I’ve just been working on a new presentation around banking trends in the retail space. One of the key things that comes out of this is the old multichannel nugget, which has also reared its ugly head in a new report from EFMA.

The headline news from the report is that almost half of Europe’s retail banks are seeking to harmonise and improving cooperation between branch, internet and call centre channels this year as their top strategic priority.

Part of the reason for this is that branch sales are declining (from 82% of sales generated in 2007 to 78% today) whilst internet sales of bank products doubled (to 10%) and are predicted to double again between now and 2013.

Similarly self-service is heavily on the rise, with teller transactions down by 3.5% whilst self-service has gone up by 15% over the last year.

The reason I say it’s ugly is that this comes up as a theme so often that it sits with ‘customer service’, ‘process management’ and ‘employee satisfaction’ as a phrase that is meaningless because no-one really deals with it.

OK, OK, so I’m cynical, but I’ve already explained why in a recent blog entry, and the multichannel challenge is no different.

How can I say such a thing?

Well, we were saying it way back in 1997 when I worked for NCR.

Way back then, new channels were rising fast.

Call centre was a problem, and ATM was viewed as a sales and marketing opportunity.

Then the internet hit and email was rising as a communication tool with the banks.

Yes, amazingly, this was an issue way back in the dim, distant past.

So NCR launched a thing called the multichannel integrator.

The multichannel integrator was meant to be a single platform that could enable bank consistent interaction across branch, ATM and call centre, and then yes, across the internet and mobile.

You may not believe it, but here’s a few slides from my old PowerPoint deck back then.

Bearing in mind this is 1997, we were talking about the rise of 24*7 mobile and wireless banking ...

... which we called Martini Banking (anytime, anyplace, anywhere ... the strapline from an old Martini advert).

The rise of new web communities ...

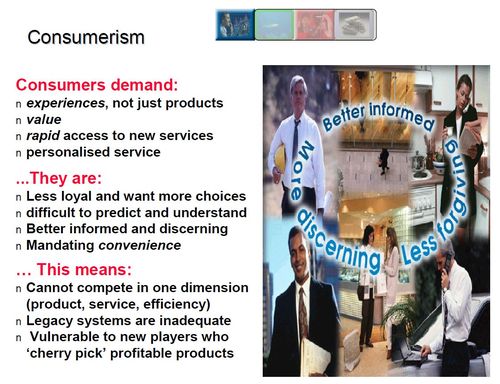

And the early signs of the experience economy ...

Thanks to consumer demands ...

In fact, looking at these slides it amazes me how much of what we talk about today is still the same.

It’s all about getting the most from employees in delighting customers to create good business.

But then, that’s always what business is about isn’t it?

Happy people = happy customers = happy business.

Now then, back to the multichannel bit.

Multichannel back in 1997 was an issue as customers were starting to interact over many access channels and consistency was a big challenge.

Could the branch tell the customer the same thing the customer read online yesterday?

Would the call centre know what the branch said?

Can the ATM be used to provide advisory notes on receipts?

All of these would be handled by the multichannel integrator.

Now, we’re in an even bigger dilemma as answering emails and phone calls has escalated to sending and responding to text alerts, blog comments, tweets and facebook wall posts.

The immensity of demand over remote channels has significantly changed the mix and complexity of handling multichannel interactions.

And handling them consistently is the key.

After all, I wouldn’t want the branch to say they couldn’t offer me a loan after going through an online self-assessment test the previous evening where I’m told it’s no problem.

Similarly, I wouldn’t want a call centre to ring offering a loan when I’ve just paid one off the previous night through my mobile payments app.

And it goes further than just having consistency across these channels and interactions; it’s also mining the data intelligently, as discussed last week.

What I mean by this is that if the bank knew from my IP address – which they know from my online banking records – that I had been looking at their mortgage offers the previous night, then it would be great marketing to get a call the next day saying: “can we clarify anything related to our mortgage offers? Is there anything you specifically are considering and did the online service answer all of your questions?”

I know that some folks, like Jacques, may find that scary ... but I personally like it and, as a bank service, believe this will again become more predominant and notable.

After all , it’s all about happy people = happy customers = happy business, and the more that technology can manage and bridge those gaps to create consistent service, responsive people and profitable products, the better.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...