Everyone’s now talking about mobile payments and mobile banking. I was talking about that effectively as a core strategic area back in 2004. So it took about five years to become the mainstream bank conversation.

Now, I talk about social payments and social banking. I’ve been talking about this as a core strategic area since 2008, so it will be around 2013 to 2014 when most banks get onto the bankwagon.

Interestingly, many already are, with American Express being up there on the top of the heap for social interactions.

There’s been loads of coverage of AMEX’s social stuff, and so I don’t really want to repeat all that stuff here, but here are three standouts.

First, go checkout the AMEX social media page and its links to their Facebook and other activities:

Then read Jeff Bullas’s blog about why their strategy is working and why it is important for them.

And finally, for background on AMEX’s journey into social media, read the Mashable’s summary of a speech by Leslie Berland, SVP of Digital Partnerships and Development at AMEX, from this year’s South by South West.

AMEX are amazing everyone with their innovative approaches from using retweets to provide loyalty rewards to teaming with firms like Zynga.

AMEX really get this space, but they are not the only ones. I’ve been pretty impressed with Visa and Barclaycard too, as well as a few others.

What is it these guys get that the others don’t?

What they get is that it’s not about Facebook and Twitter; it’s about sales, service and relationships.

In fact, the real thing they get is that Facebook and Twitter is not social media but social platform, as is YouTube, Flickr, Tumblr, Foursquare and more.

Social platforms are like Salesforce.com and the internet.

They are the building blocks of the new financial firms.

They are not the end goals in and of themselves, but are the enablers towards real social connectivity.

That is why when banks talk about We’ve gotta getta blog out there; build a Facebook page; launch a YouTube channel; and engage on Twitter, that is not the answer.

Many firms believes that having a holding twitter name @MyBank and Facebook page is all you need.

Some go as far as to populate their pages with links and news.

But you still don’t get it if you think that way.

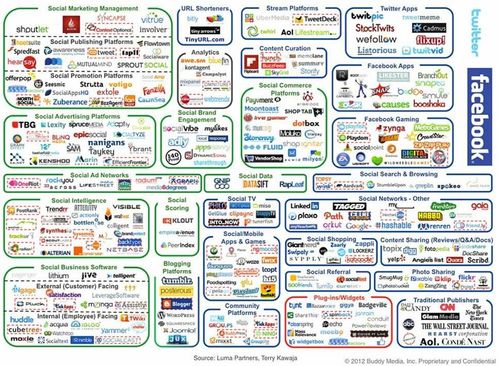

This was brought home to me by a fantastic chart published by Business Insider the other day, showing the complexity of our socially enriched and globally connected world (doubleclick image to enlarge).

The chart clearly shows that the core platforms of Facebook and Twitter are now being leveraged to the hilt by specialist services from content curation to social marketing management; from social ads to social intelligence; from apps for gaming to apps for sharing to apps for commerce; and more.

The key point of this slide is that we now can see that Facebook and Twitter are platforms, like the internet itself is a platform, that provide the underpinnings for far more targeted and specialist social connectivity.

In other words, the kaleidoscopic world of the web - which many institutions are only just learning to catch up with - are built upon the basic building blocks: Tumblr, Twitter, Facebook et al.

This means that the AMEXs, Visa’s and Barclaycard’s are one step beyond those that are just getting into this stuff, who are ten steps beyond those who think they’ve just gotta getta blog out there.

Get a social life before the social life gets you.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...