Following on from yesterday’s post about the Romans building London, they left in 410 A.D. and the City went to rack and ruin over the following centuries as the buildings were left untended.

Then, in the ninth century, the Vikings came to rape and pillage and used Lundenwic and Lundenberg as their base, settling in 872 A.D.

By the reign of King Athelstan from 925 to 939 A.D., London had become a strong commercial centre and port, with more coiners than any other town and gold and silversmiths producing fine jewellery here. According to accounts from around those times, the only shortcomings of London life were frequent fires and “the immoderate drinking of fools” … hasn’t changed much then.

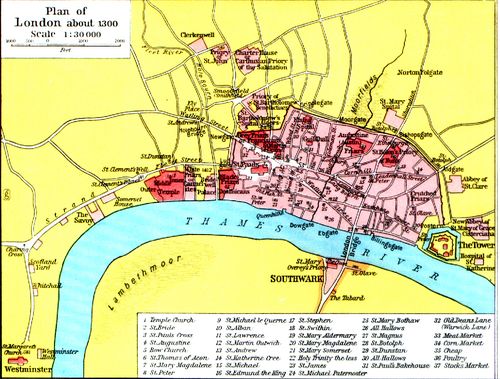

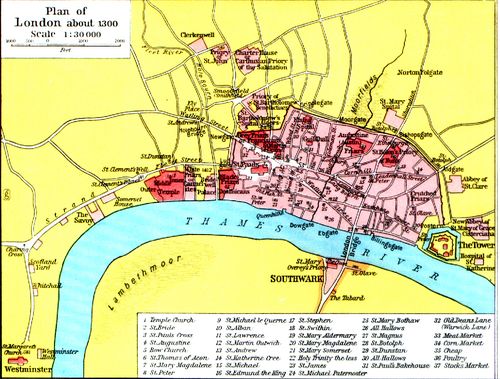

By the time of King Edward who ruled from1042-1066, the so-called Edward the Confessor, London was thriving. So much so that he decided to start extending beyond the City walls and over the River Fleet to Westminster, where he built a huge palace.

His remains can still be found today, buried in Westminster Abbey which was built during his reign.

King Edward had created a second separate centre for London: a royal rival to the commercial centre of the City.

This tension between the two powers of politics and economics shaped the millennia that followed and, even today, the political centre of Westminster vies with the economic centre of the City, as demonstrated by the raging battle between Parliament and regulators over bankers’ bonuses and operations.

Edward was succeeded Harold, who was killed by William the Conqueror at the Battle of Hastings and England moved from the Saxons to the Normans.

King William determined that the City should be held accountable to the ruler and built the Tower of London at its eastern edge to enforce such rule.

The Tower of London became an important focal point for London life, and still is today, with many functions inside its walls including the original Royal Mint.

Plan of London from around 1300 A.D., showing the Commercial City and the Royal Palace of Westminster (click for larger image):

Previous entries include:

- Part One: The Romans

- Part Two: The Vikings

- Part Three: Medieval Times

- Part Four: The Tudors

- Part Five: The Stuarts

- Part Six: The Bank of England

- Part Seven: Lloyd's of London

- Part Eight: The London Stock Exchange

- Part Nine: The 1700s

- Part Ten: The Victorians

- Part Eleven: World Wars

- Part Twelve: After World War II

- Part Thirteen: The Big Bang

- Part Fourteen: Crisis

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...