This week is dedicated to assessing the UK's best and worst banks from four dimensions:

- Customers

- Employees

- Investors

- Regulators

Having looked at the banks from the customers’ perspective on Monday and employees on Tuesday, today it’s the turn of the investment community’s view.

Now then, you could say that this one’s easy: Barclays and HSBC are a Hold, Santander’s a Buy, and RBS and Lloyds are a Sell until the UK government get off their case.

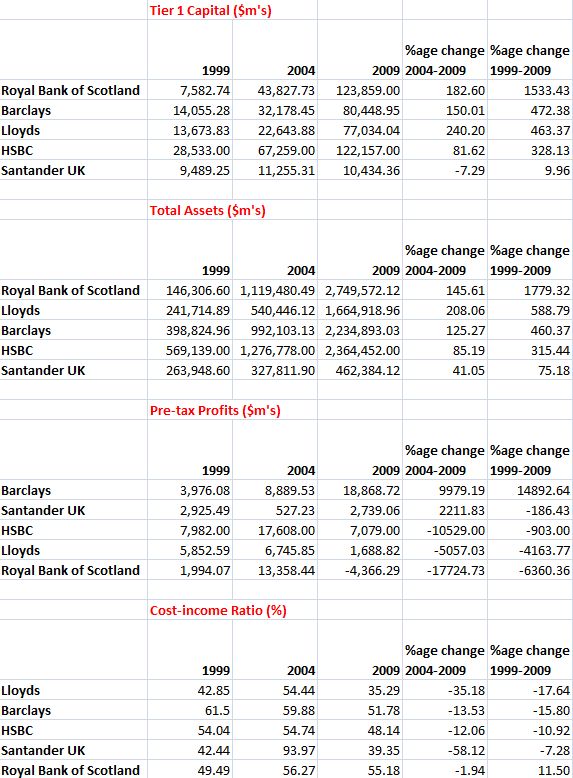

It is true that the last two years has meant that the crisis has distorted the picture, and would obviously place Lloyds and RBS in a position of weakness.

Alternatively, you could say that investing in these banks over the past few months would have given you stellar returns compared to Barclays and HSBC, as a small spike in their share price can represent ten- twenty- thirty- percent or more returns on short cycle investment schemes.

But it’s not so much the share price I want to hone in upon, but the overall assets and profitability of the banks.

Therefore, we will look at share price at the end of this blog entry, but start with looking at data courtesy of the Banker Magazine’s database.

You may remember this is the dbase that helped me to blog about the Top 20 global banks 1994-2010, and I would recommend you to subscribe to it, if you’re not already.

Anyways, it’s really hard to make a useful comparison of the banks here, as they have changed dramatically over the last decade, for different reasons.

For example, HSBC has been troubled by Household in the States, but have grown through the Asian powerhouse effect; Barclays has seen BarCap dominate the roost, even more so with the recent integration of the Lehman Brothers USA operations; Lloyds has been a steady rock, until the HBOS takeover; RBS saw a big upside after the NatWest merger but then messed up badly with ABN AMRO acquisition; whilst Santander has seen cost-income rise and fall, as they absorb the acquisitions of Abbey and, more recently, Alliance & Leicester and Bradford & Bingley.

So the picture isn’t clear-cut at all, but here’s a snapshot of assets and capital for comparative purposes (doubleclick chart below to enlarge).

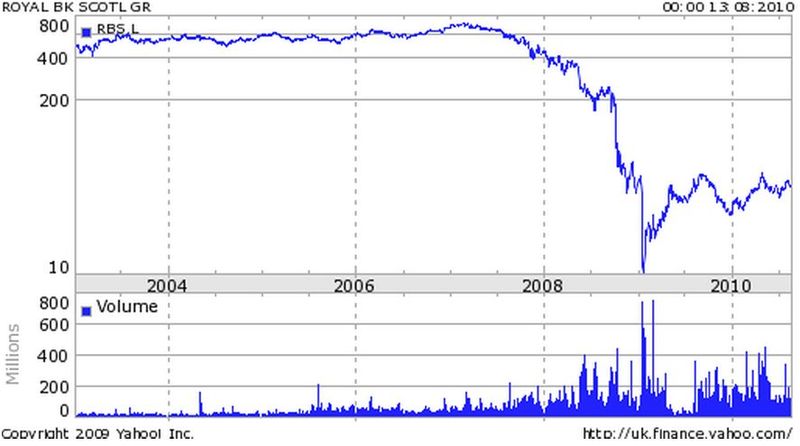

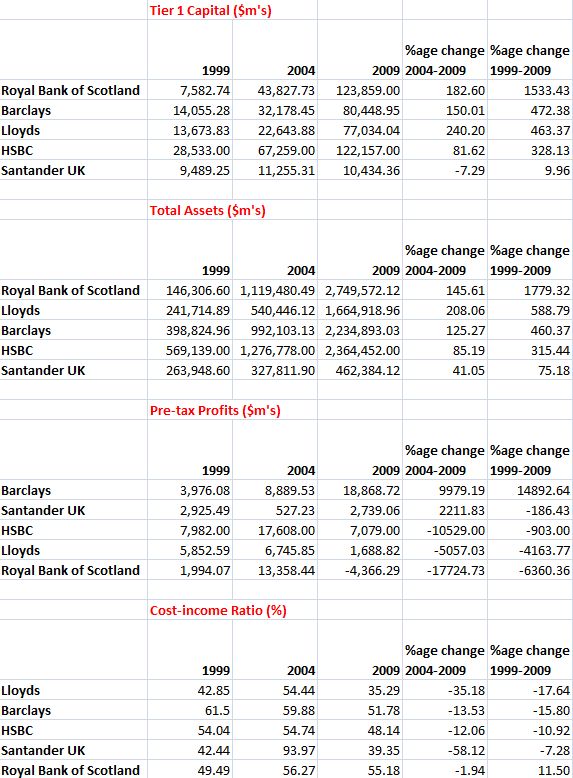

Note that RBS has seen the biggest increase in Assets and Capital – not surprising as they incorporated NatWest’s and ABN AMRO’s $’s – but it’s also worth noting that the 2008 figures would have been far more distorting, so taking year’s at random isn’t necessarily the most useful thing to do.

Just to illustrate that point particularly, the cost-income ratio shows that Lloyds have been best at managing their house ... but Santander would beat them hands-down over the last five-year window, after they acquired Abbey and Sovereign, consolidated platforms and stripped out cost and waste. Maybe that’s why Santander aren’t popular with customers, but they’re definitely popular with shareholders.

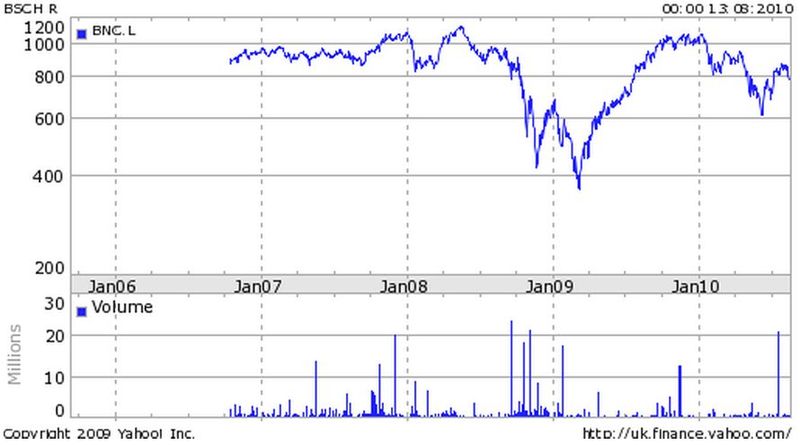

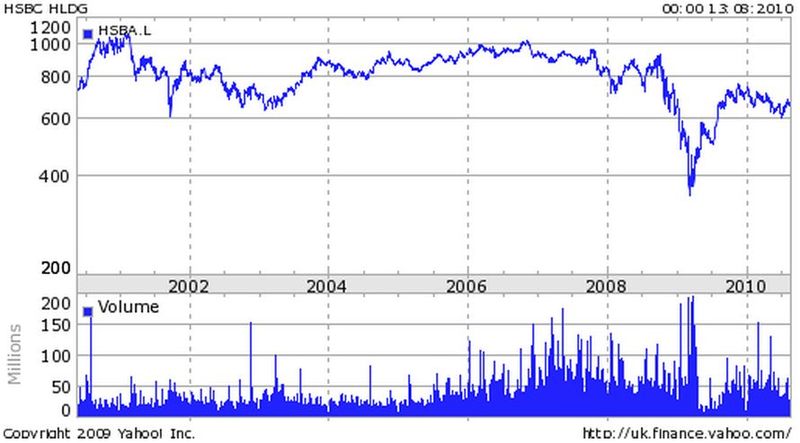

HSBC:

The net:net is that from an investment view, HSBC offered the most stability; Barclays a massive bang for the buck in Q1 2009 and now tracking along nicely; Santander is a bit of a merry-go-round; whilst RBS and Lloyds are more like a roller-coaster.

Nevertheless, as a roller-coaster, you might find far better risk-return rewards right now than taking the low risk option.

Interesting times ahead, especially as the government will one day return these banks to the private sector.

I’ll watch this space for sure.

NOTE

Itzi asks the question: If I

invested GBP 5000 into each of these banks shares five or ten years ago,

how much money (inclusive of dividends distributed) would I have now?

My answer: it's not as simple as that, as are you looking at £5,000 invested in 2005 or 2010? In 2005, HSBC would be #1, Barclays #2, Lloyds #3 and RBS #4. However, if you invest £5,000 in RBS and Lloyds today, I reckon

you'll get a greater return than you would from HSBC and Barclays, as

these banks will be floated back into private sector just before the

next election, and within five years. When they are privatised, the 70p and 46p share prices of

Lloyds and RBS respectively will be more like £4:00 and £3:00 ... a much

better return. If you want to know more, get The Banker Magazine in September, as this is their front page story.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...