Jeffry Pilcher at the Financial Brand ran an interesting survey this month to see how US banker’s are getting on with online marketing. Most of the banks surveyed were smaller credit unions, although 49 retail banks took part too. 64 of the 154 participants had $1 billion in assets or more, whilst 66 had less than $500 million in assets. Most (46%) described themselves as “novices” at online marketing with just 12 (8%) thinking that they were advanced marketers online.

Considering the age we live in and the fact that most banking is now self-served over the mobile and internet, that’s pretty dire.

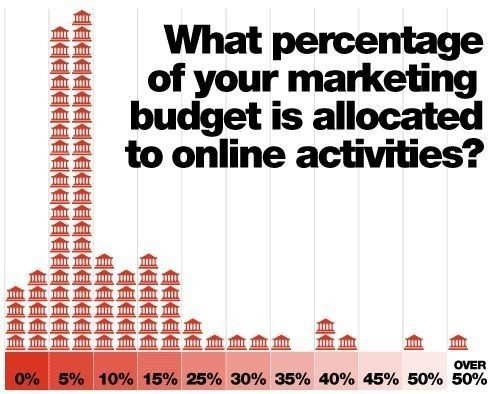

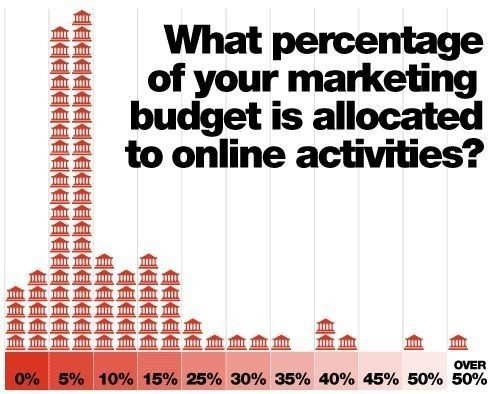

The real shocker from Jeffry's survey however is this chart ...

... showing that most US retail financial institutions spend only 5% of their marketing budgets for online activities.

Mind you, they could be quite cluey as Deloitte and YouGov just polled over 4,000 UK consumers and found that more than half (52%) believe that television is the most memorable advertising media; only 10% went for newspapers, whilst online banner ads garnered a mere one in a hundred votes as a useful advertising media.

You can download a raw Excel file with data from the Financial Brand’s 2010 Online Marketing Study by clicking here (see end of Jeffry's blog entry).

Meanwhile, talking of surveys, if you haven't taken our European Payments Survey yet, then click here to join in.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...