A friend of mine in Australia – yes, I do have friends down under (!) – sent me a link to a story that’s creating quite a stir over there.

It’s National Australia Bank’s (NAB) new advertising campaign that’s an out and out attack on the other big banks: Westpac, Commonwealth and ANZ.

What are they doing?

Going straight for the jugular by making out that the other banks are all big, fat, lazy bar stewards whilst NAB are the good guys. As a result, they're breaking up with them.

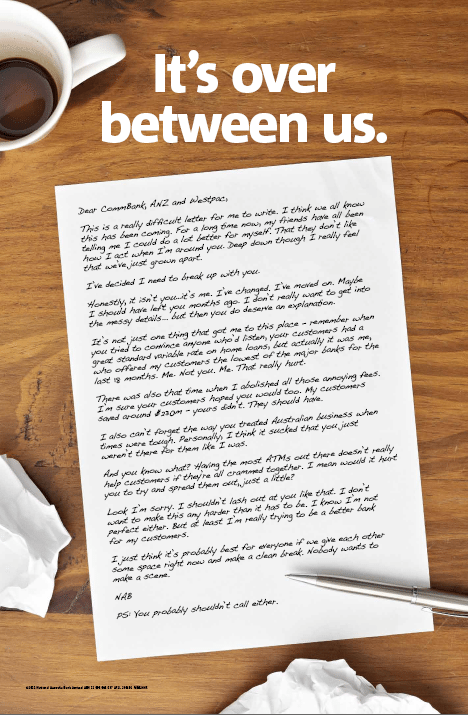

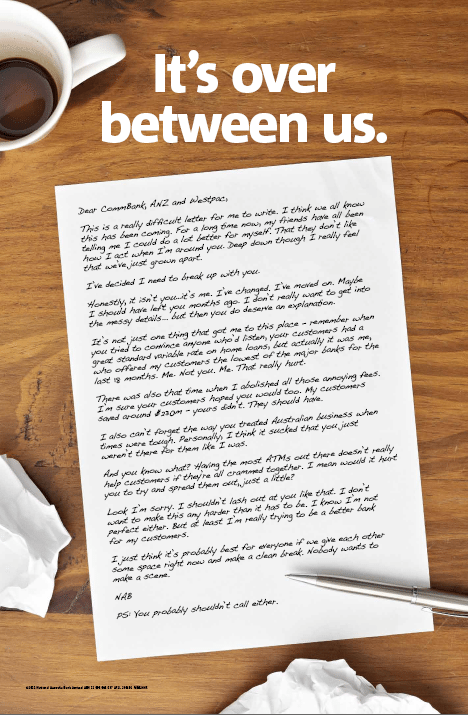

The best way to illustrate the war NAB has picked is with this advert ...

... which reads:

Dear Commbank, ANZ and Westpac

This is a really difficult letter for me to write. I think we all know this has been coming. For a long time now, my friends have all been telling me I could do a lot better for myself. That they don’t like how I act when I’m around you. Deep down though, I really feel that we’ve just grown apart.

I’ve decided I need to break up with you.

Honestly, it isn’t you ... it’s me. I’ve moved on. Maybe I should have left you months ago. I don’t really want to get into the messy details ... but then you do deserve an explanation.

It’s not just one thing that got me to this place – remember when you tried to convince anyone who’d listen, your customers had a great standard variable rate on home loans, but actually it was me, who offered my customers the lowest of the major banks for the last 18 months. Me. Not you. Me. That really hurt.

There was also that time when I abolished all those annyonign fees. I’m sure your customers hoped you would too. My customers saved around AUS$230m – yours didn’t. They should have.

I also can’t forget the way you treated Australian business when times were tough. Personally, I think it sucked that you just weren’t there for them like I was.

And you know what? Having the most ATMs out there doesn’t really help customers if they’re all crammed together. I mean would it hurt you to try and spread them out, just a little?

Look I’m sorry. I shouldn’t lash out at you like that. I don’t want to make this any harder than it has to be. I know I’m not perfect either. But at least I’m really trying to be a better bank for my customers.

I just think it’s probably best for everyone if we give each other some space right now and make a clean break. Nobody wants to make a scene.

NAB

p.s. you probably shouldn’t call either.

The campaign started in earnest this week, blasting these ads all over the print media and major urban and city traffic points ...

It was accompanied by ambushing ‘actors’ who are meant to be other bank workers having an easy time of things. Here’s the Westpac ambush ...

And, as the campaign started on Valentine’s Day, it was also accompanied by moments of couples breaking up in restaurants as part of the viral campaign ...

For the full campaign, checkout mUmBRELLA’s coverage and Smart Company are already tipping this to be one of the best marketing campaigns of 2011.

Meanwhile, there’s nothing like a bit of guerrilla marketing and it will be interesting to see how ANZ, Commonwealth and Westpac respond.

HT to Emma.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...