I haven’t written much about social media lately. The reason is that it’s now mainstream and dull. When you're scanning future views, you’re not as bothered about Facebook and Twitter when everyone’s familiar with and using such services.

Facebook's pervasiveness is well illustrated by the Facebook IPO announcement, which gave a raft of good stats about how the service has matured as it enters its eighth year of existence:

- Facebook has a total of 845 million monthly users and 483 million daily users.

- Of its monthly users, half have used Facebook on their mobile.

- The company has 3,200 employees.

- Facebook is an advertising company. Of its total revenues of $3.7bn in 2011, 85% came from advertising. And that is down from 98% and 95% in the previous two years.

- The company makes $1bn in pure profit.

- Zynga, the games maker behind CityVille and FarmVille, single-handedly accounts for 12% of its revenues.

- The majority of its money comes from the US, but the majority of the users are outside the country, and the majority of its non-US revenues comes from western Europe, Canada, and Australia.

- The company generates 2.7 billion "likes" and 250 million uploaded photos everyday.

Eight years.

$100 billion IPO.

Not bad, Mr. Zuckerberg.

But what Zuckerberg has really done is more important.

It shows in Facebook’s mission statement: “Facebook was built to accomplish a social mission - to make the world more open and connected”.

Job done and, in so doing, it has unleashed the Power of One.

We saw the Power of One rise when MySpace launched the musical careers of folks like Lily Allen, Kate Nash, Sean Kingston and more.

The social network allowed artistes to attract interest without having to find major music moguls or clubs to perform.

The Power of One began in a world where the social aspects of the global network allow anyone to vote on anything, and make it mainstream if enough voters gather.

This is being proven again and again.

Recently, we have seen the Power of One through Tumblr.

In this month’s Wired Magazine, the front page article is all about David Karp who has created a $500 million empire through the blogging platform.

And the opening is all about a young chap called Chris Brown who created a photoblog “We are the 99%” on Tumblr.

The story speaks for itself:

On the evening of August 23, 2011, Chris, a New Yorker who wishes his surname to be withheld, created a Tumblr account. His aim was to raise awareness of the Occupy Wall Street march planned for September 17. The idea was simple: he asked users to submit a photograph of themselves holding a sign explaining their economic circumstances. He called the page We Are The 99 Per Cent, and promptly forgot about it.

Four days later, Chris returned to his flat, after spending time preparing meals for protesters, and checked the We Are The 99 Per Cent tumblelog. When he had left, there had been two photos in the inbox. "I thought, I'll have five or six more submissions," says Chris, now 29. "The inbox was overflowing. I spent that night reading through the submissions. By the time I was done, I had barely dented this thing."

One photo was from Priscilla Grim, a 36-year-old activist working on strategic communications for the Occupy Wall Street movement who has been "protesting one way or another for about 20 years". Grim noticed that, two weeks after submitting her image, the blog hadn't been updated, so she emailed Chris and offered to help to edit the blog: "It struck me that this was the perfect organising tool of today," she says. Together, they started posting the submissions. Some were short: "I served in the US Army. Served 16 months in Iraq. Now I deliver pizza. I am the 99%." Others were longer, from the jobless woman prevented from donating a kidney to her friend because she didn't have health insurance, to the 19-year-old single mother who said she went without food for days to buy formula milk for her four-month-old son. But they all kept the same format, with signs often obscuring the creators' faces. "We posted 100 photos before it went big," says Grim. The New York Times covered the blog. "After that, it went all over the place."

The blog became a meme and the meme went viral. As Wired went to press, 3,000 photos had been posted; the tumblelog receives more than 100 submissions a day. Protestors adopted "We Are The 99 Per Cent" as a slogan, writing it on signs and banners. "We're standing there with thousands of people screaming [the phrase]," Grim says.

Occupy Wall Street and many other social movements would just not exist in the same way without Facebook, Twitter, YouTube and the Power of One.

The real revolution of these networks is that they allow critical mass of new movements to be linked globally within days, as demonstrated by the We are the 99% story.

In banking, we see these changes occurring rapidly too.

Just look at Molly Katchpole, the young lady who posted a petition on change.org to get Bank of America to reverse policy and waive the $5 per month fees they were going to impose if people used their debit cards.

The fee was to recoup losses due to the implementation of the Durbin Agreement, part of the Dodd-Frank regulatory changes in the USA. This agreement wiped out profits from interchange on debit card transactions and many US banks decided to add a fee therefore, in order to recoup losses (note: Bank of America were not the only bank to do this, just the first to get the headlines).

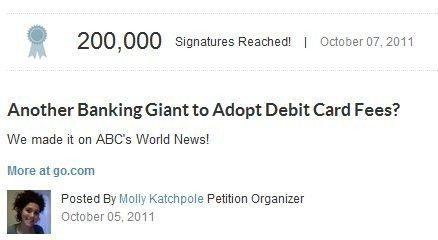

The move proved so unpopular that Molly’s petition rapidly gained traction, was promoted by change.org and then was picked up by major national media like the New York Times.

When the online petition reached 300,000 votes, Bank of America reversed policy.

It resulted in the program being voted the biggest PR gaffe of 2011 by most marketing magazines and CEO Brian Moynihan admitting that it resulted in a surge of account closures.

Note the speed of this change however, in that Katchpole posted the petition with 100 signatures on 1st October …

… and garnered 200,000 signatures a week later.

That’s how fast things happen.

It’s a bit like Zynga getting 100 million users of the CityVille game in just ONE MONTH, and is still the most popular game on the internet today with over 10 million daily players.

The Power of One is all illustrated by speed, global connectivity, leverage of the individual voice and the nature of the network.

There are many other examples of how the Power of One is impacting banks – such as the Wikileaks and Anonymous impact on PayPal, Visa and MasterCard via Twitter, and the UK Students who made HSBC reverse policy on fees after a Facebook protest - and they show that banks should be afraid of the Voice of the Customer today.

After all, the connectivity of the Power of One fuelled the Arab Spring through Facebook and Twitter.

Who would have thought that Gadaffi, Mubarak and others would have been deposed due to the fire of Mohammed Bouazizi, a Tunisian market stall holder and his note left on Facebook?

Be at least a little bit afraid.

Josef Ackermann, CEO of Deutsche Bank and head of the Institute of International Finance which represents the world's banks: “we have a social responsibility, because if this inequality increases in income distribution or wealth distribution we may have a social time bomb ticking and no-one wants to have that.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...