So the week ends with another wide ranging conversation about new business models and new ways of banking, although I still have one question that no-one seems to be able to answer: how much profit does a bank make from payments, and how has that changed over the last twenty years?

This question came up because I saw that one of my twitter friends, Daniel Gusev, had posted a comment from today’s Financial Times that: “banks in the European Union alone spend an estimated €50bn-€70bn a year moving and storing physical banknotes”.

Why estimated?

Because no-one knows how much banks spend or make from payments.

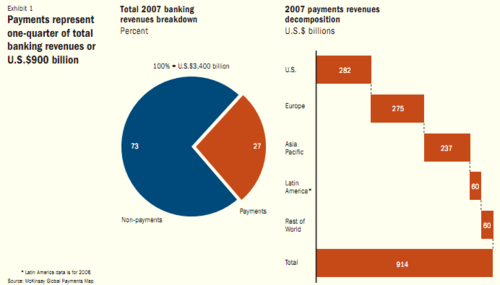

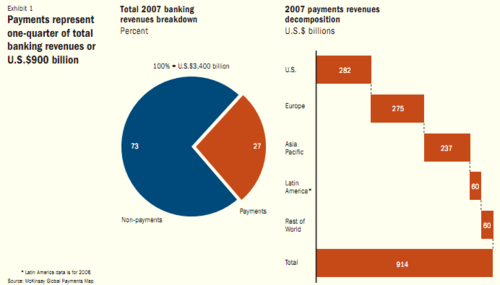

McKinsey claim that 25% of bank revenues are from payments in 2007, comprising an industry worth almost $1 trillion a year.

That’s revenues by the way, so the $10 billion that Citigroup’s Global Transaction Services generate or $4.2 billion that PayPal will generate this year gives you an indication of the players and their relative market shares.

What is interesting is that this is more than the amount of revenue estimated to be made by banks a decade earlier. From the Federal Reserve Bank of Chicago, Q4/2004 journal:

“Rice and Stanton (2003) updated and expanded Radecki’s study by estimating the volume of payment driven revenues at the top 40 bank holding companies in 2001. In order to obtain a larger sample of banking companies, Rice and Stanton drew their data from the financial reports (call report and Y9) that U.S. banking companies file with their regulators, rather than relying on banking company annual reports, which do not offer consistent information on payment-driven revenues in several important categories. In addition, these authors adjusted some of Radecki’s approximation methods, which may have over-allocated some bank revenues to payment activities. They conclude that payment revenue accounts for 16 percent to 19 percent of operating revenue—a substantially lower estimate than Radecki’s but still a surprisingly large contribution to the overall revenue streams of banking companies.”

Back in 1999, completely disagreeing with this research, my friend David Birch claimed that “the top 25 retail banks in the US derive only around 7% of operating revenue from payments”, and recently stated that revenues from payments have halved over the last two decades in the banking community.

So who do you believe and what is the truth?

Answer: no-one knows.

McKinsey, the Chicago Fed and David Birch have no idea how much money banks make from payments.

A bold statement and a provocative one, but it’s a very basic question: how much money do you make from a payment, by payment type?

It’s a simple question.

But it is completely unanswerable.

You know why it’s an unanswerable question?

Because most banks don’t know how much revenue they get for each of the payments instruments they process, versus the cost of processing that instrument.

Without that granularity of information, they cannot work out their profit from payments.

Without knowing their profit from payments, they have no idea how much money they make from a payment, let alone by payment type.

And even if the bank does have an idea of such costs and revenues, they have no idea how much is generated by tertiary products, such as deposit accounts, that drive these payment revenues.

Payments in and of themselves are not the sole revenue generator, as much of the payment process is cross-subsidised by other bank products.

All in all, payments is a great industry to be in, but show me an accurate breakdown of a banks P&L for its payments business, and I’ll show you a little bit of creative accountancy.

Now I hope this blog entry gets some real pushback, as that’s what it’s meant to do, as anyone who can point me to a clear analysis of the costs, revenues and profitability per payment type within a bank will be my friend for life.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...