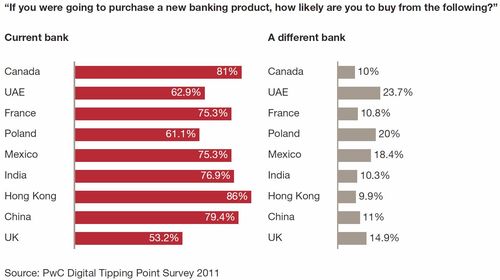

PwC conducted research with almost 3,000 banking customers from a range of segments across markets to discover their expectations of banking in the digital age.

They selected both emerging and developing markets including China, India, Mexico and the UAE, as well as developed markets like the UK, Canada, France and Poland.

The research revealed that there is a very high correlation between digital engagement and share of wallet for a customer, and that digitally active customers tended to have the largest product holdings.

They also found that if you are the primary financial relationship then this drives increased share of wallet leading to higher revenue generation.

That’s no shock is it?

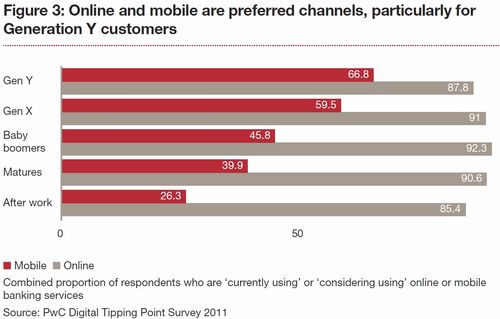

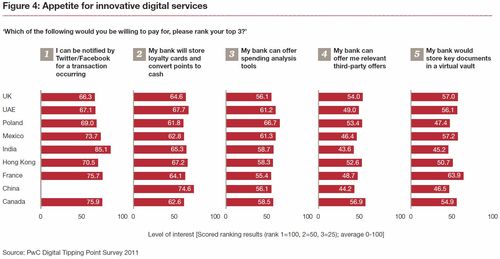

What may be a shock are the results of the willingness of customers to pay for new and enhanced digital services.

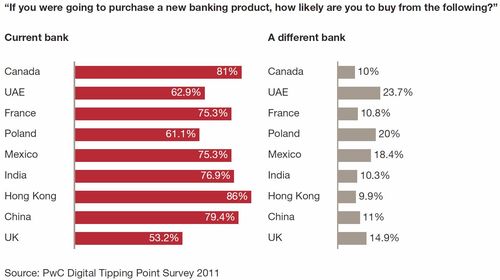

Whilst banks argue about whether to expand, maintain or shrink their branch footprints, most customers – particularly those under the age of 50 – view mobile and internet channels as their primary bank relationship channel.

The survey then tested the willingness of customers to pay for that channel and found that the majority would be willing to pay from $3 to $15 a month for enhanced digital account services, such as notifications through social media, spending analysis tools, third-party offers and storing documents in a virtual vault.

At a time when banks are finding it difficult to sustain revenue and margin growth, the fact that customers appear prepared to pay for the perceived value of using digital services that offer new value to customers, is significant.

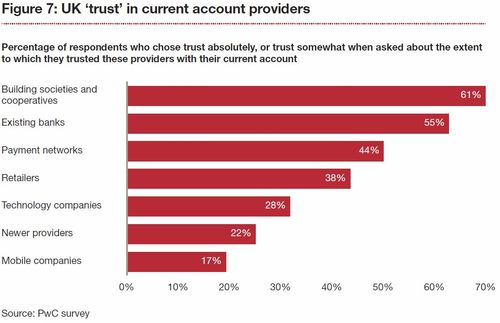

This is particularly important as consumers trust banks to keep their information secure when compared with other providers, and hence are more willing to pay a premium for banks to keep information secure over other industry providers, such as mobile carriers.

All in all, an interesting survey and worth a glance, particularly for those of us who believe banks have an opportunity to gain increased client wallet share by innovating digital channels.

Download The new digital tipping point (2.25MB PDF)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...