We finished Part Three of our History of the City with a nod to Sir Thomas Gresham, Banker to Queen Elizabeth I and forefather of all things in the City of London today.

Thomas was the son of Sir Richard Gresham, a merchant who also became Lord Mayor of London in 1537.

Richard had a partnership with his brother, John Gresham, exporting textiles and importing grain from the continent, supplying King Henry VIII with velvets and satins, from which he built a large fortune.

Thomas Gresham followed in his father’s footsteps, and was soon respected as a liveryman in the Worshipful Company of Mercers – the #1 livery company in London at that time, representing merchants – and soon was in the company of royalty and government through the livery meetings.

When, in 1551, the government got into shtick over debts, they sought his advice to see what they could do. Gresham proposed to raise the value of the pound sterling at the expense of their European counterparts. It was quite unfair but worked, and ever after Thomas worked for the Royalty in their financial dealings.

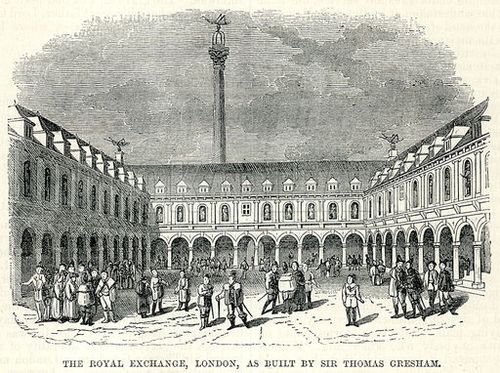

He became incredibly wealthy through such work, and proposed the building of London’s own bourse in 1565.

This became the Royal Exchange, and was modelled on the Antwerp bourse.

This Royal Exchange was burnt down during the Great Fire of London in 1666, and a second Exchange was built. This one was also destroyed by fire in 1838 with the new one built and opened by Queen Victoria in 1844, and this is the one you see there today.

Gresham died in 1579 and, in his will, stipulated that when his wife passed away their house in Bishopsgate and rents from the Royal Exchange should be vested in the Corporation of London for the purpose of instituting a college.

Gresham College was therefore established in 1597 and continues to educate to this day, as those know from my blog entries about their lectures (Andy Haldane, Chris Skinner).

It was thanks to Sir Thomas Gresham and his colleagues that the City became known for its banking.

For example, goldsmiths were prominent in London life at this time, and they created the grounding for today’s banking world.

Goldsmiths changed from passive deposit takers, offering physical security for the wealth of their clients, to offering credit on the security of the assets at this disposal.

Marine and later life insurance was also an innovation of the period, due to improvements in mathematics from Newton, Napier and Sir William Petty (1623-87).

The culmination of these efforts was the formation of the Bank of England in 1694, invented by the Scotsman William Patterson. Interestingly, the Bank of Scotland was created by an Englishman, John Holland.

More about that in the next part of How the City Developed.

Previous entries include:

- Part One: The Romans

- Part Two: The Vikings

- Part Three: Medieval Times

- Part Four: The Tudors

- Part Five: The Stuarts

- Part Six: The Bank of England

- Part Seven: Lloyd's of London

- Part Eight: The London Stock Exchange

- Part Nine: The 1700s

- Part Ten: The Victorians

- Part Eleven: World Wars

- Part Twelve: After World War II

- Part Thirteen: The Big Bang

- Part Fourteen: Crisis

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...