Well, it’s Valentine’s Day and there’s the usual raft of bank-related love and hate going around.

Most of the Valentine’s Day headlines are about giving gifts that won’t break the bank.

That’s not surprising when, in the US alone, total jewellery spending is expected to top a staggering $4 billion, and a further $1.8 billion will be spent on flowers, $1.5 billion on chocolates and candy, and $1.1 billion on Valentine’s cards.

It’s a real money spinner, isn’t it?

According to a survey by Big Insight, the average person will spend $126 for Valentine's Day in 2012, 8.5%. Men spend more with an average $168 lashed out on their lady’s clothing, jewellery, greeting card and other gifts, whilst women spend half that amount, about $85.

Obviously, this is all down to the ‘glass ceiling’ effect, as men do earn twice as much as women don’t they?

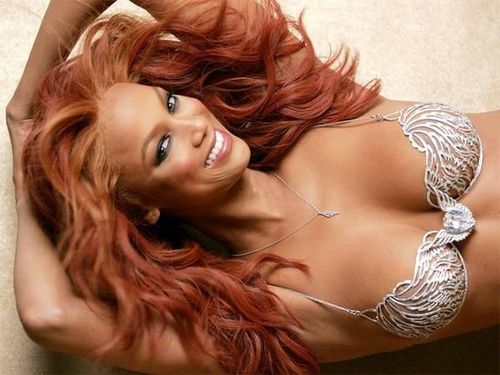

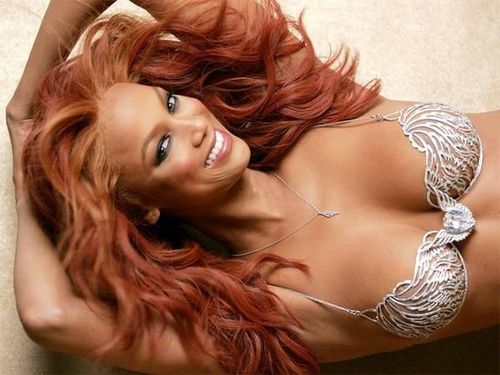

And, if a banker with a healthy bonus wants to give the love of his life a truly stupendous gift, why not buy one of Victoria’s Secret’s Fantasy Bras?

This one is being modelled by a bank – Tyra Banks – and is only going to set you back a mere $10 million …

The bra has an 18-carat white gold setting and over 275 hours of labour went into its creation.

Lovely.

And can you get me a pair of briefs to match?

The States have always pushed the envelope of Valentine, and even have a town called Valentine.

There are fourteen Valentine bank branches.

Super.

Mind you, America also has a few other towns with names like Cupid, Arrow, Love and Romance.

You could live and love there every day.

They even have a Love Bank, but do they love their banks?

Not if they’re big.

Once again, the USA has their annual “Dump Your Bank”campaign on Valentine’s Day, and it’s all about hate the big banks and move to the smaller ones.

Sure, it’s just an ad for credit unions, but is it working?

No.

Only $2 million moved out of big banks to credit unions, according to their homepage.

Bank Transfer Day was far more effective, with over 600,000 US consumers moving from large banks to small last quarter.

Mind you, introducing fees for debit card usage helped the cause immensely.

Maybe it’s better to offer more positive news and views, as the BMO Bank of Montreal has tried to achieve.

BMO runs an annual Valentine’s Day study of … retirement?

Will you still need me, will you still feed me, when I’m 94?

Yes, the study looks at Canadian couples attitudes towards retirement and found that over half (56%) think retiring is more stressful than Valentine’s Day (20%).

Duh?

On that note, I think it’s time to retire from this love-in and get on with some real work.

Happy Valentine’s Day folks.

p.s. my favourite Valentine’s Day bank story still has be last year’s NAB campaign when they broke up with the other banks.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...