Talking with a friend this week, they said that they had found my blog entries a little over the top lately.

“Calm down”, she said, “and stop being a rebel without a cause.”

But that’s where she’s wrong.

I am a rebel (?) with a cause: the disruption of banking as we know it.

Now it’s not me that’s trying to disrupt banking, but my approach to studying the future of banking is to track what might disrupt the industry and never before has there been so much potential change.

The change that most of us are tracking within the industry is the regulatory agenda.

I recently made a list of what’s on the regulatory agenda and who’s driving it, and the non-exhaustive list below gives you a little clue as to how challenging this space is.

Things the regulator is focused upon:

- Macro-economic risk

- Credit risk

- Liquidity

- Capital availability

- Political interference

- Regulation

- Profitability

- Derivatives

- Corporate governance

- Quality of risk management

…

Key players involved in new bank regulations:

- Chris Dodd

- Barney Frank

- Paul Volcker

- Dick Durbin

- John Vickers

- Michel Barnier

- Christine Lagarde

- Tim Geithner

- Ben Bernanke

- Mervyn King

- Mario Dragi

…

Some of the regulations:

- Basel III

- CRD IV

- MiFID II

- PSD II

- Solvency II

- UCITS IV

- FATCA

- EMIR

- T2S

- Bribery Act

…

This is only a partial list - it doesn't even mention half the changes in the FSA - and so you can see from the above that we could spend days discussing the regulatory cause and probably still be left with many questions unanswered.

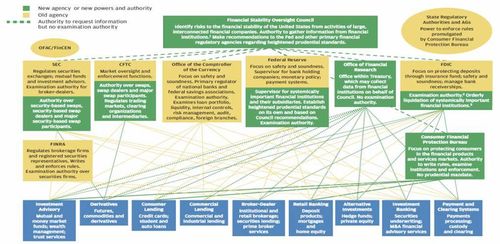

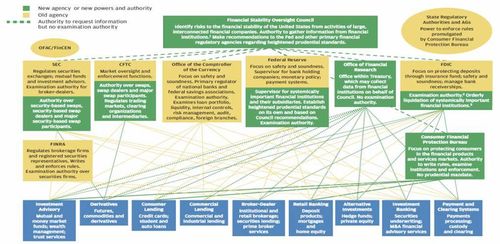

In fact, this one chart from JPMorgan’s annual report shows the situation at its best and worst (doubleclick image to enlarge):

This chart (page 20) shows how challenging the regulatory regime has become, with many new rules and agencies layered on top of or replacing old ones.

The regulations aren’t joined up much either, as the US ones are not quite the same as the European ones, and you need a Magellan regulatory nerd to navigate you through the waters of such complex change.

This is why Jamie Dimon has been so outspoken against Dodd-Frank and Volcker, which prompted Mad Money’s Jim Cramer to label Jamie Dimon a ‘whiner’ when he saw this chart in the JPMorgan annual report … but the whiner is now whining all the way to the bank as his bank’s $2 billion trade failure has led to Dodd-Frank being bolder and stronger than ever before.

The regulatory regime is not a deal-breaker for banks however, as it can be negotiated, debated, discussed and determined in advance.

What cannot be negotiated, debated, discussed and determined in advance is customer change.

But it can be foreseen and forecast, which is what I try to do and why I go off on one every now and again.

You see, we all grew up in a world where governments and corporations determined technology directions.

Large systems would be implemented in back office rooms, and would grind and steam away data for administrative cost savings gains.

That’s where the fundamental change is happening because today’s world reflects the consumerisation of technology.

No longer is technology direction determined by governments and corporations, but by children and consumers.

That is why it is too easy to dismiss the technology change being influenced by the iPad generation, as just being froth on the cake as the back office steam machine will stay the same.

Of course, the infrastructure may change, but the consumerisation of technology has already meant that steam machines that are non-responsive to change are being replaced by cloud machines.

Of course, some organisations get this and are rapidly rearchitecting their infrastructures to be responsive to unpredictable demands.

Today, you may have 400 downloads of your bank’s mobile app; tomorrow, 400,000; and 4 million the next.

You may see huge upward spikes in transactions and interactions as a result, with no control of peaks and troughs.

That’s why the consumerisation impact of technology on the front and back office is of so much interest to those who are looking for disruption to the banking system.

Sure, the regulators will disrupt the system, but that’s predicable; the consumer is not.

You need to watch both.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...