I was intrigued to see Chris Anderson’s discussion of the Web is Dead in last month’s Wired Magazine, for no other reason than how it resonates with my own thoughts on this area back in May.

In May, I received a very lukewarm reaction in Asia to the idea that everything in the future will be an app. They thought I meant it was all going to be based upon Apple, but what I was really talking about is what Mr. Anderson has articulated so well: the end of the need for a browser.

For so long, we’ve used the web as a method of finding stuff. We enter URLs and search for things on Google.

With apps, we’ve finally moved beyond this towards the more semantic web discussed by Tim O’Reilly and others, as the next wave of change after Web 2.0. Equally, it's a massive change in that we now touch screens rather than use keyboards.

But it's all backed by the internet as the backbone, and each wave of internet change is transforming business and commerce, entertainment and life.

Simply put, the major waves of internet transformation so far could be categorised as follows:

- Early 1990s internet: trials and connectivity

- Late 1990s internet: advertising and publishing

- Early 2000s internet: interacting and servicing

- Late 2000s internet: socialising, entertaining and self-publishing

- Early 2010s internet: receiving, intuitive and proactive using touch technologies

- Late 2010s internet: location specific push services everywhere

In other words, we’ve gradually moved from pull to push; from find to deliver; from seek to service; and the next decade will see such things become even more pervasive, as the mobile internet is stitched into our clothing and life everywhere.

We’re already pretty much there with apps on Android and iPhone, but the fabric of our world is now being re-engineered by the net.

This is where and when we talk about the network of things, where all products, people and services are wirelessly communicating from fridges to phones, cars to carriages, shoe to treadmill.

These current trends are no more obviously illustrated than in the world of entertainment, as television moves from real-time to my-time.

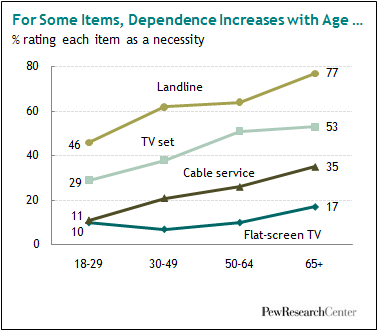

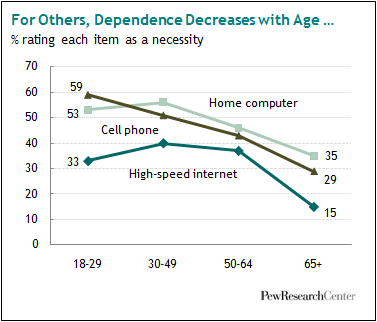

In fact, it was really interesting to see the Pew Research that came out the other day, showing that it’s older demographics who watch ‘live TV’, whilst the rest of us slingshot around the world to watch what we want when we want.

The result is that many industries have been revitalised or crushed by this march of change (think travel agents, book stores, record shops, TV station, newspapers ...).

What does it all mean for banking?

Well, I’ve just started a new theme in my presentations: making the antisocial bank social.

It’s not about using social media or any of that stuff, although that all comes into it, but it’s more to do with the fundamental challenge to banks and banking to become social.

Banking is by nature dull.

We want it to be dull.

It should be boring.

After the financial crisis, that’s what all the regulators, policymakers, customers and consumers have been clamouring for: bring back boring banking.

This is because banking is meant to be safe and secure.

It’s not meant to be risky or, if it is, it should only be risking my money because I asked the bank to do that ... that’s why Paul Volcker’s rule about proprietary trading in banks has been proposed and why JPMorgan closed down their prop desk this week.

Banking should be dull, boring, safe and secure.

What that means in practice is that a banker is not the sort of person who will be the life and soul of the party.

You don’t want that.

You want them to be dull and boring, safe and secure.

That’s why you know when you meet an extrovert banker that they’re the one staring at someone else’s shoes.

So the first challenge is to make that antisocial position social.

That’s a hurdle.

But an even bigger hurdle is to be so social that you catch my attention.

Y’see we live in an age where we all suffer from ADD – Attention Deficit Disorders.

We have the focal time of a gnat.

If you don’t grab me in the first five seconds, I’m off multi-tasking and sharing my thoughts elsewhere via twitter and facebook.

Don’t believe me?

How easy is it these days for you to sit through a meeting without fiddling with your blackberry or mobile?

Can you sit in the evening and watch a TV without checking out who’s tweeted?

Even more telling: do you see a two-hour movie coming on and think that you’d rather tivo it so that you can fast forward the ads and the boring bits?

The next generation do (see the Pew research).

Even more if you can gain attention, can you respond and manage the communication?

After all, today’s socially networked digital generation are far more outspoken and in-yer-face than ever before.

This is illustrated well by Kevin Pietersen.

Kevin is an England Cricketer, who tweeted:

... when he found out that he’d been dropped by England’s selectors this week.

He reacted immediately and angrily to bad news, but it was live and online.

Not a great role model as a hero of many children and, with almost 40,000 followers, using the f-word on your public tweets is not viewed as being good or honourable by the authorities that run the sport.

Sure, he deleted it seconds after posting, but this is a real-time world where real-time emotions are shared in real-time with your real-time friends and followers.

This is the point.

How will your staff react to bad customer comments?

What happens if your official tweeter calls someone ‘scum’ – just for a second on a tweet – or gets virally hacked with sex and porn, so that your official bank messages are asking people for the wrong sort of withdrawals?

There are many challenges here, to be sure, but if a bank does not try to meet them, then they will be one of those crushed by the changes created as the world becomes digitally social.

After all, if your customers have all of their other services packaged and delivered with minimal effort to access, share and receive, will they want your last century style of service based upon search, seek and enter the URL?

If they can tailor those services to their lives and lifestyles through apps, and mix and match everything for spontaneous gratification, will they want your secure access logon with second-level authentication, firewall and access barriers?

Think about it.

How do you make banks social with instant gratification, whilst being dull and boring, safe and secure?

For most, it implies running a secure social network.

For some, it means offering bank apps with functionality designed to allow the browser to be defunct.

For a very small few, it means being completely immersed in customer conversations online and on the mobile net.

And for a rarity, it means being a truly social bank, with USAA and First Direct leading the early charge to achieve the social bank vision.

Wanna know more?

Come and socialise with me ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...