Spent most of this week at a payments conference.

The theme was relentlessly around mobile payments, as this area of the market has truly kicked off as a major focal point for banks, telecommunications firms, retailers and merchants.

There was a particularly interesting debate about contactless payments, as this is also something that is being heavily promoted by some.

For example, VISA gave an interesting presentation about the London Olympics, with the whole Olympic village being contactless.

VISA reckons that by the end of 2011 there were:

- 31 million contactless cards issued in Europe today, rising to over 80 million by 2015

- Two-thirds of those cards are in the UK, with 20.3 million cards issued and over 100,000 terminals contactless enabled by seven issuers

- Across Europe, there are now 227,000 contactless terminals being used by 51 acquirers and 60 issues in 15 European Union countries

No wonder the processing firm saw a six-fold increase in contactless transactions in 2011.

Telefonica also gave an interesting presentation about their payments plans for O2 in the UK, with NFC being a central part of the plan.

This video illustrates their approach and the benefits of NFC contactless mobiles well:

Having said that, Japanese experiences may indicate that mobile contactless isn’t all it’s cracked up to be.

Japanese firm DoCoMo launched contactless mobile services in 2004. Eight years later, such payments are only used by a third of consumers who have contactless mobiles.

In a recent survey shown to me by Makoto Shibata of Bank of Tokyo-Mitsubishi:

- 67% of Japanese consumers who use contactless payments only make such payments using contactless cards;

- 14% make the payments on cards and mobile; and

- only 18% of consumers purely use mobile contactless.

Two-thirds of consumers aren’t using mobile contactless, even though they have contactless mobile telephones and have had such services since 2004.

Why?

Because they have real concerns about mobile contactless payments being insecure but, more importantly, because they are difficult to use.

You not only have to find out how to trigger the contactless chip by reading the telephone’s instruction manual, but also find it hard to transfer the chip if you change telephones. This is because each chip is embedded in the phone and so you have to trigger a new chip each time you change your phone.

Shucks.

This is certainly true of my experience so far however.

I orderd the Barclaycard/Orange contactless mobile telephone last year, for example.

Once it arrived, not only did the Orange network coverage provide zero reception to my home address, which made the phone useless, but the set up of the contactless service was so darned complex that I gave up.

In fact, I don’t think contactless has much of a future anyway.

It’s been a slow burn, but it’s finally arriving thanks to the pioneering efforts of firms such as Barclaycard, who launched their original campaign way back in 2008.

This video premiered in October 2008:

Four years later, I still only use my Barclaycard for Oyster contactless payments on the subway. Most other places, I can’t find a contactless terminal. And even when I do need to pay, to reach out like the lady does in the O2 ad, to touch terminals seems so 1990s.

For these reasons, and particularly based upon the Japanese experience, I believe in proximity payments rather than NFC contactless.

Proximity means that you don’t touch or do anything, other than confirm it’s ok.

It’s far easier to think of a GPS payment based upon geolocation, rather than a contact payment.

And that’s what contactless payments really are today, using NFC and RFID.

They demand the consumer makes contact between chips.

Nah.

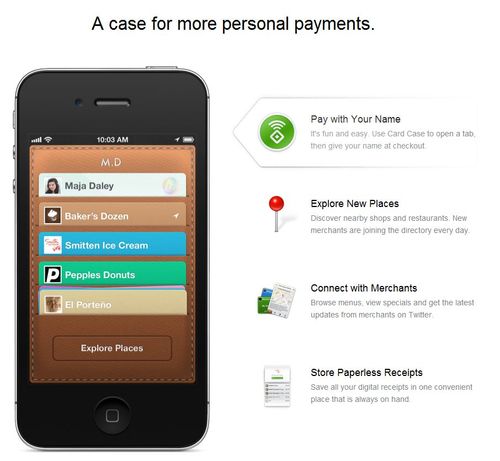

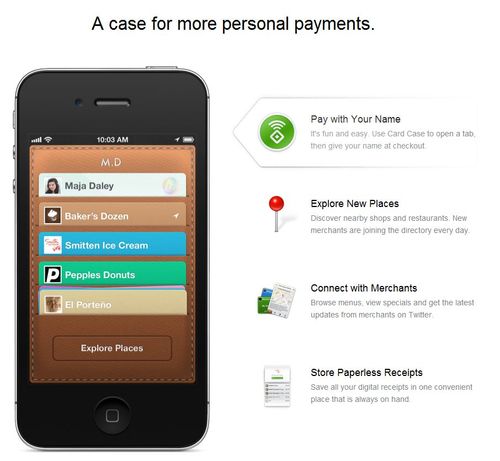

What we need is proximity payments, such as the Square Card Case.

Brilliant.

And with PayPal introducing a Square killer yesterday ...

... this is far more likely to be the way of the future.

Net:net - don't bother with contactless if you want to save some dollars and cents.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...