This week is dedicated to assessing the UK's best and worst banks from four dimensions:

Having looked at the banks from the customers’ perspective on Monday, employees on Tuesday and investors on Wednesday, today it’s the turn of the regulator.

Now the regulators have been in a frenzy of self-analysis and navel-gazing ever since this crisis began, trying to work out their role in the world and how to avoid another crisis.

They’ve not done badly ... after all, since Lehmans collapsed and we had that horrible week of banks announcing implosion in September 2008, there’s only been 264 bank failures in the USA to date (see end of blog entry). There’s been about the same number in Europe but, unlike the USA, we don’t create websites that broadcast every bank failure.

So there’s been around 500 bank failures since 2008.

How to avoid another one.

Easy.

The regulator says that they’ll use the Bank for International Settlements (BIS) Tier 1 Capital Ratio’s to avoid further bank failures and financial crisis.

So let’s look at the BIS Tier I Capital Ratio measures for a second.

Tier I Capital Ratio measures a bank’s balance sheet strength, and shows the ratio of a bank's equity capital and disclosed reserves as a percentage of its risk-weighted assets. The higher the ratio, the more capital it is holding to enable it to absorb losses.

Effectively it’s the amount of money the bank keeps in its vaults. A 10% Tier I Capital Ratio, for example, means that the bank is holding $1 for every $10 it has in customer deposits. If there’s a run on the bank, that’s what causes the problem, because the other $9 is out there working the markets and earning interest.

The reason why it’s referred to as Tier I Capital is because it is that liquid – it’s like cash in the bank – versus Tier II Capital which tends to be more illiquid, such as land owned and balance sheet movements from undisclosed reserves or provisions for future losses.

Now, the BIS under Basel II says that a bank must have at least 4% of its total exposures – risk-weighted assets – held in Tier I Capital, and 4% in Tier II, creating a total of a minimum 8% in reserve to cover any unexpected downturn and losses.

In other words, it’s basically a minimum 8% needed in capital to cover all of a bank’s risks.

This is what went wrong in the financial crisis, as the risks were much greater and faster to impact a bank’s balance sheet than expected. For example, Northern Rock had a 7.7% Tier 1 Capital Ratio in 2007 – that’s double the minimum amount required – and yet it failed in August of that year due to liquidity risks, and its’ 2008 Tier 1 Capital Ratio was declared at 2.9% as a result.

This is why the regulators are struggling, as a run on the bank can soon eat away at all of that liquid capital and leave the bank desolate.

But of course, a bank run rarely happens and so it’s OK to think that Tier I Capital doesn’t need to be overly onerous, but just about right.

But what is ‘just about right’?

According to the BIS review of regulations, about 6% for Tier I Capital, of which the core has been doubled from 2% to 4%. Oh yes, that’s another nuance, ‘core Tier I’ versus ‘Tier I’.

This is slightly more confusing, but there are actually two sorts of Tier I Capital Ratio’s – core Tier I and Tier I. The main difference is that banks don’t like to keep cash in the vaults, and so they’ve worked out ways to use exchange controls and other Special Purpose Vehicles (SPVs) – read ‘derivatives’ – to make sure cash can still be liquid, but working the markets to gain interest.

These are viewed as ‘innovative’ Tier I Capital measures as it's not really cash in the bank, and such instruments are limited to 15% of Tier I Capital.

So there you go. I know it’s confusing, but you basically have Core Tier I Capital – read this as cash in the bank; Tier 1 Capital – cash and liquid assets; and Tier II Capital – less liquid assets.

Finally, according to Reuters, banks will need a minimum of 4% Core Tier I, and overall “Tier 1 capital of 6 to 8 percent and 8 to 10 percent of combined core Tier 1 and the countercyclical buffer”. The countercyclical buffer is this idea that came from Spain where reserving in the good times will cover the bad. Therefore, a bank must keep an extra 2% of reserves during profitable years which they can dip into in unprofitable years.

OK.

So how do our banks shape up if we use these measures?

According to the above, as times are now profitable, the banks should have a minimum 10% Tier I Capital as they should be building that countercyclical buffer.

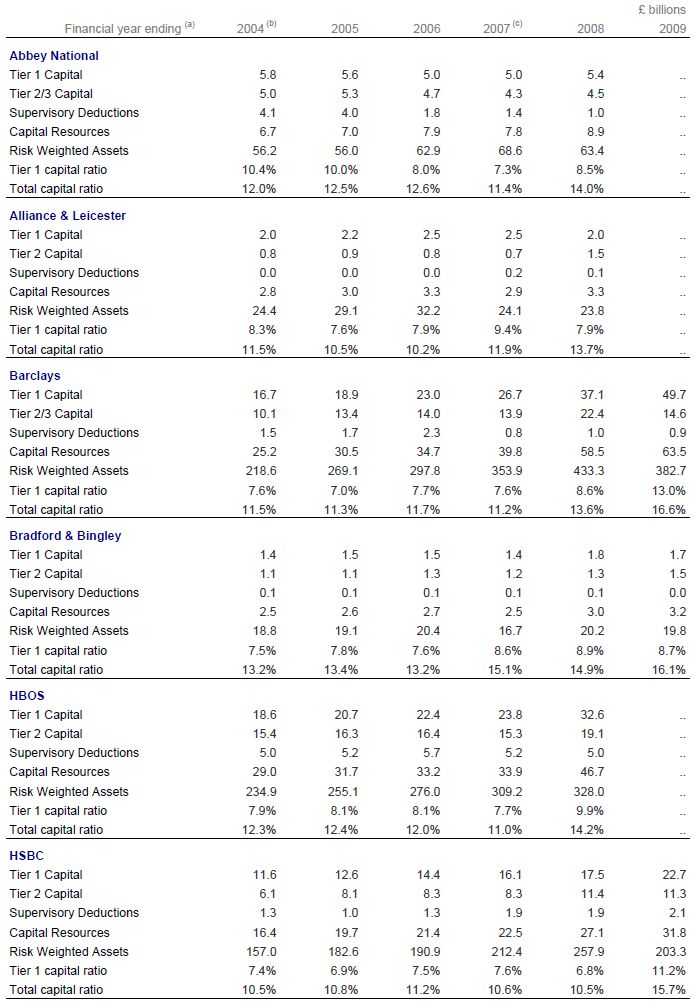

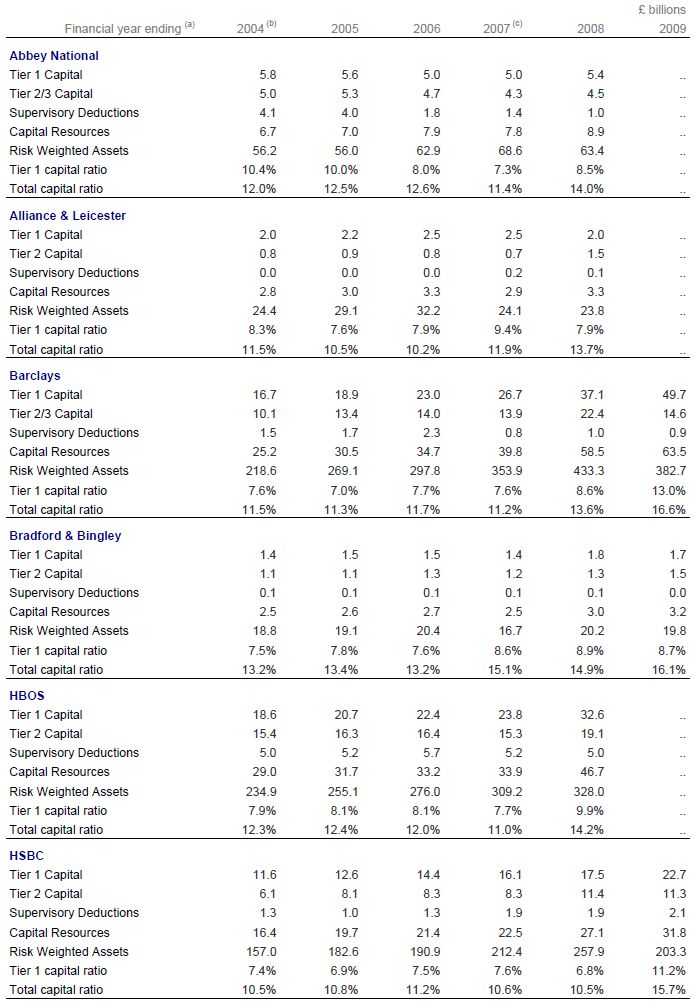

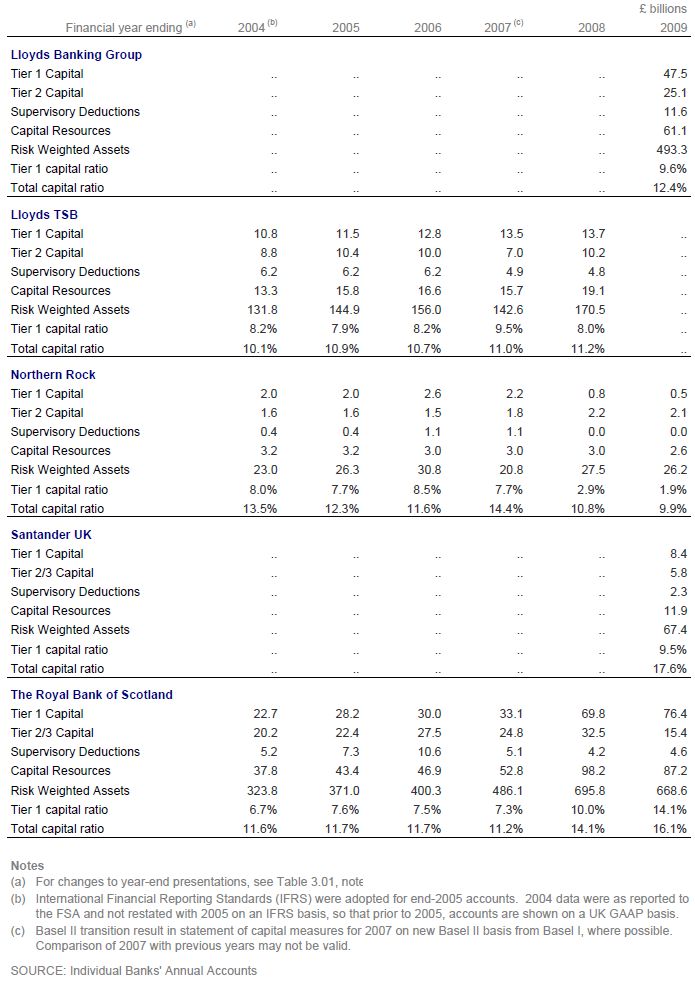

OK, here's a useful chart from the British Banker's Association (double click image to see larger version):

Source: BBA’s latest banking facts and figures

Narrowing this down to the main headline news of Tier I Capital Ratios, here’s the information we really need to look at:

Hmmm ... HBOS had a higher Tier I Capital Ratio than Lloyds TSB in 2008; Alliance & Leicester and Bradford & Bingley were well above the BIS requirements; RBS is particularly well capitalised; and Northern Rock appeared to have no issue in 2007, as mentioned.

And yet, these are all the failed banks of Britain!

This Tier I Capital Ratio measure ain't that good is it?

And what does it tell us about the EU stress tests? Oh dear ...

FDIC list of US banking failures since Lehmans crashed (September 15th 2008):

- August 13, 2010 Palos Bank and Trust Company

- August 6, 2010 Ravenswood Bank

- July 30, 2010 Bayside Savings Bank

- July 30, 2010 Northwest Bank & Trust

- July 30, 2010 LibertyBank

- July 30, 2010 The Cowlitz Bank

- July 30, 2010 Coastal Community Bank

- July 23, 2010 Williamsburg First National Bank

- July 23, 2010 Sterling Bank

- July 23, 2010 Crescent Bank and Trust Company

- July 23, 2010 Thunder Bank

- July 23, 2010 SouthwestUSA Bank

- July 23, 2010 Community Security Bank

- July 23, 2010 Home Valley Bank

- July 16, 2010 Metro Bank of Dade County

- July 16, 2010 Woodlands Bank

- July 16, 2010 First National Bank of the South

- July 16, 2010 Olde Cypress Community Bank

- July 16, 2010 Turnberry Bank

- July 16, 2010 Mainstreet Savings Bank, FSB

- July 9, 2010 Bay National Bank

- July 9, 2010 Home National Bank

- July 9, 2010 USA Bank

- July 9, 2010 Ideal Federal Savings Bank

- June 25, 2010 Peninsula Bank

- June 25, 2010 High Desert State Bank

- June 25, 2010 First National Bank

- June 18, 2010 Nevada Security Bank

- June 11, 2010 Washington First International Bank

- June 4, 2010 Arcola Homestead Savings Bank

- June 4, 2010 First National Bank

- June 4, 2010 TierOne Bank

- May 28, 2010 Granite Community Bank, NA

- May 28, 2010 Bank of Florida - Southwest

- May 28, 2010 Bank of Florida - Southeast

- May 28, 2010 Bank of Florida - Tampa

- May 28, 2010 Sun West Bank

- May 21, 2010 Pinehurst Bank

- May 14, 2010 New Liberty Bank

- May 14, 2010 Midwest Bank and Trust Company

- May 14, 2010 Satilla Community Bank

- May 14, 2010 Southwest Community Bank

- May 7, 2010 The Bank of Bonifay

- May 7, 2010 Towne Bank of Arizona

- May 7, 2010 Access Bank

- May 7, 2010 1st Pacific Bank of California

- April 30, 2010 Eurobank

- April 30, 2010 Frontier Bank

- April 30, 2010 BC National Banks

- April 30, 2010 Champion Bank

- April 30, 2010 CF Bancorp

- April 30, 2010 Westernbank Puerto Rico

- April 30, 2010 R-G Premier Bank of Puerto Rico

- April 23, 2010 Broadway Bank

- April 23, 2010 New Century Bank

- April 23, 2010 Peotone Bank and Trust Company

- April 23, 2010 Wheatland Bank

- April 23, 2010 Lincoln Park Savings Bank

- April 23, 2010 Citizens Bank and Trust Company of Chicago

- April 23, 2010 Amcore Bank, National Association

- April 16, 2010 AmericanFirst Bank

- April 16, 2010 First Federal Bank of North Florida

- April 16, 2010 Lakeside Community Bank

- April 16, 2010 City Bank

- April 16, 2010 Tamalpais Bank

- April 16, 2010 Innovative Bank

- April 16, 2010 Butler Bank

- April 16, 2010 Riverside National Bank of Florida

- April 9, 2010 Beach First National Bank

- March 26, 2010 Desert Hills Bank

- March 26, 2010 Unity National Bank

- March 26, 2010 Key West Bank

- March 26, 2010 McIntosh Commercial Bank

- March 19, 2010 Appalachian Community Bank

- March 19, 2010 Advanta Bank Corp.

- March 19, 2010 Century Security Bank

- March 19, 2010 American National Bank

- March 19, 2010 State Bank of Aurora

- March 19, 2010 First Lowndes Bank

- March 19, 2010 Bank of Hiawassee

- March 12, 2010 Old Southern Bank

- March 12, 2010 The Park Avenue Bank

- March 12, 2010 Statewide Bank

- March 11, 2010 LibertyPointe Bank

- March 5, 2010 Bank of Illinois

- March 5, 2010 Sun American Bank

- March 5, 2010 Centennial Bank

- March 5, 2010 Waterfield Bank

- February 26, 2010 Carson River Community Bank

- February 26, 2010 Rainier Pacific Bank

- February 19, 2010 La Jolla Bank, FSB

- February 19, 2010 George Washington Savings Bank

- February 19, 2010 The La Coste National Bank

- February 19, 2010 Marco Community Bank

- February 5, 2010 1st American State Bank of Minnesota

- January 29, 2010 First National Bank of Georgia

- January 29, 2010 Community Bank and Trust

- January 29, 2010 Marshall Bank, N.A.

- January 29, 2010 American Marine Bank

- January 29, 2010 First Regional Bank

- January 29, 2010 Florida Community Bank

- January 22, 2010 Bank of Leeton

- January 22, 2010 Premier American Bank

- January 22, 2010 Charter Bank

- January 22, 2010 Evergreen Bank

- January 22, 2010 Columbia River Bank

- January 15, 2010 Town Community Bank & Trust

- January 15, 2010 St. Stephen State Bank

- January 15, 2010 Barnes Banking Company

- January 8, 2010 Horizon Bank

- December 18, 2009 Independent Bankers' Bank

- December 18, 2009 New South Federal Savings Bank

- December 18, 2009 Citizens State Bank

- December 18, 2009 Peoples First Community Bank

- December 18, 2009 RockBridge Commercial Bank

- December 18, 2009 First Federal Bank of California, F.S.B.

- December 18, 2009 Imperial Capital Bank

- December 11, 2009 Valley Capital Bank, N.A.

- December 11, 2009 SolutionsBank

- December 11, 2009 Republic Federal Bank, N.A.

- December 4, 2009 Benchmark Bank

- December 4, 2009 The Buckhead Community Bank

- December 4, 2009 First Security National Bank

- December 4, 2009 AmTrust Bank

- December 4, 2009 The Tattnall Bank

- December 4, 2009 Greater Atlantic Bank

- November 20, 2009 Commerce Bank of Southwest Florida

- November 13, 2009 Century Bank, F.S.B.

- November 13, 2009 Orion Bank

- November 13, 2009 Pacific Coast National Bank

- November 6, 2009 Gateway Bank of St. Louis

- November 6, 2009 United Commercial Bank

- November 6, 2009 United Security Bank

- November 6, 2009 Prosperan Bank

- November 6, 2009 Home Federal Savings Bank

- October 30, 2009 Park National Bank

- October 30, 2009 California National Bank

- October 30, 2009 Community Bank of Lemont

- October 30, 2009 Bank USA, N.A.

- October 30, 2009 San Diego National Bank

- October 30, 2009 Pacific National Bank

- October 30, 2009 Citizens National Bank

- October 30, 2009 Madisonville State Bank

- October 30, 2009 North Houston Bank

- October 23, 2009 Partners Bank

- October 23, 2009 First DuPage Bank

- October 23, 2009 Riverview Community Bank

- October 23, 2009 Bank of Elmwood

- October 23, 2009 Flagship National Bank

- October 23, 2009 Hillcrest Bank Florida

- October 23, 2009 American United Bank

- October 16, 2009 San Joaquin Bank

- October 2, 2009 Jennings State Bank

- October 2, 2009 Southern Colorado National Bank

- October 2, 2009 Warren Bank

- September 25, 2009 Georgian Bank

- September 18, 2009 Irwin Union Bank, F.S.B.

- September 18, 2009 Irwin Union Bank and Trust Company

- September 11, 2009 Brickwell Community Bank

- September 11, 2009 Corus Bank, N.A.

- September 11, 2009 Venture Bank

- September 4, 2009 First Bank of Kansas City

- September 4, 2009 InBank

- September 4, 2009 Platinum Community Bank

- September 4, 2009 Vantus Bank

- September 4, 2009 First State Bank

- August 28, 2009 Bradford Bank

- August 28, 2009 Mainstreet Bank

- August 28, 2009 Affinity Bank

- August 21, 2009 CapitalSouth Bank

- August 21, 2009 First Coweta Bank

- August 21, 2009 ebank

- August 21, 2009 Guaranty Bank

- August 14, 2009 Colonial Bank

- August 14, 2009 Dwelling House Savings and Loan Association

- August 14, 2009 Community Bank of Nevada

- August 14, 2009 Community Bank of Arizona

- August 14, 2009 Union Bank, National Association

- August 7, 2009 Community National Bank of Sarasota County

- August 7, 2009 Community First Bank

- August 7, 2009 First State Bank

- July 31, 2009 Peoples Community Bank

- July 31, 2009 First State Bank of Altus

- July 31, 2009 Mutual Bank

- July 31, 2009 Integrity Bank

- July 31, 2009 First BankAmericano

- July 24, 2009 Security Bank of Jones County

- July 24, 2009 Security Bank of Houston County

- July 24, 2009 Security Bank of Bibb County

- July 24, 2009 Security Bank of North Metro

- July 24, 2009 Security Bank of North Fulton

- July 24, 2009 Security Bank of Gwinnett County

- July 24, 2009 Waterford Village Bank

- July 17, 2009 BankFirst

- July 17, 2009 Temecula Valley Bank

- July 17, 2009 Vineyard Bank

- July 17, 2009 First Piedmont Bank

- July 10, 2009 Bank of Wyoming

- July 2, 2009 Elizabeth State Bank

- July 2, 2009 First State Bank of Winchester

- July 2, 2009 John Warner Bank

- July 2, 2009 Rock River Bank

- July 2, 2009 First National Bank of Danville

- July 2, 2009 Millennium State Bank of Texas

- July 2, 2009 Founders Bank

- June 26, 2009 Neighborhood Community Bank

- June 26, 2009 Community Bank of West Georgia

- June 26, 2009 MetroPacific Bank

- June 26, 2009 Horizon Bank

- June 26, 2009 Mirae Bank

- June 19, 2009 Southern Community Bank

- June 19, 2009 First National Bank of Anthony

- June 19, 2009 Cooperative Bank

- June 5, 2009 Bank of Lincolnwood

- May 22, 2009 Citizens National Bank

- May 22, 2009 Strategic Capital Bank

- May 21, 2009 BankUnited, FSB

- May 8, 2009 Westsound Bank

- May 1, 2009 Silverton Bank, NA

- May 1, 2009 Citizens Community Bank

- May 1, 2009 America West Bank

- April 24, 2009 Michigan Heritage Bank

- April 24, 2009 American Southern Bank

- April 24, 2009 First Bank of Beverly Hills

- April 24, 2009 First Bank of Idaho

- April 17, 2009 American Sterling Bank

- April 17, 2009 Great Basin Bank of Nevada

- April 10, 2009 Cape Fear Bank

- April 10, 2009 New Frontier Bank

- March 27, 2009 Omni National Bank

- March 20, 2009 Colorado National Bank

- March 20, 2009 TeamBank, NA

- March 20, 2009 FirstCity Bank

- March 6, 2009 Freedom Bank of Georgia

- February 27, 2009 Security Savings Bank

- February 27, 2009 Heritage Community Bank

- February 20, 2009 Silver Falls Bank

- February 13, 2009 Corn Belt Bank & Trust Co.

- February 13, 2009 Riverside Bank of the Gulf Coast

- February 13, 2009 Sherman County Bank

- February 13, 2009 Pinnacle Bank of Oregon

- February 6, 2009 Alliance Bank

- February 6, 2009 County Bank

- February 6, 2009 FirstBank Financial Services

- January 30, 2009 Suburban FSB

- January 30, 2009 Ocala National Bank

- January 30, 2009 MagnetBank

- January 23, 2009 1st Centennial Bank

- January 16, 2009 National Bank of Commerce

- January 16, 2009 Bank of Clark County

- December 12, 2008 Haven Trust Bank

- December 12, 2008 Sanderson State Bank

- December 5, 2008 First Georgia Community Bank

- November 21, 2008 Community Bank

- November 21, 2008 Downey Savings & Loan

- November 21, 2008 PFF Bank & Trust

- November 7, 2008 Franklin Bank, SSB

- November 7, 2008 Security Pacific Bank

- October 31, 2008 Freedom Bank

- October 24, 2008 Alpha Bank & Trust

- October 10, 2008 Main Street Bank

- October 10, 2008 Meridian Bank

- September 25, 2008 Washington Mutual Bank

- September 19, 2008 Ameribank

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...