We had a fantastic meeting of the Financial Services Club last night.

It was the close of our 2010-2011 season of meetings, and therefore slightly racier subject matter with Richard Noble, OBE.

Richard is an inspirational character and the driving force behind Britain’s land speed record winning cars: Thrust2 and Thrust SuperSonic Car (SSC).

Richard set the land speed record in 1983, driving Thrust2 himself at speeds averaging 633 miles per hour (1,018 kilometres per hour).

Then, in the 1990s, a battle broke out between an American team, the Formula 1 McLaren team and Richard Noble’s team to break this record and the sound barrier.

The other teams were well advanced with multimillion dollar budgets, but Richard’s team had passion and engineering prowess.

As a result, on 15th October 1997, Richard’s team claimed a new land speed record, driving beyond 763 miles per hour (1,228 kilometres per hour).

Here’s a short video of the record-breaking drive of ThrustSSC:

This record still stands and ThrustSSC was the first car to be supersonic.

It was also an indescribably risky project at the time.

First, there were all the challenges of getting the project financed. No banks wanted to help, nor government. The project ended up being virtually wholly funded by sponsorship, driven by Richard’s passion.

Then there’s the risks involved in building a car that can withstand such speeds. As Richard mentioned in his first land speed record attempt, the way the car was built back then meant that, if it had been driving at just 7 miles per hour faster (11 kilometres per hour), it would have taken off!

Finally, there’s the risks of failure due to any number of reasons: weather, the track, animals and birds or stones on the track, the tyres, parachute, brakes, etc.

It takes nerves of steel to do these sort of projects and that’s why we discussed this at the Financial Services Club last night, as risk management is what it’s all about.

Taking risk out of the game.

When we talk about high frequency trading, real-time payments, liquidity risk or anything in banking, we are talking about and taking big risks with the world’s finances.

Richard is taking big risks with the car and the driver.

Or is he?

I asked Richard about Richard Hammond’s crash on Top Gear:

This was a 300 mile per hour crash. Under half the speed of the Thrust SSC vehicle.

Richard explained that everything was wrong with the attempt by Hammond, from the car to the track to the safety checks to the weather … shame that Top Gear hadn’t consulted the expert.

And there’s the rub.

Sure, there’s risks but Richard takes out all the risks, as far as is humanly possible, to ensure the car drives safe.

This is why there are so many tests and test runs before any record attempts, to ensure that everything is a known factor and that there no known unknowns.

And why is all of this topical now?

Because Richard is trying to break the land speed record again.

And this time it’s a big challenge.

A really big one.

A 1,000 miles per hour challenge (1,609 kilometres per hour).

This new project is called Bloodhound SSC, named in deference to the original Bloodhound missile.

The aim is to run the car twice over the salt flats of South Africa in 2013 or 2014. The project is already four years from inception, and has designed and proven the car can reach the 1,000 miles per hour mark in simulation tests.

In theory that’s fine but, in practice, it’s a little bit more complicated.

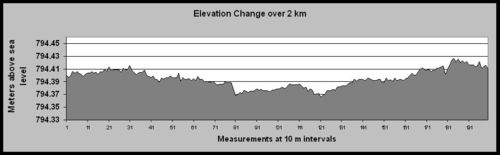

For example, the car will achieve this feat in the Hakskeen Pan salt flats of South Africa, a long flat area that has just 61mm of variation over a two kilometre stretch of land.

The challenge will be to clear the area of all obstacles, particularly any stones of which there are 1,000’s for every metre of track.

This is why there are major clearances taking place of all debris and potential hazards, including removing any stones or other possible obstructions on the track such as scorpions, of which there are also many.

But the key question is: why do this again?

No-one’s beaten the sound barrier record … yet.

And there’s the rub.

Richard is motivated by the fact there are always people who want to go faster and, in the mid-2000’s, Steve Fossett announced that he would challenge for the land speed record.

Fossett’s team built a car – the Sonic Arrow – that they hoped would exceed 800 miles per hour (1,287 kilometres per hour).

Unfortunately Steve Fossett died in September 2007, and so his car project stalled and was recently put up for sale.

However, Noble had by then committed to exceed 1,000 miles per hour and the project was under way.

So, the parallels with banking are there.

It’s all about being the fastest you can be with the least possible risk. This is particularly true in City trading, where Goldman Sachs and Chi-x dominate due to their ultra high frequency electronic trading liquidity pools.

Sure, the risk is there, but those who manage risk best and at the fastest speeds get the highest returns.

Oh, and if you really want to get a sense of how risky and fast Richard’s project is, then take a look at this …

… incredible and inspirational.

And that’s what the project is really about: being the inspiration for Britain’s next generation of engineers.

The Bloodhound SSC project has over 4,000 schools involved in the program, with the aim of creating a new generation of engineering intelligence second-to-none.

That’s pretty inspirational too.

Finally, if you feel inspired, you can sponsor the Bloodhound SSC Project for as little as £10 and get your name on the car's tailfin.

No sting in this tail.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...