Which? issued news that banks don't inform customers of interest rate changes on their loans and savings.

The BBA responded by saying:

“If all customers were to be notified of all changes to their interest rates - as Which has suggested - the costs to the environment, the economy, to banks and ultimately to customers would be considerable:

- around 13.5 million personal letters would have to be sent for each rate change;

- in 2008, when there were five negative base rate movements, this would have generated 67.5 million letters;

- the cost to the banking industry would be around 50 pence per letter (total: £33.75 million) and to the environment would be some 575 trees.”

Answer?

STOP SENDING OUT BLOODY PAPER ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...