A controversial title I know, but one that summarises well the conversation I was having with one senior European banker about the crisis we have today.

He turned to me and said: “the problem with Europe and many other economies is a lack of growth and this is not the crisis today, but the one that has been building for a long time”.

“Oh”, says I, “what problem is that?”

“The lack of workers and the massive increase in pensioners”, he replied.

Now I’ve heard this debate for a while. In fact I used to run workshops on our world and the shrinking population syndrome.

The essence of the debate went as follows: Europe has around 500 million citizens but, due to families having an average 1.6 children, this is shrinking rapidly. You need 2.1 children per family or more for a society to be sustainable.

Germany, for example, has 81 million people today, but will see that number shrink to 70 million by the end of the next decade.

Spain, historically a high reproduction rate, has sunk down the league tables so that, by 2050, Morocco will have 60% more people than Spain when, just sixty years ago, Spain’s population was three times that of Morocco.

The same discussion was posed about the UK and USA but has proven to be wrong, as both countries welcome immigration and immigration is a great way to top-up the workforce.

It’s certainly true in Britain, where most service jobs are now filled by Eastern Europeans for example.

Nevertheless, the point is valid that, unless something radical changes, Europe will see its population shrink.

This leads to the other issue: an ageing population.

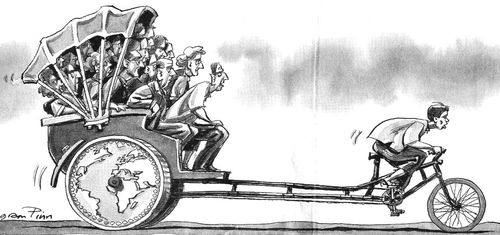

It’s all well and good to have a shrinking population, as long as the proportion of workers stays at the same level to those not working or retired, with healthy ratios of around 4 workers to every non-worker.

The workers pay for the health, education, policing and more thanks to their tax donations, whilst the non-workers and pensioners suck up the tax bills in state pensions and benefits.

And there’s the rub: even with mass immigration, if the domestic population’s ratio is shifting to 3 or even 2 workers per retiree, there is an issue.

Cartoon by Ingram Pinn of the Financial Times

With forecasts of average lifespans for children born today of over a century, there’s the rub.

Originally, when retirement ages were discussed and pensions plans put in play in Germany towards the end of the 19th century, Bismarck had planned on most Germans being dead by the time they could claim benefits.

This was on the basis that the average age expectation for a man in the 1880s was 46, which is why the pension age was set at 65.

A century and half later, we still think we can become pensioners at 65 even though the average lifespan has increased to over 80 in most developed economies.

This is the core issue – the pensions time bomb – and it’s already hitting many societies across Western Europe today.

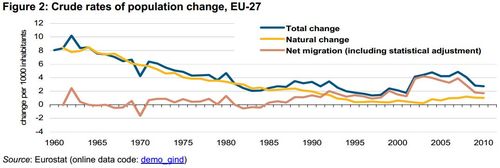

If you want to know more, just read the Europa report on demographic trends or checkout these charts from Eurostat:

But then my banking friend made another point: “the reason for the shrinking population workforce is because, as women are educated, they choose not to reproduce” and pointed to various studies that shows this to be the case.

In other words, as women gain choices through education, they decide not to couple with the male beast or have children quite as readily as when they are uneducated.

A key factor is that the more educated woman often has a career and independent life and can choose to have children later, although this can have an impact upon fertility as the older a woman chooses to have children the harder it can be to conceive.

Equally, in societies where educational opportunities are limited, poverty, religion and coercion are often a higher factor in seeing women have more children at a younger age.

In fact, women in the poorest societies will often have as many children as possible, to ensure that one survives in areas of true poverty and war. Think of Somalia, Sudan or other war-torn poverty areas and you get my drift.

The point of all of this is that children literally are our future and therefore the solution to the growth crisis caused by a shrinking, ageing population is: more sex.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...