Talking with some of the Financial Services Club sponsors last week, it is clear that there is still a debate raging about the future of cash. Like the future of branches, which both Brett King and I discuss endlessly, cash is one of the other traditional bastions of the old guard of financial servicing.

Yet with mobile wallets, ebanking, contactless everything and real-time transactions, does cash really have a future?

Some say ‘yes’, due to the unique attributes of cash, as noted in a recent Payments Council report on “the Future of Cash”:

- Cash circulates, and is reused limitlessly.

- Cash is always valuable.

- Cash provides full and final settlement of a transaction.

- A cash payment is anonymous.

- Once issued, the circulation of cash is uncontrolled.

- It is regarded as a public good by its users.

These attributes have never been completely substituted by new forms of payment and, until they are, cash will always be prescient.

The most recent attempt to provide a good alternative, that gained significant traction too, is Bitcoin.

Bitcoin is a digital currency designed to be controlled through encryption rather than a centralised authority. Operating in exactly the same way as cash, Bitcoins are fully exchangeable as an anonymous form of currency in real-time across the internet and, shortly, at Point-of-Sale.

The core features of Bitcoin are that they can be:

- sent to anyone with a Bitcoin address;

- accessed from anywhere with an Internet connection;

- anybody can start buying, selling or accepting Bitcoins regardless of their location;

- completely distributed with no bank or payment processor between users (this decentralization is the basis for Bitcoin's security and freedom); and

- transactions are free (for now, this will change).

Now I’m not going to get into the whole debate about whether Bitcoin is a good or bad thing, as there are plenty of other currencies attempting to displace cash out there, but it is the one that has garnered the most media attention in the past year.

In May, Techcrunch wrote:

‘Bitcoin. Oh, man, where to begin. Its Hype-O-Meter got cranked to 11 this week, and breathless histrionics are everywhere. Death and Taxes called this new currency “a seismic event“; Adam Cohen says it’s nothing but a giant scam; Jason Calacanis calls it “the most dangerous project we’ve ever seen”.’

In June, they wrote:

‘I last wrote about Bitcoin less than a month ago. Since then the value of Bitcoins has quadrupled—and then halved. The founder of Sweden’s Pirate Party moved all his savings into Bitcoin (which disappoints me; I had hoped they were buried on Oak Island) just as US Senator Charles Schumer attacked it as “an online form of money laundering.” Malware designed to steal Bitcoin wallets has been seen in the wild, and in possibly related news, 25,000 Bitcoins were stolen a few days ago. Meanwhile, the virtual currency’s long-term stability has been seriously questioned.’

And now everyone is writing the same story: the end of Bitcoin, as their value has fallen below the level at which it makes sense to trade.

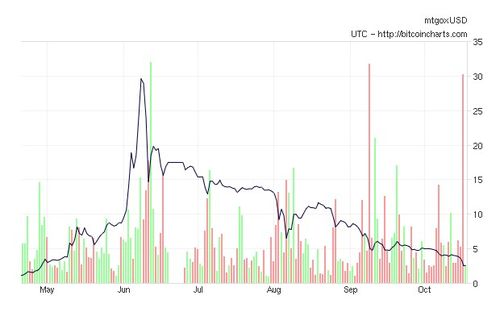

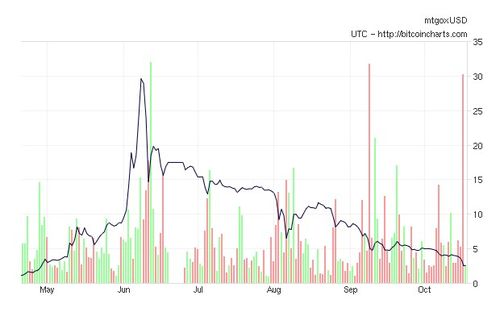

The value of Bitcoins peaked in June 2011 at $33: now they are worth between $1 and $2.

The black line = the closing price for Bitcoins on the MTGox Exchange where they are traded; the red and green lines = volumes of coins sold and purchased.

Tim Worstall at Forbes says that this is because Bitcoin lacks key attributes.

A currency not only needs to be “a medium of exchange, a store of value, we’d also like to it be liquid and security is important as well”. He doesn’t believe it offers much in any of these dimensions.

So where are things headed?

Well, there will always be a war on cash with lots of attacks from providers of alternative means and technologies … but cash is our oldest form of exchange of value.

Unlike cheques, cards, chips and everything else, cash has had durability and even with the best placed attempts to displace its usage, cash still wears well throughout the world.

Having said that, my friend who read my article about Icleand did go thjere and travelled with just cards … he had a very nice cashless week on holiday.

So you never know.

Postnote 1:

We will be having a meeting focused upon virtual currencies including Bitcoin and Ven Currency at the Financial Services Club on 25th January 2012, as well as a seperate debate about the Future of Cash in Q1.

Postnote 2:

One of the more contentious points about Bitcoin is that there are only 21 million of them, but they are infinitely divisible.

The aim is to limit the number of coins in existence because, unlike fiat currencies issued by government agencies, there is no centralised issuing authority in Bitcoin … just users.

This is why the cap was placed and is one of the more contentious points as those who own a whole Bitcoin today might be billionaires downstream, if it becomes a mainstream currency.

Oh yes, and you may also wonder whether the cap means that this will never become a mainstream currency, but don’t worry as the divisibility of the coins is a key point too.

Each Bitcoin can be divided to eight decimal places giving you a total of 2.1 quadrillion units eventually (today, of the 21 million coins to be issued, just over 7.5 million have been issued).

Postnote 3:

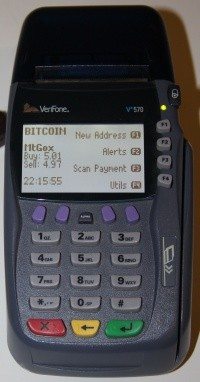

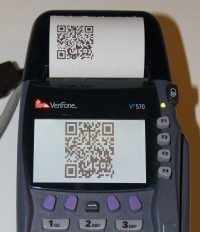

Although cynics may be promoting the idea of the end of Bitcoin, Bitcoin has been doing some other interesting stuff. For example, they’ve just rolled out a Point-of-Sale (PoS) system with Verifone that will allow Bitcoins to be traded on merchants terminals in stores.

The system is based upon QR codes – digital barcodes for mobile – and these are printed by the Verifone terminal. The customer can then scan this into their phone. Equally, they can make a Bitcoin payment by presenting the QR code on their phone for the merchant to scan.

Postnote 4:

Bitcoins have also now moved into reality so, if you want to order some physical Bitcoins, you can.

The code required for each coin is kept in a hologram inside.

Postnote 5:

A really good overview of Bitcoin's rise and fall from the Economist, June and October 2011.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...