Another aspect of innovation discussed this week was slightly out of the negative SEPA box and more on the positive future box.

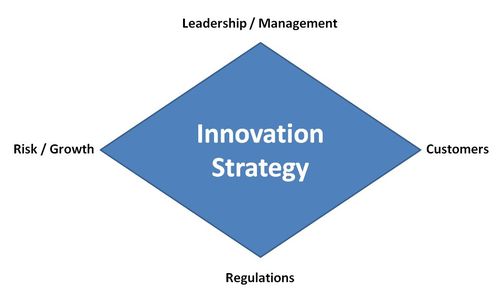

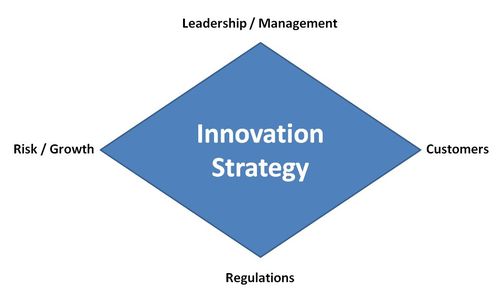

We were talking bout all the things that were innovative – NFC, mobile, anything Chinese, Google, etc – and it soon became clear that most of the organisations around the table were being driven by one of four factors when we talk about innovation.

First, most were addressing regulation.

This is something I’ve blogged about a lot before, and the industry usually agrees that any regulatory change will create innovation. This is because regulation forces banks to change, and if they are investing in change they automatically grasp the opportunity to innovate as part of the process.

The second big innovation driver is the leadership.

If the top person or top team have an appetite to innovate and are willing to invest, then innovation will be freely created. That’s why we see many organisations that innovate being associated with a strong leader: Wal*Mart (Sam Walton), Apple (Steve Jobs), Virgin (Richard Branson), ING Direct USA (Arkadi Kuhlmann), Commerzbank (Vernon Hill), Citibank (John Reed and Sandy Weill), etc.

Therefore, the leadership is a key.

Third, risk came up regularly as an area of discussion. The riskier the climate, the less innovative firms tend to be. The less risk, the more innovative. For me, you could just as easily substitute risk with growth. If markets are contracting, innovation lessens; if markets are expanding, innovation grows.

So risk and growth are key factors, although I feel these are confused as the less growth and more risk there is in the world, the more innovative you need to be, not less. If there’s a high risk of your company going bust due to markets contracting, innovate your way out of it.

Finally, and most importantly, are customers and customer needs. All innovation should be driven by customer focus and need although, in the words of the deity Steve Jobs: “You can't just ask customers what they want and then try to give that to them. By the time you get it built, they'll want something new.”

That was in an interview Inc. Magazine in April 1989. He also followed this with the statement in 1997 that “you‘ve got to start with the customer experience and work back toward the technology - not the other way around.”

In other words, start with the customer and build innovation from there.

So I would actually layer this approach and say that if you want to innovate, start with an internal assessment to ensure there’s an appetite and leadership there to make it happen.

If that appetite is subsumed by regulation constraints, risk, compliance and cost cutting, be cautious as it will inhibit the capability of the management to make it happen (not in Steve Jobs case though).

And if the management is clearly on board and the environmental factors are conducive to innovatory change, then make it happen.

Be interesting to see what thoughts folks have, as this is by no means an exhaustive view.

Just mine.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...