Much of last week was focused on the Long Now and Long Finance for me.

Working with a group of thought leaders that included Venessa Miemis, Thierry Touchais, John Hagel, Stefan Nusser, Michael Mainelli, Paul Saffo, Bruce Davis, Brett King, Nova Spivack and more, we debated big topic items all week.

And yes, there were some conclusions too, so here’s the Long Blog Entry on the Long Now and Long Finance at SIBOS 2010.

First, it’s difficult to get the concept across and make it meaningful. Someone said to me: “What are you doing this week?” and I replied: “Building the concepts for a banking system that will last for 100 years.” They snorted dismissively and said: “Who cares about 100 years, I’m just interested in the next 100 days”.

As a result of this comment, the week taught me about why the Long Now is important, as it is totally concerned with what we leave our children.

When we think in business, we think short. Usually the next month or quarter.

If you are in charge of strategy, then maybe you think about the next year or two.

If you’re really lucky you get to think about the very long-term, especially if you are in charge of grand schemes like building, construction, oil or the environment.

Even then you are thinking long-term about how to make money rather than long-term about legacy.

What legacy are you going to leave your children?

Your wealth? Your savings? Your house? Your memories?

Does it matter?

Well, it’s only when you think about your children, their children and their grandchildren that you start to personally think Long.

The Long Now asks: what is your footprint going to be on this planet?

Many of us might not be that bothered about the footprint we leave on this planet as we just want to exist and enjoy the Now, not the Long Now.

Luckily, a few folks think differently, and I’ve blogged already about those thinkers who created Pyramids and Cathedrals.

Second, the Long Now is important for more than just a few bricks and buildings. Think about the current construct of our world? Our world is made up of forces that shape decades and centuries through decisions made today.

- If Alan Greenspan had left office in 2000, would there still have been a financial crisis?

- Where would Africa be today if there hadn’t been a Live Aid?

- Would the world be different if JFK had lived?

- What would have happened if Neville Chamberlain hadn’t signed a piece of paper with Adolf Hitler?

All of these decisions and moments in time shape the future. That’s why the Long Now is really important.

We are shaping the next decades today as we reconstruct our financial system from its meltdown.

- How do you want to shape this?

- How should it work?

- What happens if we rebuild it and it only lasts till 2020?

- Could the world survive another economic shock of this size and nature so soon?

These are the fundamentals with which the Long Now grapples, so sure, focus on 100 days and let’s just screw the children, the planet and our futures.

Third, Thierry Touchais gave a fantastic insight into Long Now thinking as he talked about the environment in the future.

Climate Change brings our world into sharp focus because we all now accept that this is important.

If you think you don’t believe climate change is important, do you recycle?

Do you think about carbon credits?

Do you fly as cheaply as possible, or do you accept there should be a carbon tax on your flights?

Finally, Paul Saffo finished our week with a view that again brought into focus the sharp reality of the Long Now.

He outlined the legal perspective, and said that rules and regulations were political fashion statements made to last a term in office.

Directives and legislation were structures made of cement, but that would only live for decades and not centuries.

What is really important is to focus upon the bedrocks of the system: the Magna Carta, the Constitution, the Napoleonic Code.

These are the Schema that rule our legal view of the world and, if these are shaken, our bedrocks of trust are shaken.

And here’s the rub: the longer the system lasts, the more we trust it works.

If the system changed every year, you would trust nothing and no-one.

This is why Facebook is not a trusted global currency: they are too young and fragile.

PayPal can create a global currency: but it’s not proven for the long-term. It is still not wholly trusted as a global conduit.

Banks can offer global commerce and trading finance: it is trusted because banks have been around doing this for over five centuries (the oldest bank in the world still surviving is Monte dei Paschi di Sienna, established in 1472 and still going today).

But has that bedrock trust been shaken?

If Facebook is the political fashion statement, and PayPal is the regulatory directive, have the banks that are the Constitution of the financial system cracked?

That is the question we were really grappling with last week: Do we need a new Magna Carta, Constitution, Napoleonic Code for the Financial Markets?

Is this what the authorities are creating right now anyway?

And no, we did not get an answer.

But what we did get was some illumination and, between the dialogue, some progress towards a view regarding what would ensure a robust financial market for the next century?

SWIFT, Long Finance, the Financial Services Club, IBM and others have determined to continue this work, and it will be interesting to see where it takes us.

In the meantime, we had several blogs produced, two videos and numerous white boards full of ideas, so here are a few of the other contributions.

Blogs from other attendees at the Long Now SIBOS sessions:

- Bruce Davis: A magna carta for money?: reflections on a week of talking about 'the long now'

- Brett King: What innovations will rock our world in the next 25 years?

The summary video (3 minutes 30 seconds), produced for Paul Saffo’s closing plenary.

This was a combination of the trailer of Sean Park's and Motherlode's "Financial Reformation" video and the "Future of Money" video produced by Venessa Miemis (Emergent by Design) and Gabriel Shalom.

The full videos are also worth watching individually.

The Financial Reformation by Sean Park (4 minutes)

Video on the Future of Money by Venessa Miemis and Gabriel Shalom (7 minutes 32 seconds)

The Future of Money from KS12 on Vimeo.

Full details: Web Premiere of Future of Money video; Now where do we go from here?

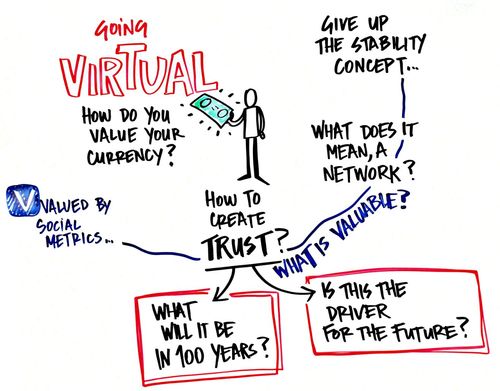

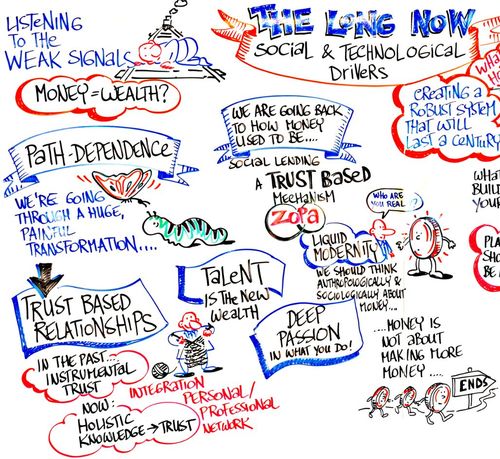

Throughout the week, the guys from the ValueWeb provided scribing and visioning through their white board mindmap illustrations. Here's a small selection of just a few.

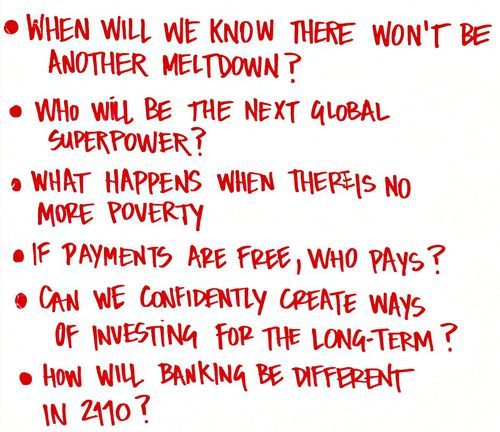

The six big questions I raised and blogged about before the show:

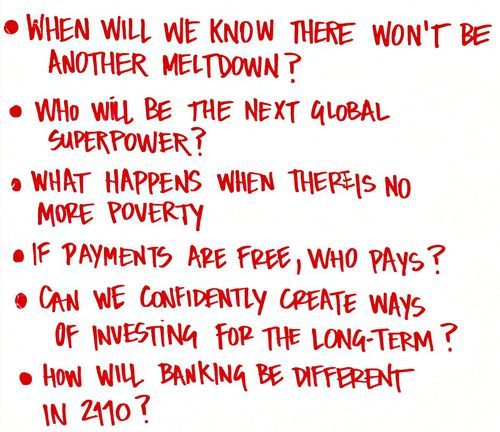

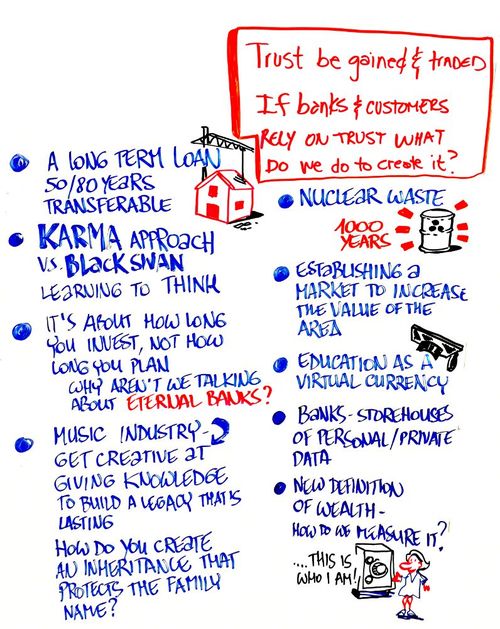

"Trust" in banks and the creation of virtual currencies were a continual source of debate, especially Facebook credits.

Then PayPal announced a partnership with Facebook to do just that.

By the end of Day One, we had lots of themes and the challenge was how to put these into practice. As a result, we asked team members to work on stories on Day Two about how to describe the Long Now.

And there were lots of good ideas.

Equally, we studied Long Now from many angles: political, economic, social, technological, environmental and legal. I've mentioned the last two above in the text, but here's the picture of the social and technological views:

And finally, if you're really into the Long Now and Long Finance, here's my own 50-page summary from all the blog entries to date: Download Long Now (PDF, 250Kb).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...