I’ve enjoyed the Banker’s Top 1000 listings for a long time now and, when last year’s listings came out, looked back over the last twenty years to see how things had changed.

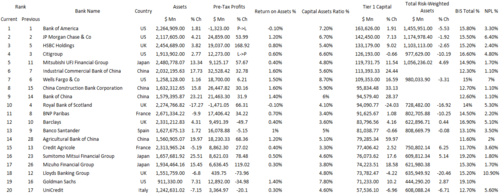

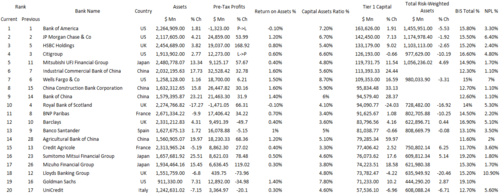

This year’s list has now just been published (get a copy by subscribing) and makes for interesting reading, especially as Chinese banks have finally made the big time (doubleclick image to see large version).

All in all, this list when combined with my reflections in 2010 over the last twenty years, makes for a fascinating story of risk bubbles and bursts.

You had the banks from the rising sun rising up the charts in the early 1990s.

Then, as the Asian crisis nuked most of the region, the Japanese banks disappeared and the Anglo-Saxon banks took over.

The principle-led regulatory regime was rife and the Americans and Brits ruled until 2008 when their “debt whore” approach failed.

Now, everyone is bailing out everyone else, with PIGS, TARPS and QE’s by the shedload.

So last year’s list was interesting, in that we finally saw Chinese banks rising up the list and more diversity as the American and British banks stumbled a little.

I have been saying that China’s banks will dominate global banking since 2005, and certainly there is a growing swagger of China’s banks as they watched the failure of the West.

For example, it used to be that Chinese bankers were desperate to learn how the West did banking and would send troops of managers to European and American conferences to learn their ways, as well as hiring the best talent to import into Chinese territories.

Back then, we all scoffed at Asia for their poor risk management of credit leading up to the 1997 crisis, with debt defaults and NPLs everywhere.

Now the Asians and Chinese may scoff at the West for the same reasons, although there is still risk in the Chinese system as most enterprise is propped up by financing given through the governmental influence over the banking system.

That aside, the fact that China's market capitalisation will rise to $41 trillion by 2030 from $5 trillion today, according to Goldman Sachs, makes it a market that cannot be ignored. After all, this would make China's stock market the biggest in the world, as American market capitalisation rises to $34 trillion from $14 trillion over that time.

This is one of the reasons why this year's Banker list is important as, for the first time, THREE of the TOP TEN banks of the world are Chinese. Last year, there was just one.

This year, four of the top twenty banks of the world are Chinese, when there were none just a few years ago in 2004’s list.

So, no matter the risks, China’s banks have finally risen to the top ... but at what risk?

The original Asian crisis was created by a higher than expected percentage of Non-Performing Loans (NPLs) and Moody’s has recently downgraded China’s banks on the basis that “8 to 12 percent of all the loans made by Chinese banks could go unpaid. Moody's had earlier estimated only 5 to 8 percent of the loans would be classified as ‘non-performing’.”

If China has a financial crisis, then we really will all be up the swanee ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...