I did a speech about innovation yesterday.

As usual, the opening question was: “which is the most innovative company in the world?” and, as usual, the answer shouted back was: “Apple”.

Apple.

The firm everyone wants to be like because they are cool, successful, the world’s most valuable company by market capitalisation and because they are what we all want to be.

But it wasn’t always this way.

Some of us remember 1997 when the company was on its knees.

Back then, when asked what he would do with Apple, Michael Dell was famously quoted as saying that he would “shut it down and give the money back to the shareholders”.

Instead, Steve Jobs came in and took the company into the stratosphere.

The result is that $1,000 invested in Apple in 1997 would be worth $58,000 today.

Not a bad return on investment.

What did he do?

He made a simple statement and took a simple view: “the cure for Apple is not cost-cutting. The cure for Apple is to innovate its way out of its current predicament.”

So easy to say, but so hard to do in reality.

But Steve Jobs made it happen.

How?

By redefining the competitive battleground.

For example, many of us think Apple is a computing company, but Apple has nothing to do with computing.

Apple is an entertainment enabling company.

Apple first of all allowed us to enjoy entertainment in a new form by creating the simplest to use music machine possible: the iPod.

They took the iPod and allowed us to use it with a touch screen phone.

They took the phone and integrated it tightly with a website for entertainment that offered not just music, but books and films and more.

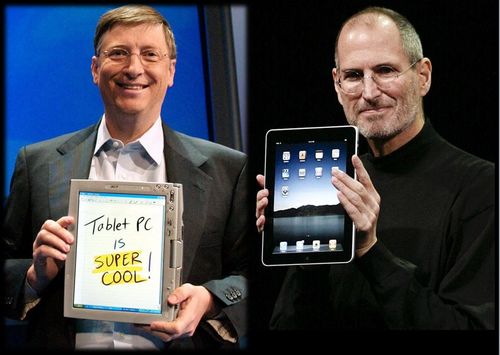

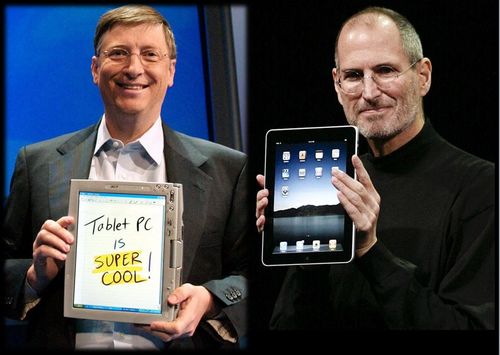

And then they gave us a bigger mobile device to watch our movies easily, as well as surf the web.

These are continuous innovations on a theme of consuming visual and audio content.

And that is what Apple does best.

So the real innovation was to stop thinking about compute power and start thinking about entertainment hubs.

This redefined Apple’s strategy, approach and vision, and is a core to their resurgence as they stopped competing with Microsoft and Dell, and started competing with Sony and EMI.

It is something I often look for when we see disruptive innovation, and is illustrated by this story from the 1950s.

Olympic Tyres made high strength rubber tyres for aircraft and, during the 1950’s, were the market leaders, with twice the market share of their nearest rival.

They charged a premium price for what was perceived as a leading product.

The strategic positioning was “Technically Excellent Rubber for Aircraft Tyres”.

All proposals and discussions were based around the technical product excellence. For example, they would say things like: “our tyres are twice the tensile strength of any other with the ability to take 100kg of pressure per mm2.

Then the Japanese entered the markets with cheaper tyres that were just as good.

Within two years, market share was declining so rapidly Olympic Tyres were going out of business.

So Olympic re-positioned and changed the ground rules.

They redefined their business from “Technically Excellent Rubber for Aircraft Tyres” (product-based) to “Safe Landings for Aircraft” (customer-based).

Proposal language changed to new statements guaranteeing so many thousands of safe take-offs and landings.

They communicated this new positioning to employees and customers, and it was so simple and memorable that they managed to achieve a ground shift in market perception, resecured their market leading position, and revenues and profitability soared for many years after.

Sounds so simple doesn’t it?

The real message is that the innovators change the ground rules of the markets where they compete, and continually do so until they gain market leadership.

Which financial institution is doing this?

Apple.

News this morning: the Apple iWallet.

On March 6, the U.S. Patent and Trademark Office granted Apple a patent for a new technology called "iWallet," which is a digital platform that gives the user complete control over their subsidiary financial accounts directly on their iPhone, and also leverages Near-Field Communication (NFC) technology to complete credit card transactions on the phone as well. On Tuesday, more patents were granted to Apple in relation to the iWallet technology, including security measures that aim to keep financial information safe, and the app in iTunes that will house these features. In all likelihood, this is Apple's mobile payments solution intended for its next-generation iPhone, presumably called "iPhone 5."

Apple breaks down the iWallet like this: Credit card transactions happen all the time, whether or not the cardholder is present. There's a lesser chance of fraud when the cardholder is present, but unfortunately, the cardholder can't be present all the time. Apple's solution, the iWallet, aims to provide real-time authorization for transactions where the cardholder is not present, or remote. However, unlike transactions over the Internet, Apple promises its service to be highly secure and reliable.

Here are some of the components of the iWallet.

Credit Card Profiles

When a user visits their profile in iWallet, they will see their available credit cards attached and be able to open up each individual card's "profile." Within the profile, users can view their monthly statements, read messages and alerts from the bank, and even adjust preferences or add additional cards. Within preferences, the owners can set payment alerts for days in advance, or let the user know when their balance is approaching the limit.

Parental Controls

Parents can be pleased to know that thanks to the iWallet, their children will be able to use their phones as digital credit cards, and thankfully, parents can set the restrictions. Under the parental controls within preferences, parents can set spending limits -- either per transaction or overall -- and can even restrict which merchants a child can purchase from. It's all done digitally in the iWallet.

When a child exceeds his or her monetary limit -- set by the parent, of course -- the transaction can then request an authorization from the parent (via their iPhone), or simply decline the request. It's extremely easy, and it gives total control to the parent to let them manage their family funds.

Authorization Requests

If you have a child or teenager that plans on making a lot of purchases, you as a parent may be receiving a LOT of iWallet Authorization Requests. To filter through all of these, Apple gives the cardholder several options, including automatic authorization for all missed requests, or just certain requests under a specific value, or just requests with a specific merchant, like Barnes & Noble or Apple.

Flagging Fraudulent Purchases

When a cardholder finds fraudulent activity on their account, it's always best to contact the authorities right away. Unfortunately, however, most people don't know their card has been stolen until they receive their monthly billing statements. The iWallet aims to give the user greater awareness of their transactions and facilitate contact with authorities when fradulent activity is suspected or found.

In iWallet, users will have the ability to "flag" any purchase, likely in the same way a user flags an email. When a purchase has been flagged, the cardholder's bank is immediately notified, and the bank will quickly get in touch with the cardholder to discuss the situation further and offer instructions. While there's no easy way to prevent theft, iWallet provides a great way to pounce on it as soon as it's happened and nip it in the bud.

And there’s a lot more too. Read the full article at the International Business Times.

Meanwhile, a few more Steve Jobs innovation quotes for the Jobs-worths out there:

“Innovation distinguishes between a leader and a follower.”

“Sometimes when you innovate, you make mistakes. It is best to admit them quickly, and get on with improving your other innovations.”

“Pretty much, Apple and Dell are the only ones in this industry making money. They make it by being Wal-Mart. We make it by innovation.”

“Innovation has nothing to do with how many R&D dollars you have. When Apple came up with the Mac, IBM was spending at least 100 times more on R&D. It’s not about money. It’s about the people you have, how you’re led, and how much you get it.”

And finally, the sting in the tail.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...