OK, so I said that banks would absolutely not be disintermediated last week, and it sparked some interesting debate and dialogue.

A few folks were incredulous that I could say this; others thought it made eminent sense; some noted that the movement of money could be disintermediated, but the holding of money could not; whilst others were up in arms over the fact that I could possibly believe any of it.

Well, for those who know me, it was written with a deep sense of irony and disbelief.

I absolutely believe that banks will be disintermediated and have believed it for a long time.

However, I also believe that some of the system will be protected and will never be destroyed or replaced.

This is the part that governments are regulating, protecting, licensing and calling too big to fail, or 2B2F.

The 2B2F area is the core of the monetary system, and needs to be protected.

If your social media account is compromised, it doesn’t matter too much that someone sends a status update saying: “I’m flat on my face in a flap” or worse from your account.

Sticks and stones will break my bones, but names cannot hurt me.

Losing money can hurt though, so it does matter if they steal all your worldly wealth.

This is the part that will never be disintermediated, and I guess that’s the part that Nancy Pierce of HSBC and Mark Buitenhek of ING were saying is core.

- “We will absolutely not be disintermediated … who’s better to move the money than the banks?” Nancy Pierce, Head of Product Management for Payments and Cash Management Europe, HSBC

- “Banks need to reinvent themselves as they will be disintermediated by other banks, because we are the only ones that are trusted for secure transaction processing.” Mark Buitenhek, Global Head of Payments and Cash Management, ING

But it’s open season for the rest of the financial system and yes, there are companies that claim they could replace VISA, MasterCard, SWIFT and other infrastructures.

In fact, as discussed on Monday, it’s warfare between the banks, card processors and PayPal.

The iDEAL system originating from the Netherlands gains more traction for banks across Europe as an alternative to PayPal; this is in the same moment as AMEX opens a P2P platform, as does VISA, as an alternative to PayPal; and this is in the same breath as PayPal stretches out towards physical store paypoints to compete with VISA, AMEX and MasterCard, as the online world merges with the offline.

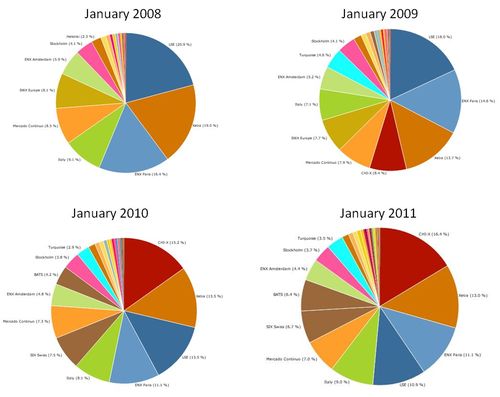

A similar story can be seen in capital markets where the rise of Chi-X, from upstart electronic trading platform to the biggest trading system in Europe, took place in just two years (doubleclick image to see full size version):

Source: Monthly MiFID Monitor / Thomson Reuters Equity Market Share Reporter

A similar story can be seen with BATS in the USA, which is why BATS is buying Chi-X.

So disruption can occur.

In the latter case, it’s down to deregulation.

In the case of PayPal, it’s down to disruptive innovation and the dilemma of something that appears to be innocuous at first but soon becomes mainstream, e.g. with $4.2 billion revenues forecast for 2011, PayPal is now almost half the size of Citigroup’s Global Transaction Services business.

The real issue of disintermediation therefore, is not around the core of banking – the holding money area that is protected by banking licences – but around the boundaries of banking.

The thing is the boundaries is where all the profit lies.

The boundaries is everything from savings to investments, cards to loans, trade finance to treasury dashboards, insurances to wealth management, foreign exchanges to bond markets, pensions to mutual funds, swaps to futures, mortgages to marriages …

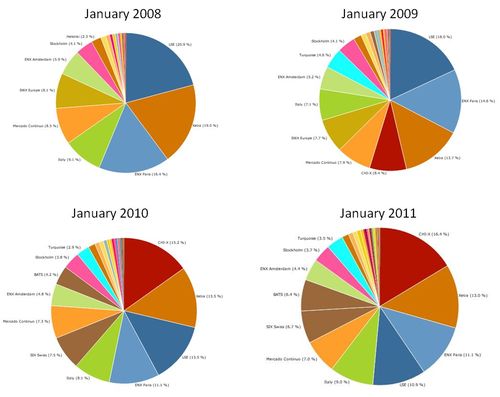

In fact, everything in a bank can be broken down into components of functionality and then traded in and out by new competitors.

Source: ACI Worldwide

This is the picture I’ve talked about for a while, where all of the processes and functions of a bank can become apps that users can download and integrate to build their own bank.

The Build-Your-Own-Bank (BYOB) is the new generation of banking.

It’s the generation where anyone from a banksimple to a Mint can step in and take out a piece of core banking.

That’s what disintermediation is really all about.

Taking out the parts of banking where there is not enough competition, and leaving the bits of banking that aren’t worth competing against … which is the part that is protected by licence because it’s too big to fail.

BYOB will absolutely be disintermediating, whilst 2B2F will never be disintermediated.

That’s the real bottom-line.

- “Could we see a wholesale version of Zopa or PayPal? Yes, I think we can.” David Birch, Director, Consult Hyperion

- “Disintermediation is well under way, and will happen very quickly.” Daniel Marovitz, Head of Product Management, Global Transaction Banking, Deutsche Bank

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...