This week is dedicated to assessing the UK's best and worst banks from four dimensions:

- Customers

- Employees

- Investors

- Regulators

Having looked at the banks from the customers’ perspective yesterday, this second part looks at the views of employees.

This view is actually darned hard to find out.

Although there are 400,000 staff working for banks in Britain, it’s very hard to discover any quantitative views of their employers in the public domain.

You can find subjective references, such as these two opposing views from ‘supposed’ HSBC staff:

“At HSBC employees have one credo, if there's anything wrong going on, keep your mouth shut, you never noticed it. A couple of months ago a guy detected major flaws in HSBC systems. Instead of checking it out immediately, managers did not bother for two months. Reason: managers wanted the credit as it would result in promotions. The guy eventually left in disgust as action was taken against him indirectly on other grounds for not disclosing exact details.”

“I read the above review, slightly in shock. All the stories, all the tales, but I wonder how much of it is drama and fiction from previous employees looking for a bit of attention. I work in one of HSBC's UK based customer contact centres, where I 'sell' loans and other lending products to customers from all different backgrounds ... I would highly recommend HSBC over any other UK based banks, especially Barclays.”

Equally, you can find plenty in social networks such as Facebook and Twitter, but nothing of much use.

For example, Facebook has this group for Barclays Bank employees, with over 2,000 members. It describes itself as: “for all those who struggle with the daily grind of working for Barlcays Bank!!”, and cannot even spell the banks name properly. It’s open to everyone, which is why there are so many members, and the posts are generally turgid:

“Please join to CFA UK Society on FACEBOOK if you`re a member or planning to take CFA exam. Exiting offers will be released soon for those who are interested in Banking and Finance career. Thank You”

or whiners about poor customer service.

The discussion threads prove more interesting. For example, the discussions: “Things you most hate about your job” has a bit more kudos:

From Jenny Campbell: “The fact that you have to be a 'B' player (internal grading system) in order to get any kind of career advancement -even when non barclays folk can clearly apply for the role (eg non experienced Trainee Mortgage Advisor).....nice!”

Gets a reply from Ashley Penny: “I think the B/C argument will never go away but really you have to see the purpose behind it. If someone is rated as 'C' they are just doing an average job, which is what they are paid to do. Yes you then have outside recruitment, but that's bringing in some new talent which has to be an option for every business and I feel that closing off promotion (and bonuses!) to C players is only a good thing. Certainly people that I have worked with have responded well to this by raising their game, which is the whole idea. If someone is just doing an average job, should we pay them a bonus? and give them opportunities for career advancement when they arent going the extra mile in their current role? It drives people to do better, rather than knowing they can just coast along and still get a bonus/payrise/move on.”

Followed by Rob Barbour: “In theory the topgrading thing is excellent, but in practice personal & departmental politics come into it. Even in Group Centre HR, which in theory should have been driving best practice for the whole group, people's ratings were basically a reflection of who the directors liked the most, and who had worked the stupidest hours. And even then, you had B5s working their a***s off til 1-2 AM regularly for no overtime, and still receiving a C rating. F***ing disgraceful.”

That sounds more near the mark of true employee transparently communicating ... until you realise these postings are over a year old and nothing much new is out there.

Of course, for a more professional view of the world, we should look to LinkedIn anyway. This was proven by our social media survey earlier this year – LinkedIn is for professionals – and so I delve a little around there.

Unfortunately, it’s also a mish-mash of groups that are semi-active but not much insight.

For example, the Royal Bank of Scotland Group has almost 4,000 members but zero discussion or postings. The ABN AMRO Group has more activity, but it’s all based around Eva Martin, an Accountant at Kerry Brothers Ltd, posting stuff about auditing and accounts.

This is lame guys!

When social networking first started, I could find out lots more about the naked truth direct from bank staff views.

What this really means is that banks have locked down their employees from leaking too much online, by making it clear that if you blab in a social network you lose your job.

Good.

That’s the way it should be isn’t it?

But then there are other things you can do.

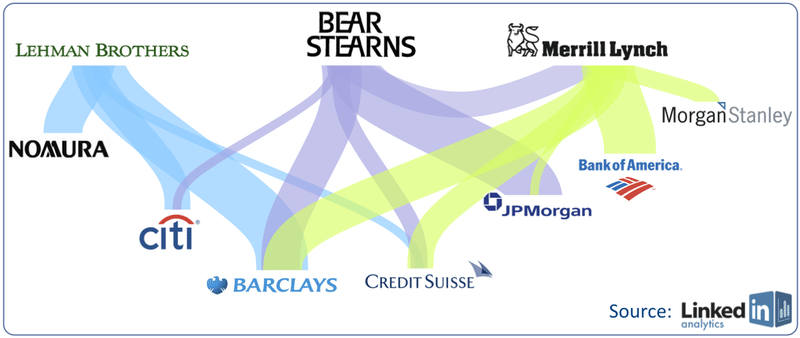

For example, LinkedIn can track staff movements and tenure, and they can point out where the Bear Stearns and Lehman staff ended up for example:

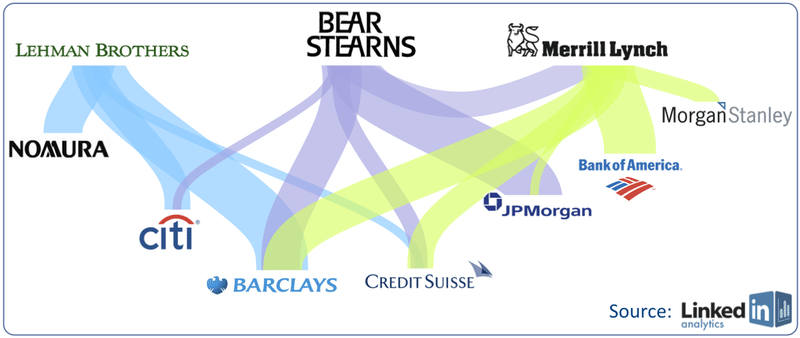

So I did a bit of analysis of the UK High Street Banks via LinkedIn, particularly who had left whom for where and a rough calculation of attrition rates. Please bear in mind that this is totally unscientific, inaccurate and probably completely wrong, but here’s what I got:

Line colours: dark blue (RBS); light blue (Barclays); black (Lloyds); red (HSBC); and the thicker the lines, the more folks moving in each direction.

This shows that the main corridors of staff are movers from Lloyds to RBS and Barclays, and from Barclays and HSBC to RBS. I should say that the chart above may be inaccurate, but it does purely look at retail banking movements in the UK for these institutions and appears to be about right to me.

Another source of great input on this is The Vault.

The Vault is for professionals who provide views on their firms.

Their rankings of who’s happy with which banks are ususally pretty robust, so here are their rankings (based upon selecting the main UK high street bank names only):

#1 HSBC (#8 in Europe)

#2 Barclays (#11 in Europe)

#3 Lloyds (#24 in Europe)

#4 Royal Bank of Scotland (#27 in Europe)

According to the Vault, HSBC is committed to a good work/life balance with a "collegiate" culture; it is good for “worldwide opportunities, good for consumer banking” and is “still strong” as the bank that is “most unscathed by credit crunch” which means it “has survived well” and has moved from “previously third tier” to “arguably second tier now”. However, the bank apparently “lacks direction” and is too bureaucratic for individuals to make a real difference.

Barclays is a “meritocracy” with “a relatively flat management structure,” “a good mix of people from different backgrounds” and a spirit of “trying to reach goals and putting all the efforts in to get there.” Employees describe their peers as “open, fair and keen to share,” and from the start, hires “are given responsibility, and it really is up to you how quickly you progress.” In terms of making a good impression, “efficiency matters more than quantity” of work, and those who do well find it’s possible to carve out a niche “if you take the initiative and form your role”.

Lloyds is a bit of a contradiction, with several people feeling its lost its way since the HBOS takeover. They describe it as “a very, very English bank” (with an American CEO!) that can be “slow to adapt to change” due to its “silo-ed and political” structure. On the other hand, some staff think it is a “progressive, intellectually challenging and entrepreneurial culture that embraces change,” with hours that are fairly flexible. Whilst one trader works a 60- to 70-hour week, another worker spends less than 40 hours a week in the office and is happy to reveal that “there is no pressure to work long hours.” With “six weeks’ paid holiday,” private health care and a gym membership discount, it sounds pretty good to me (as a retirement home).

Royal Bank of Scotland has less commentary but is “friendly and open” where “everyone on the team puts in the hours”, but “it isn’t uncommon to put in 60-hour weeks.”

It’s all interesting stuff but there’s another factor here.

All these websites tend to focus upon professionals, management and office workers.

What is the teller’s – or customer service advisor, if you prefer – view?

Hmmm ... using Google most of what comes up is that bank teller’s are all thieves, but that’s just a one-off, not the mainstream.

Instead it's better to look at Working Mums where you maybe start to find the real truth about UK retail bank workers.

Why?

Because when you go into a branch, have you ever noticed that all the tellers are female?

Usually the one male in a branch is the manager.

That’s no problem, after all it’s well known that Britain is a nation of misogynists. In fact, you could argue that banks are doing women a favour by offering such work at low pay (typically, a branch teller gets about £12,500 a year, well below the average annual salary of £23,450), and if you look at this cahrt from Working Mums:

You can see why there’s another angle at play here.

This is because banks offer a highly accommodating work structure for many. For example, looking at the Royal Bank of Scotland, their “promotion of diversity has been recognised throughout the financial industry and beyond”, with a range of awards:

- Gold Standard Award from Opportunity Now (2008-2009)

- Gold Standard Award from Employers’ Forum on Disability (2008)

- Gold Standard Award in the Race for Opportunity benchmarking and first place ranking within the Financial Services sector (2009)

- Shortlisted in three award categories for the Women in Banking & Finance Awards for Achievement (2009)

- Placed in the Stonewall Top 100 Employers Workplace Equality Index for Lesbian, Gay and Bisexual people (2009)

- Placed in The Times Top 50 Where Women Want to Work (2010)

- Placed in the Stonewall Top 100 Employers Workplace Equality Index for Lesbian, Gay and Bisexual people (2010)

All very impressive.

But then I look at the Times Best 100 Companies to work for in Britain, and none of the High Street Banks make the lists. In fact, the largest financial firms that make the list are quite surprising:

#2, Goldman Sachs (must be the bonuses);

#11, down from #3, AMEX (strong management);

#14, down from #8, Morgan Stanley (great leadership); and

#21, Zurich (low stress and good benefits)

So what does this tell us about employee satisfaction in Britain’s High Street Banks?

I guess that staff are happy at a bank that accommodates their lifestyle of low stress, low ambition and low pay with high flexibility, whilst three-quarters of management are getting on up the chain of the bank’s slow staircase of promotion whilst a quarter are on a churn between the four main players.

Sounds like any other industry really.

And if you want to join a bank or understand their culture, my net:net comes from the Vault:

Barclays: meritocracy

HSBC: collegiate

Lloyds: English

Royal Bank of Scotland: friendly

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...