As mentioned, three core financial service businesses began at the same time at the end of the seventeenth century: the Bank of England in 1694; Lloyd’s Coffee House in 1688; and the London Stock Exchange in 1698.

The Stock Exchange has obviously been the major innovator in cementing London’s standing as a focal point for finance through the 20th and 21st centuries, but it is also one of the world’s oldest stock exchanges.

The origins of the exchange can be found in the Royal Exchange, opened in 1571 and designed by Sir John Gresham in the Tudor years.

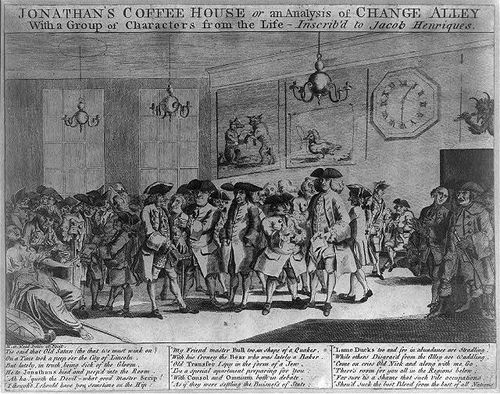

Stocks were exchanged here, but the stock brokers were eventually thrown out for being too rowdy – nothing changes – and so they start to operate in the streets and coffee houses nearby, notably in Jonathan’s Coffee House in Change Alley, near the Bank of England’s offices.

Jonathan’s Coffee House was run by John Castaing, and he actively encouraged trading in his house by issuing a list of stock and commodity prices called “The Course of the Exchange and other things” in 1698. It is the earliest evidence of organised trading in marketable securities in London.

Over the years following, the coffee house became a focal point for trading stocks, and was at the heart of key events such as the “South Sea Bubble” of 1720.

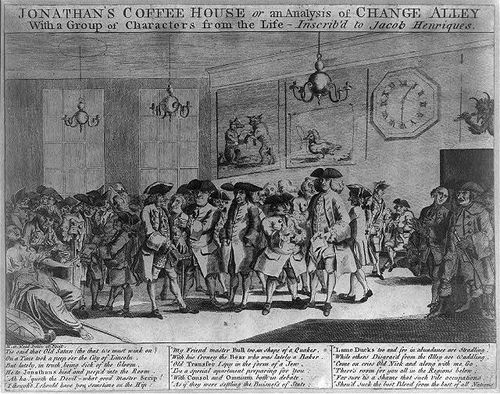

The South Sea Bubble was created due to the British Government proposing a deal with the South Sea Company to allow Britain’s debt to be financed in return for 6% interest in 1711. The government sweetened the deal by adding another benefit: sole trading rights in the South Seas.

Because of their monopolistic position and strength with government backing, shares in the South Sea Company were incredibly popular and their value rose to ten times their initial public offering price.

Seeing the success of the first issue of shares, the South Sea Company quickly issued more.

Again, the stock was rapidly consumed by the voracious appetite of the investors.

Investors saw that the stock was going to the stratosphere and they wanted in.

Then the 'bubble' burst because people discovered that the South Sea Company, after several years of trading, had yet to actually deliver any goods from the South Seas.

The shares had been valuable on paper, but worthless in reality.

Hence, the herd mentality that caused this madness of crowds suddenly sobered up and everyone pulled their money out of the markets.

The South Sea Company Directors were arrested and their estates forfeited and frantic bankers thronged the lobbies at Parliament.

Hmmmm … sounds familiar.

Following this bubble and other incidents, a New Jonathan’s coffee house was launched by a group of brokers and jobbers in 1773, although it soon changed its name to “The Stock Exchange”.

The new Stock Exchange in Sweeting's Alley included a dealing room on the ground floor and a coffee room above. Even so, the new venue also had issues particularly with fraud and, to deter fraudsters, it was suggested that users of the stock room pay an increased fee.

This caused some debate but led to a formal membership subscription being introduced in 1801.

On 3rd March 1801, the Stock Exchange therefore opened under a subscription basis, and became the world’s first regulated stock exchange. The Exchange moved to another new building in Capel Court to coincide with this change.

By the mid 1800’s, the telephone, ticker-tape and the telegraph had been invented, creating a revolution in the work of the Exchange.

Interestingly, telephones were initially given to post boys as they were seen as a replacement for mail runs, but were soon used by secretaries and, from around 1878, became a core technology in the stockbroker’s toolkit.

Victorian-era expansion saw regional exchanges opening in Manchester and Liverpool, as well as another bubble in 1845 based upon speculation in the Railways. All of this purely added impetus to the LSE's progress as bonds and gilt-edged securities began being traded, to support expansion of government and company activities during the Industrial Revolution.

Since then, the new Stock Exchange Tower was opened by the Queen at Threadneedle Street more recently in 1972 and, of course, there was the Big Bang of 1986 when many of the exchange's activities were deregulated.

Before the Big Bang, chaps and blokes ruled the Exchange, with chaps being your Eton and Harrow crew – the brokers – whilst blokes were the East End barrow boys – the jobbers.

The chaps would wear top hats and blokes bowler hats, all with furled umbrellas.

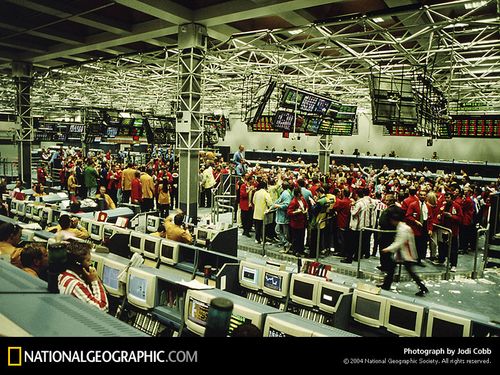

The change was immense when the Big Bang occurred, as the three hundred year tradition of face-to-face trading was replaced by machines.

The trading floor with its rowdy buy, buy, buy and sell, sell, sell calling with hand gestures to indicate what was being bought and sold, was suddenly being replaced by electronic trading.

But it went far deeper than this, as the culture changed from some sort of Collegiate Club to a truly competitive market fit for the future.

That is why the Big Bang is so important in the development of London as a financial centre, as it marked the transformation of the UK from some old Imperial baron to a cut-throat competitive centre for trading and finance.

I still remember discussions as late as the end of the 1990s, when everyone feared that London would be superseded by Frankfurt as a European centre. However, the fact we speak English, operate with low entry barriers, have a centre of skills covering legal, technological, financial, accounting, audit and more for investment banking, is the reason that today “the UK accounts for 36% of the EU's wholesale finance industry and a 61% share of the EU's net exports of international transactions in financial services”, all flows through the City of London.

This is the reason why David Cameron used his veto in the EU treaty discussions and why Margaret Thatcher has a lot for us to be thankful for (as well as issues with).

Anyway, back to the Big Bang, the world shown was changed forever on 27th October 1986.

This was when a series of deregulations of the rules and restrictions that governed the London Stock Exchange were implemented, including the introduction of a computerised system that wiped out face-to-face dealing, and the abolition of the division of members of the Exchange into jobbers and brokers.

From this point onwards, one firm could carry out both roles and so act as a market maker, dealing with the public and trading on their behalf for a commission, while also buying and selling securities as a principal.

A summary of the key changes included:

- Ownership of member firms by an outside corporation;

- All firms become broker/dealers able to operate in a dual capacity;

- Minimum scales of commission were abolished;

- Individual members cease to have voting rights;

- Trading moves from being conducted face-to-face on a market floor to being performed via computer and telephone from separate dealing rooms; and

- The Exchange became a private limited company under the Companies Act 1985.

Since then, the London Stock Exchange, or LSE plc, has seen plenty more action, such as the IRA bomb planted in the men’s toilets on 20th July 1990 that blew away half the City,

Equally, the closure of the trading floor as the LSE moved out of Threadneedle Street in 1992 and, today, can be found near St Paul's Cathedral at Paternoster Square.

Anyways, a few other milestones include the introduction of women to the LSE in 1973 (!); the launch of AIM for SMEs in 1995; the launch of the Stock Exchange Electronic Trading (SETS) in 1997 and CREST soon after; and the merger with Borsa Italiana in 2007.

This last action is actually a fairly critical one, as the last decade has seen the most frenetic change to the LSE in its entire history, as the MiFID and MTFs such as Chi-X, have attacked its core business now that trading is electronic, rather than face-to-face.

Here’s a final quick overview of the big hits of the 2000s:

May 2000 - The LSE and Germany's Deutsche Boerse (DB) announce plans to merge, to form a rival to Euronext, the exchange set up by Paris, Amsterdam and Brussels earlier that year.

Aug 2000 - Sweden's OM Exchange makes a hostile £808m bid for LSE, forcing LSE to pull out of the merger with DB so shareholders can look at the OM offer. It is rejected.

2003 - London and OM set up a joint equity derivatives exchange, called EDX London.

December 2004 - Deutsche Boerse comes back with another offer for LSE, this time valuing the London exchange at £1.35bn. LSE rejects the approach.

January 2005 - LSE rejects a formal offer from Deutsche Boerse.

December 2005 - LSE goes on to reject a £1.6bn takeover offer from Australia's Macquarie Bank. The exchange called the offer "derisory."

December 2005 - There is speculation Euronext will make an offer for LSE.

February 2006 - Macquarie then withdraws its bid after failing to win shareholder support.

March 2006 - Hot on the heels of Macquarie, US exchange Nasdaq then made a £2.4bn offer for the LSE. That was rejected too. Later in March, the Nasdaq withdraws its bid.

May 2006 - Nasdaq raises its stake in LSE to 25.1pc.

November 2006 - Nasdaq raises LSE stake to 28.75pc and makes "final" £2.7bn offer, which the LSE turns down.

June 2007 - LSE agrees to buy Italian exchange Borsa Italiana for more than £1.1bn.

August 2007 - Nasdaq says it will sell its stake in LSE and focus on trying to buy OMX, the Scandinavian exchange.

September 2007 - Nasdaq agrees to sell most of its LSE shares to Borse Dubai.

February 2011 - LSE and TMX, the Canadian stock exchange, in merger talks to create world's seventh largest exchange.

September 2011 - LSE in talks with LCH.Clearnet in a deal that could value the clearing house at £900m.

Meanwhile, for a look-back on the old days, checkout this BBC video and interviews with old pre-Big Bang traders, and note that much of my Big Bang description is liberally nicked from here.

This is the eighth in a series about how the City of London developed its financial prowess and system.

Previous entries include:

- Part One: The Romans

- Part Two: The Vikings

- Part Three: Medieval Times

- Part Four: The Tudors

- Part Five: The Stuarts

- Part Six: The Bank of England

- Part Seven: Lloyd's of London

- Part Eight: The London Stock Exchange

- Part Nine: The 1700s

- Part Ten: The Victorians

- Part Eleven: World Wars

- Part Twelve: After World War II

- Part Thirteen: The Big Bang

- Part Fourteen: Crisis

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...