Just got home from travels and found a leaflet on my doormat.

Usually such leaflets get thrown in the bin, but the strapline “start a whole new movement” in orange intrigued me.

I wonder what this is about I thought, as I’ve never had junkmail from what I assumed was Orange, the mobile phone operator. Orange had never written to me before.

Turning to the back of the leaflet, the sight of a mobile telephone with “powered by Barclaycard” immediately caught my attention.

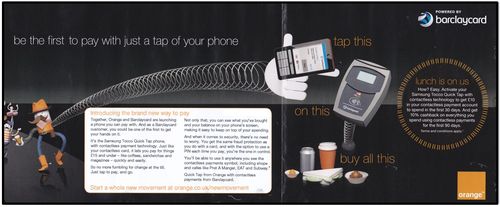

So I opened the leaflet and yay, this is the launch of Britain’s’ first mobile contactless programme in action (doubleclick image below to see large version).

The leaflet asks me to clink on an Orange webpage for more information ...

... and, on the webpage is a video explaining more:

The ordering is simple, and the phone is available for just £59.99 ($100) on a pay-as-you-go contract that’s quite attractive.

Maybe this really is a way for mobile carriers and banks to partner?

Either way, it shows Barclaycard on the leading edge once again. After all, they appear to be the only card firm that regularly gets coverage on this blog as an innovator:

- Great advert for Barclaycard Contactless

- Barclaycard show some creativity

- Barclaycard contactless strikes again

All in all, the mobile payments revolution is under way and, in the UK, this one leads the way.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...