I joined an interesting webinar yesterday about P2P Lending alongside:

- James Gardner, author of "Innovation and the Future Proof Bank"

- Gijsbert Koren, author of "Crowdfunding - The New Investing"

- Rhydian Lewis, CEO of RateSetter

What was new to me was Rhydian’s take on P2P Lending.

Rhydian is a career investment banker and set up Ratesetter with colleague Peter Behrens of RBS in 2009.

I had assumed it was another Zopa, but Rhydian distinguishes between the two by saying that in Zopa’s model the investor (or saver) chooses the borrowers they want to accept based upon risk profiles. Ratesetter is just a pure S&L (Savings & Loans) platform, and they pool funds and allocate to borrowers on a purely commercial, rather than social offering.

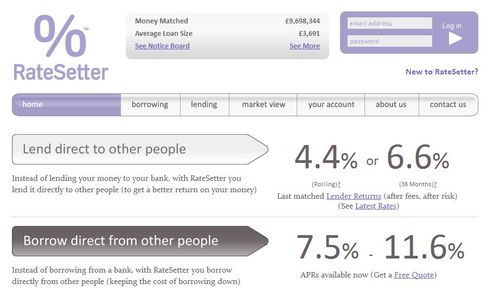

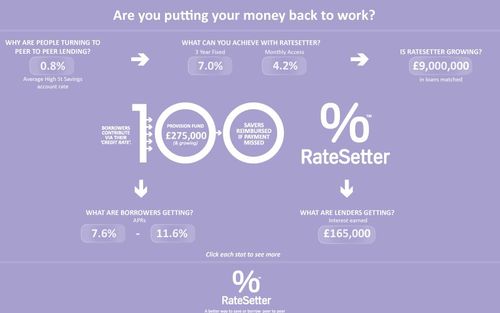

Here’s the low-down on Ratesetter from their blog of October 7th:

“RateSetter today celebrates our first full year in business. One year ago today, we launched RateSetter on an unsuspecting world, with the vision of creating great value Savings and Loans products between creditworthy Borrowers and smart Savers.

“In that time, we have reached some terrific landmarks. We have matched just shy of £9m (now £9,800,645 with an average loan size of £3,695), across 2,400 loans, and 65,000 members. We regularly match more than £1m a month, and have helped create over £165,000 in interest for our Savers.”

And from May 26th:

“The Provision Fund (PF) is what makes RateSetter different from any other P2P lender. It is a pot of money that shields Savers from defaults from Borrowers. If a Borrower is late on a payment or defaults altogether, the PF steps in to compensate whoever lent the money. If/when that money is recovered, it returns to the PF.

“The easiest way to understand the PF is as a company. Credit Rates are like revenues, and any late payments or defaults are like costs. RateSetter acts as the management for the PF, managing both revenues and costs. It’s important to note we have no direct financial interest in the performance of the Fund (though naturally we have a substantial indirect interest).

“The reason that the PF exists is because we believe that this is a better way of mitigating the risk for Savers – it drastically reduces the element of “luck” that loans will go bad, that Saver returns will be less than expected. We have a very stringent credit policy, which at the moment declines over 85% of the applications made to it. So it’s important to recognise that the PF makes us no less cautious than if we were lending our own money (which incidentally some of us are).”

So this is a very different offer from social P2P lending, as it removes the social context and makes it pure crowdfunded lending via a third party risk manager.

For example, here’s how Zopa talk about their style of operation:

“Peer-to-peer lending is a smarter, fairer and more human way of doing money. It's like borrowing and lending with your friends and family - except there are thousands of people you can lend and borrow with.

“Both lenders and borrowers get better rates, because peer-to-peer lending is more efficient than the traditional banking model. Banks have massive overheads, with thousands of employees to pay and hundreds of branches to maintain. So they have to take large margins on the money that passes through them.

“There's no smoke and mirrors here. Banks use your money to make even more money for themselves. They lend some of it out, gamble some of it on the price of tin or the Yen depreciating, and invest the rest in any other money-making schemes they can think of.

“Whereas at Zopa, people who have spare money lend it directly to people who want to borrow. There are no banks in the middle, no huge overheads and no unethical investments.”

A key point Zopa make on their website is that “Lenders make lending offers - 'I'd like to lend this much to A-rated borrowers for this long and at this rate'”; and “borrowers size up the rates offered to them, and snap up the ones they like the look of. If they don't like the rates today, they can come back tomorrow to see if things have changed.”

Ratesetter fixes rates and risk, Zopa allows the lenders and borrowers to match as a community structure. There are also other P2P operations in the UK, such as Funding Circle, Yes Secure and Quakle. Each is slightly different, e.g. Funding Circle focuses upon SMEs, and there are equally other examples of new models such as CrowdAboutNow in the Netherlands, Smava in Germany, Communitae in Spain and Kickstarter and Prosper in the USA.

Either way, Rhydian made the point that the consumer credit P2P market was purely competing with banks on rates. He did qualify that service came into it too, and brand and trust, but that the social aspect was meaningless and purely played to some investors who liked the philanthropic returns of such activity.

He claims P2P lending is nothing new, not innovative and purely an alternative source of funds in the S&L markets.

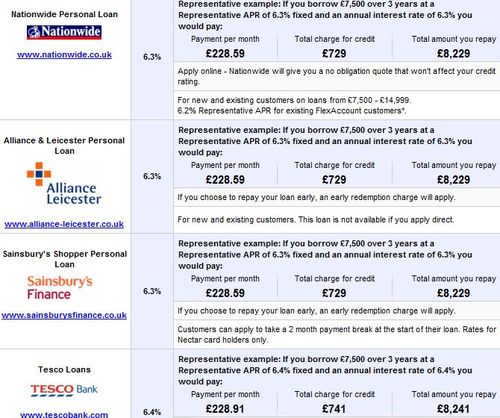

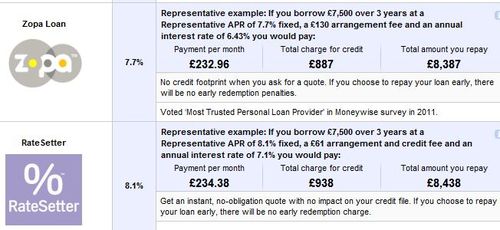

This is demonstrated by comparison sites like moneysupermarket.com, where the P2P offers appear.

So I went to moneysupermarket to have a look and wasn’t that impressed, as a search for a £7,500 three-year loan resulted in Zopa and Ratesetter coming in at rates 1.4% and 1.8% respectively higher than the equivalent from a mainstream building society and other competing retailers like Sainsbury and Tesco.

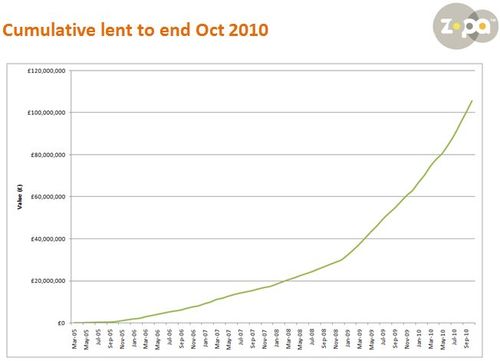

It made me question Rhydian's claims as, if it was purely rates, why would Zopa have grown so dramatically in cumulative lending levels:

In 2010, Zopa processed £70 million ($100 million) in enabled lending – about £6 million per month ($10 million) – and hope to increase this to £140 million this year. Ratesetter is so far under £10 million and growing, but Zopa can claim more brand and trust as they’ve been around longer. Maybe that’s why their list of active lenders is up from 9,000 in 2008 to 16,000 in 2009 to over 22,000 last year, and an expectation of around 35,000 this year.

I think the figures reflect the community orientation of Zopa – where savers and borrowers connect with each other to set rates and match – versus Ratesetter’s model which is purely to crowdfund and compete with banks on narrower margins.

Rhydian claims that the community aspect of Zopa’s business model is the part that’s unsustainable. We shall see.

After all, it may be that credit is so tight with the banks that finding a loan is now only available through alternative markets.

Either way Rhydian then went on to say, wearing his other hat of part of the P2P Finance Association, that the average age of funders in P2P networks is 55 years old and borrowers are 39 years old.

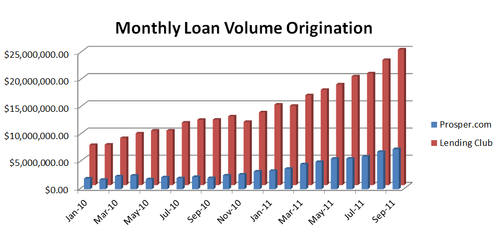

The P2P lending market in the UK has sourced over £200 million in funds, with £100 million funded this year. This is a similar experience to the USA, where Prosper and Lending Club are seeing significant growth in funds managed:

Lending Club issued a total of $24.9 million in loans in September, up 8.3% on a month-over-month basis from its August total of $23.0 million in loans. Lending Club has issued $373,473,595 across 35,918 loans since it launched its service in 2007.

Comparatively, Prosper has now issued a total of $262,342,733 across 43,950 notes as of September 30th, 2011 since launching its service in November 2005. The company issued a total of $7.4 million in loans, up 7.1% on a month-over-month basis from its August total of $6.9 million in loans.

What this tells me is that, in the scheme of things, P2P Lending is now grabbing a good slice of the USA and UK market for consumer and small business lending. This is demonstrated by the Bank of England’s stats for lending which shows unsecured consumer credit pretty much disappearing off the radar since 2008:

It’s a good time for these guys to be in the market and the prediction of 10% of all unsecured retail lending being in the hands of P2P lenders by 2010, made by Gartner in 2008, may have been precipitate but is not far off the truth of today.

As always, we anticipate the speed of change to be too fast and the impact to be far less than realised.

For more on P2P Lending, follower the twitter stream of P2P Lending News.

Postnote: Simon Deane-Johns, a mate of ours, has written a good piece on regulating these markets too, A New Regulatory Model For Retail Finance

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...